A Note from Mark DeHaan, CEO of TenantCloud

“The rental market is in transition. National averages tell one story, but when you dig deeper into regional shifts, you see an entirely different picture. That’s why our Q2 Rent Industry Trends Report is designed to give landlords and property managers a clearer view of what’s really happening.”

The Market at a Glance

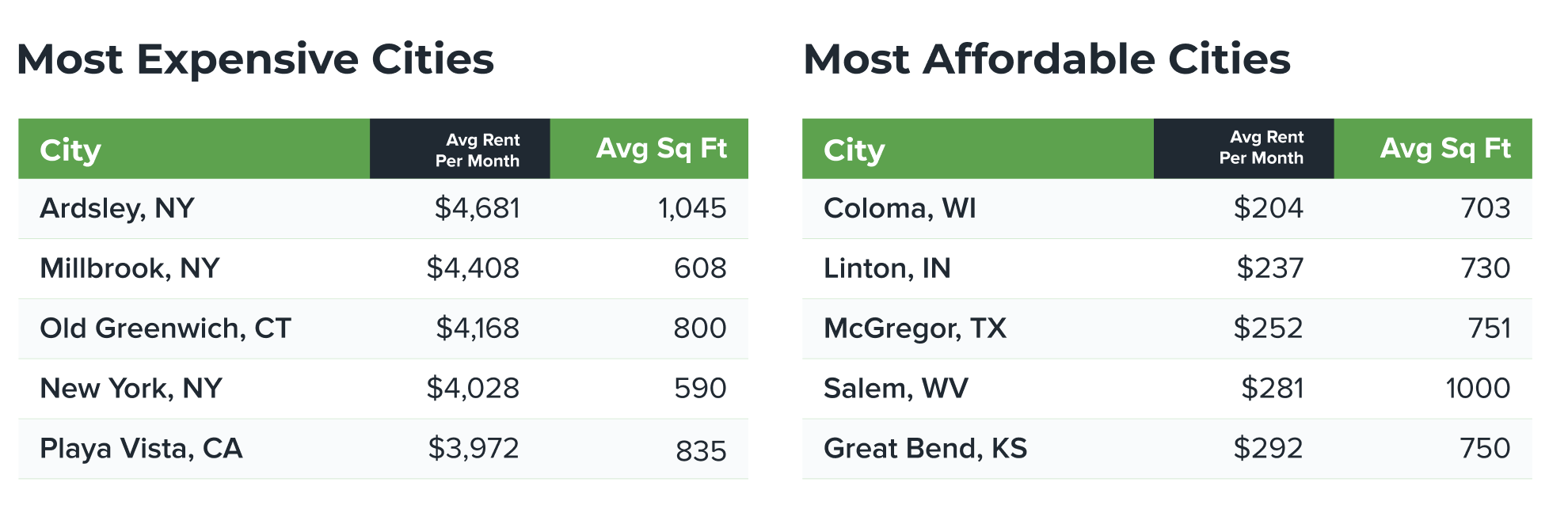

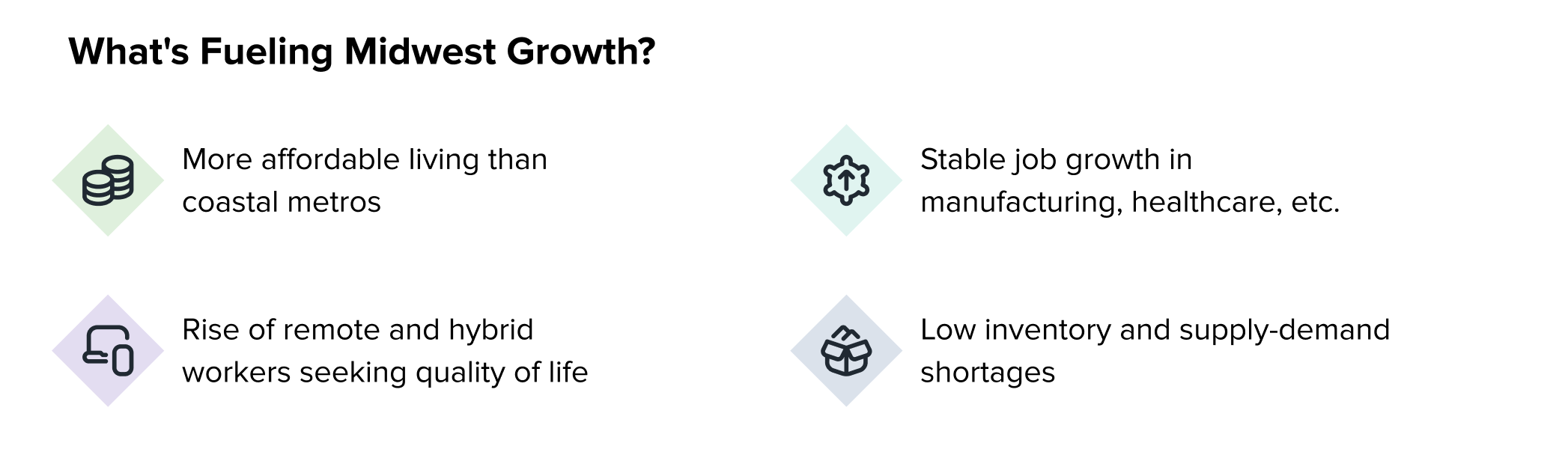

In Q2 2025, the national average rent reached $1,887 per month, reflecting a 4% year-over-year increase. While this shows continued growth, the pace has slowed compared to Q1, suggesting a market that’s beginning to stabilize. But national averages only scratch the surface—regional markets tell a much more dynamic story.

For instance, Queens, NY, recorded one of the sharpest rent spikes this quarter, while Denver, CO, saw significant declines. These kinds of shifts highlight why local conditions matter more than ever for landlords and property managers.

Payments Are Going Digital

Another clear trend: renters are embracing online payments at record levels. Nearly 80% of payments were made online this quarter, saving landlords time and ensuring faster processing. This digital shift also reduces the friction of late or missed payments, though late fees still provide insight into which markets are under financial stress.

What Landlords Should Watch

Beyond rent prices and payments, Q2 data uncovered changes in renter behavior and property management needs:

- Generational shifts: Gen Z renters are entering the market in bigger numbers, often prioritizing affordability and flexibility.

- Maintenance trends: Requests spike during warmer months, with HVAC and plumbing topping the list—landlords who prepare early can avoid costly emergencies.

- Market divergence: Some regions are cooling rapidly, while others remain hot spots for demand, showing that localized data is essential for setting rents.

What’s Inside the Full Report

The complete Q2 Rent Industry Trends Report provides deeper insights into:

- The top 10 fastest-growing and slowest rental markets

- Regional breakdowns that go beyond national averages

- Detailed payment behaviors across renter demographics

- Turnover and renewal patterns every landlord should anticipate

- Expert commentary to help guide your strategy into Q3

Why This Matters

If Q1 hinted at stabilization, Q2 makes it clear: the rental market is splitting into multiple stories depending on where you look. Understanding these differences can help you make smarter decisions—whether that’s setting rents, choosing where to invest, or improving tenant retention.

Related: TenantCloud Q1 2025 Rent Trends Report: What's Really Happening With Rent Prices?