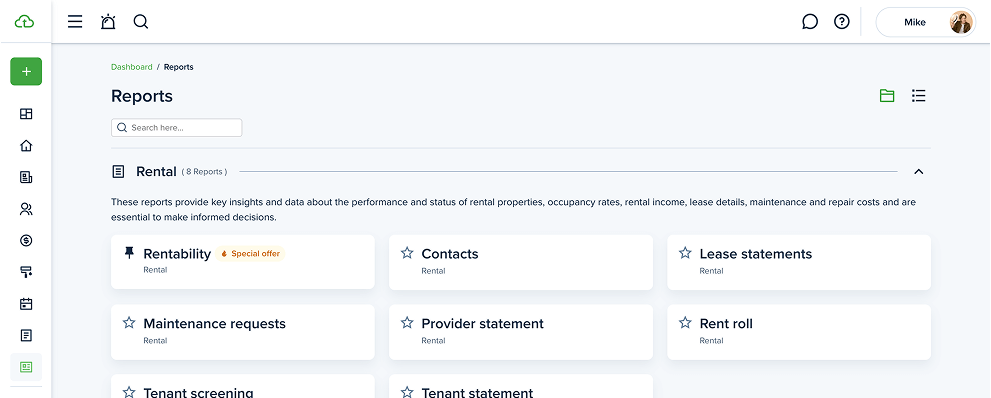

Reports

All your rental reports, one easy dashboard

Track rent payments, property expenses, maintenance costs, and generate tax-ready reports like depreciation and amortization, all in just a few clicks.

Track every detail with customizable financial and property reports

Filter with precision by report type, date, property, and more

Export or sync with ease to PDF, Excel, or QuickBooks

Trusted by users—60% rely on Rent Roll daily, and 75% use monthly

- Online Rent Payments

- Maintenance Management

- Listings and Applications

- Enhanced Reporting

- Move In/Out Inspections

- Property Message Board

- Team Management & Tools

- Task Management

- User-Interface Customization

Prices exclude any applicable taxes.

FAQs

What is a property management report and what’s included?

A property management report is a summary of a rental business’s financial activity. This report helps landlords and property managers keep track of their total income via a total income and expenses statement. It also helps track overall unit performance across the property management company's portfolio.

Here’s what is included in a property management report on TenantCloud:

- Profit and loss statement

- Net operating income (NOI)

- Rent payments and late fees

- Operating costs and maintenance

- Lease activity and occupancy insights

These reports are designed to give a clear financial overview and help with performance tracking, tax filing, and business planning. With property management software like TenantCloud, you can have report access to a variety of simple, direct rental reports.

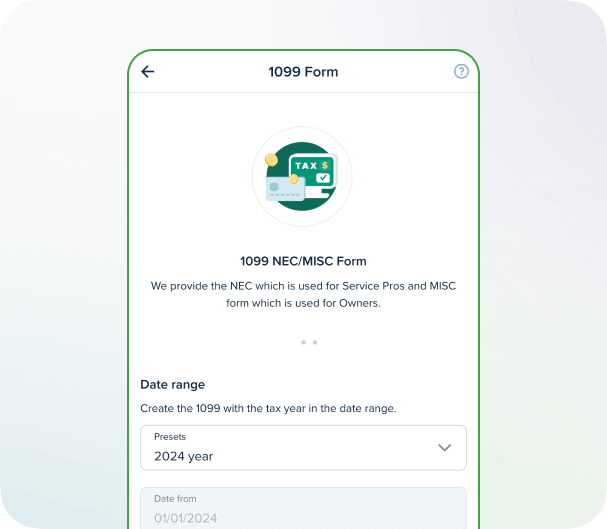

Does TenantCloud help with Schedule E tax reporting?

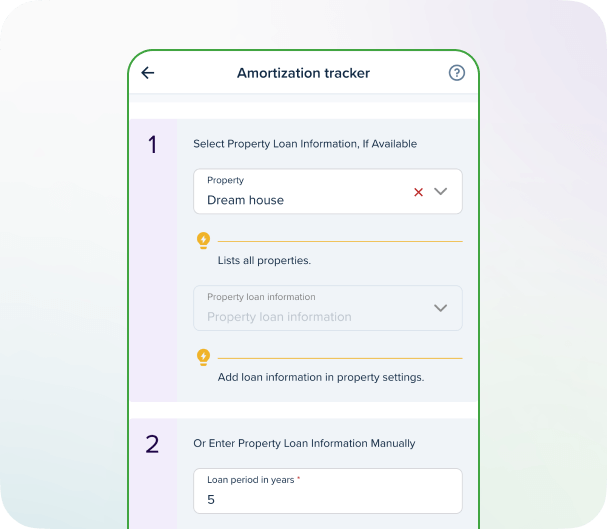

Yes! TenantCloud provides tools to simplify your Schedule E tax reporting. The system automatically tracks rental income, operating expenses, depreciation, and other key data you’ll need to complete IRS Schedule E forms for your rental properties.

With TenantCloud, users can generate detailed reports, like a profit and loss statement, expense statement, tax preparation report, or a property management report, helping you organize your finances in one place and stay prepared during the tax filing process.

TenantCloud's property management report tools go even further with an automatic bank reconciliation feature. With Reconciliation, you can ensure your bank account balances match your transactions in TenantCloud, allowing for seamless, accurate rent collection and financial records.

What is a Rent Roll Report in property management?

A Rent Roll Report is a detailed summary of an active rental unit, including tenant names, lease terms, rent amounts, and payment status. It’s one of the core components of a property management report, giving landlords a snapshot of their current total income, occupancy rates, and upcoming lease expirations for a specific property.

TenantCloud automatically generates rent roll reports based on your lease and transaction data, making it easy to stay organized and evaluate your rental portfolio at a glance.

What is an Expense Statement in property management?

An Expense Statement outlines all property-related expenses, including maintenance, repairs, utilities, and other operating costs. It’s a key part of your property management report, helping landlords track total income expenses and monitor the financial health of each rental unit.

In TenantCloud, expense statements are generated automatically from your recorded transactions and can be customized, exported, and used to build your profit and loss statement or operating statement for tax season and budgeting purposes.

What is an Operating Statement in rental property management?

An Operating Statement is a financial summary that shows how much income your property generated versus how much it cost to operate. It typically includes total income, operating expenses, and net operating income (NOI).

In TenantCloud, you can generate a Property Statement management report to quickly understand how your rental is performing over a selected period. This property management report helps landlords make informed decisions about budgeting, cash flow, and profitability. It’s especially useful when preparing for tax time or evaluating real estate assets.

What is a Profit and Loss Statement for landlords?

A Profit and Loss Statement (P&L) is a property management report that summarizes the total income and total expenses associated with your rental property over a specific period, showing whether your rental business made a profit or operated at a loss.

TenantCloud automatically compiles this information in one place into an easy-to-read format. The P&L statement includes details like rental income, property upkeep, fees, and other expenses, helping landlords track their net operating income and make data-driven decisions.

What is Net Operating Income (NOI) in property management?

Net Operating Income (NOI) is a key metric used in property management to evaluate a rental property's profitability. It's calculated by subtracting total operating expenses (excluding mortgage payments and capital expenditures) from total income generated by the property.

In TenantCloud, NOI is automatically reflected in property management reports like the Profit and Loss Statement and Operating Statement, giving a clear view of a property’s financial performance.

What do 'Total Income' and 'Total Income Expenses' mean in rental property reports?

Total Income refers to all revenue generated from a rental property, including rent payments, late fees, pet fees, and other recurring or one-time income sources.

Total Income Expenses, on the other hand, represent the full amount of costs directly tied to income-producing activities, like property maintenance, utilities, service fees, and property management costs.

In TenantCloud, both figures are automatically calculated in property management reports like a profit and loss statement, helping landlords and property managers track profitability and make informed decisions.

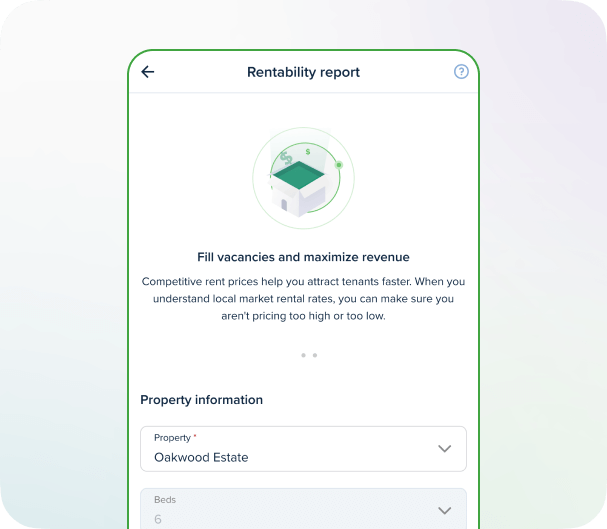

What are Occupancy Rates and why do they matter for rental property management?

Occupancy rates indicate the percentage of time your rental units are occupied over a given period. It’s a key performance metric for property managers, reflecting how efficiently you're filling vacancies and generating rental income.

In TenantCloud, occupancy rates are tracked through the Property Management Report, helping you identify trends, adjust marketing strategies, and improve lease renewal planning.

A high occupancy rate typically means stable rental income, while a low rate may signal a need to adjust pricing, marketing, or property improvements.