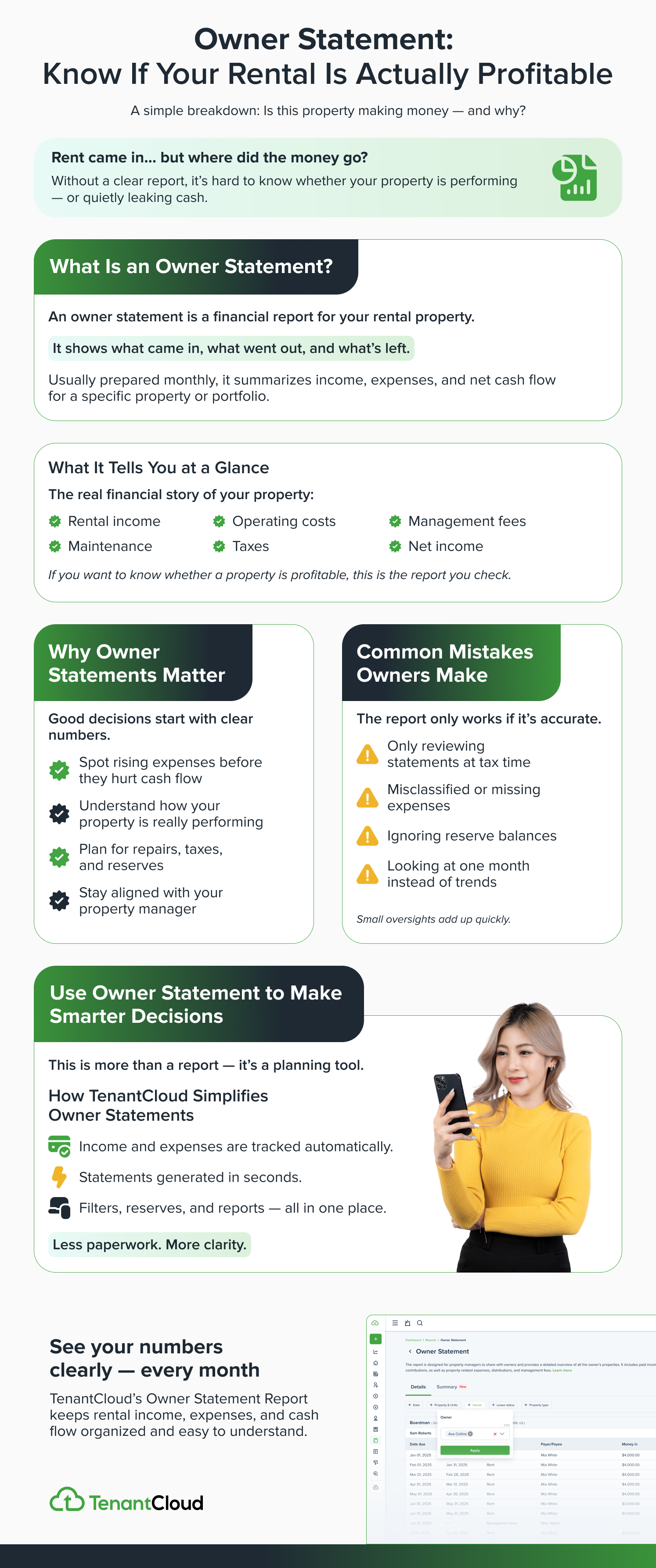

Managing a rental property is more than collecting rent and handling repairs. To truly understand your property’s financial health, you need a clear, organized report. That’s exactly what an owner statement provides.

An owner statement is a detailed report that shows all the money coming in and going out of your property over a set period. In a nutshell, it tells you whether your property is turning a profit and why.

In this guide, you’ll learn what an owner statement is, how to read it with confidence, avoid common pitfalls, and use tools like TenantCloud to simplify the process.

What Is the Owner’s Statement for a Rental Property?

An owner statement is a detailed financial report that shows how your rental property performed over a set period, most often as a monthly owner statement.

This report gives you a clear snapshot of your property’s financial health, covering rental income, property management fees, maintenance costs, taxes, and other charges. The final figure, your net income, reveals whether the property is turning a profit.

A standard owner statement includes:

- Statement period and property details

- All income received (rent, late fees, and other revenue)

- All expenses paid (repairs, taxes, insurance, management fees)

- Net cash flow (income minus expenses)

- Account balances or reserves

Why Owner Statements Matter

For rental property owners, an owner statement is the foundation for smart, profitable decision-making. Without a clear view of your property’s income, expenses, and net cash flow, it’s easy to overlook small issues that can erode your returns over time.

Regularly reviewing these statements helps you:

- Track performance and profitability – See whether your property is meeting your financial goals and identify changes needed to improve net income. Example: If your net income drops for two months in a row despite stable rent collection, it could point to rising operating costs.

- Maintain transparency – If you work with a property management company, monthly owner statements ensure you fully understand how your funds are being handled.

- Plan for upcoming costs – Use historical expense data to budget for maintenance, repairs, and property taxes.

- Spot trends and take action – Notice patterns in occupancy rate, rental income, or recurring expenses that may require adjustments. Example: A summer spike in maintenance costs could signal the need for preventive HVAC servicing.

- Support informed decisions – From setting rental rates to evaluating new investment opportunities, accurate financial data gives you confidence in every move.

When you make it a habit to review your owner statements, you will be able to manage your property with purpose. Over time, this level of insight can protect your investment, strengthen tenant relationships, and help you scale your portfolio effectively.

How to Write a Statement of Ownership

Once you’ve decided to prepare regular statements of ownership, the key is to make the process consistent, accurate, and easy to maintain. You can do this manually with a spreadsheet or streamline it using property management software.

1. Decide on your reporting period

Most owners prepare monthly statements, but you might also want quarterly or annual reports for a broader view. In TenantCloud, you can select a specific date range for one property or your entire portfolio in just a few clicks.

2. Gather all transactions in one place

Keep a record of every payment received and every expense paid during that period. This includes rent, late fees, pet fees, repairs, utilities, taxes, and management fees. TenantCloud automatically records online rent payments and lets you upload receipts or invoices for expenses, ensuring nothing is missed.

3. Organize income and expenses by category

Use consistent labels for each type of income or expense. This makes it easier to compare periods and spot trends. TenantCloud’s property management accounting feature categorizes transactions automatically and keeps your ledger balanced.

4. Review and verify your numbers

Cross-check totals against bank statements or payment records. Look for missing transactions or duplicate entries. Software tools can help by flagging discrepancies, but a quick manual review is still worth doing.

5. Include reserves and balances

If you keep a reserve for repairs or emergencies, note the amount at the start and end of the period. TenantCloud allows you to set reserve amounts for each property so they’re always reflected in your reports.

6. Save and back up your statements

Store reports in a secure, accessible location, whether that’s cloud storage, an external drive, or your software account. In TenantCloud, past statements and your rent ledger are stored in your account, ready to download or share at any time.

Owner Statement Mistakes That Can Cost You (and How to Avoid Them)

Even experienced landlords can make errors that reduce the accuracy and usefulness of their owner statements.

These mistakes can lead to missed income, inflated expenses, or poor decision-making.

Here’s what to watch out for:

1. Skipping Regular Reviews

Waiting until tax season to look at your statements means you might miss small errors or recurring issues.

Tip: Review your owner statements monthly so you can address discrepancies quickly and keep your finances on track.

2. Misclassifying Transactions

Putting expenses in the wrong category or lumping unrelated costs together can distort your reports.

Tip: Use consistent categories for rent, fees, maintenance, and other expenses. TenantCloud’s accounting features help by automatically categorizing transactions, making your reports easier to read and compare.

3. Overlooking Small Charges

Minor maintenance costs or late fees may seem insignificant, but over time, they add up.

Tip: Ensure every transaction, no matter how small, is recorded. Linking your payment system or bank account to a platform like TenantCloud can help ensure nothing slips through the cracks.

4. Not Tracking Reserve Balances

Forgetting to include your reserve funds can make your net cash flow look higher than it really is.

Tip: Keep a consistent record of starting and ending reserve amounts in each statement so you have an accurate picture of available funds.

5. Ignoring Trends in the Numbers

Looking at a single month in isolation doesn’t show the full story.

Tip: Compare current statements to previous periods to spot rising expenses, seasonal income dips, or changes in occupancy rates.

6. Mixing Personal and Property Finances

Combining personal purchases with rental transactions makes it harder to prepare clean, accurate statements.

Tip: Use separate bank accounts and payment methods for your rental business, so your owner statements reflect only property-related transactions.

How to Read an Owner Statement

An owner statement’s value depends on how carefully you review it. Start by confirming the statement period and property details to ensure you’re looking at the right report.

Next, review the total income for the period, making sure rent payments and any additional charges, such as late fees, pet fees, or parking, are clearly itemized. This breakdown helps you see exactly where your income is coming from each month.

Look closely at all expenses related to the property, including repairs, taxes, insurance, and management fees, to confirm they are valid and correctly categorized. This is where you can spot unexpected charges or cost patterns.

Check your balances and reserves to be certain the funds available for maintenance or emergencies are accurate. Finally, cross-check the numbers with your rent ledger or bank records to verify that every transaction has been recorded and nothing is duplicated or missing.

Taking these steps ensures you have a complete and reliable picture of your property’s financial performance before making any decisions based on the report.

Using Owner Statements to Make Informed Decisions

When you treat your owner statements as a decision-making tool rather than just a record-keeping requirement, you get a clearer view of where your property stands today and what steps will help it perform better tomorrow.

- Spotting Opportunities to Adjust Rent: If your net cash flow is consistently low despite high occupancy, your rent may be below market rates. Comparing your income figures to local rental trends can help you decide whether an increase is justified.

- Managing Occupancy and Turnover: Recurring vacancies or turnover costs in your statements may indicate the need to improve tenant retention through better communication, maintenance responsiveness, or lease incentives.

- Budgeting for Maintenance and Improvements: By tracking how much you’ve spent on repairs and upkeep over several months, you can set more accurate budgets and schedule preventive maintenance before small issues turn into costly problems. If your expenses are consistently high due to damage or repairs, scheduling regular property inspections can help you address issues earlier and reduce long-term costs.

- Evaluating Property Performance: If one property in your portfolio consistently outperforms others in net income, that insight can influence where to invest in upgrades or which property type to acquire next.

- Planning for Taxes and Reserves: Statements showing steady profits make it easier to plan for property taxes and ensure reserve funds are maintained at a comfortable level.

How TenantCloud Simplifies Owner Statements

Keeping accurate, easy-to-read owner statements doesn’t have to be a manual, time-consuming task.

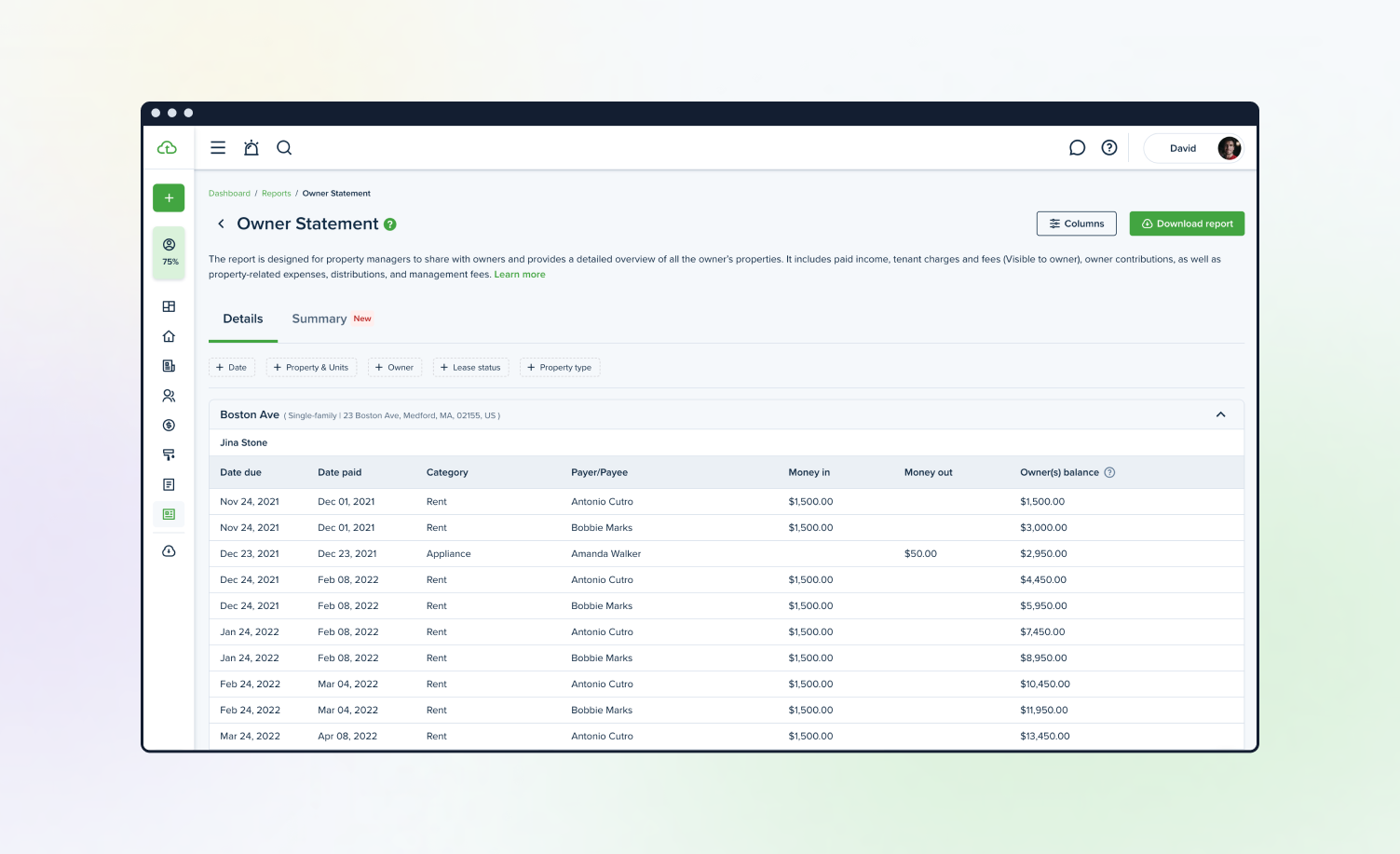

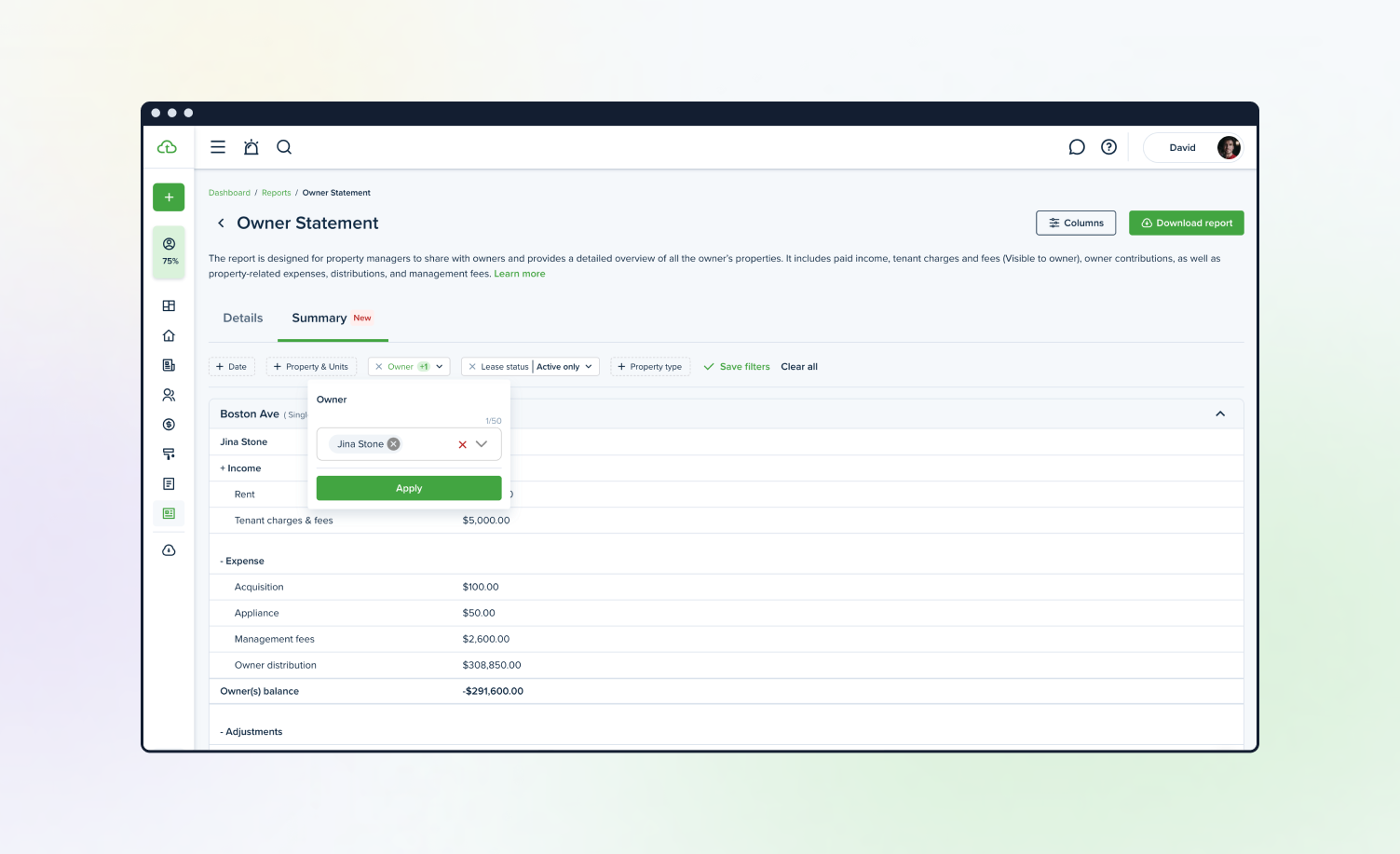

The TenantCloud Owner Statement Report makes it simple to track and share financials with property owners. View income and expenses for any property or owner, filter by date, lease, or unit, and sort transactions by due date for a clear timeline. Customize columns with drag-and-drop, and rely on accurate tracking with income on a cash basis and expenses on an accrual basis.

Manage every step of the process in one place, from collecting rent to generating downloadable reports.

- Automated tracking – Online rent payments, late fees, and other charges are recorded automatically.

- Built-in accounting – Income and expenses are categorized for you, so reports are always organized and tax-ready.

- Custom reporting – Generate statements for one property or your entire portfolio over any date range.

- Reserve tracking – Set and display reserve balances on each monthly statement.

- Secure access – View, download, or share statements anytime from your desktop or mobile device.

By having your rental income, expenses, and financial reports all in one system, you’ll spend less time chasing paperwork and more time making informed decisions for your rental business.

Ready to simplify your rental finances? Start your free 14-day trial with TenantCloud and see how effortless managing owner statements can be.

From tracking income and expenses to generating detailed reports, TenantCloud puts everything you need in one place, so you can stay in control of your property’s financial health, whether you manage one unit or an entire portfolio.