It's January 29th, and you just realized you paid your handyman $800 last year. Now you're frantically googling "Do I need to send a 1099?" while that January 31st tax filing deadline looms large.

If this sounds familiar, you're not alone. But here's the thing: proper tax preparation isn't just about avoiding IRS penalties—it's about establishing your rental activity as a legitimate business and potentially qualifying for the 20% pass-through deduction that can save thousands in income tax.

This tax prep option can deliver a max refund while ensuring you file your federal tax return correctly.

This guide will show you exactly when to file, which forms to use, and the systems that make tax season run smoothly. Whether you prepare your own taxes or work with a tax preparer, understanding these requirements protects your money and guarantees compliance.

What Are 1099 Tax Forms and Why Do Landlords Need Them?

1099 forms track money flow between businesses and help establish your rental activity as legitimate.

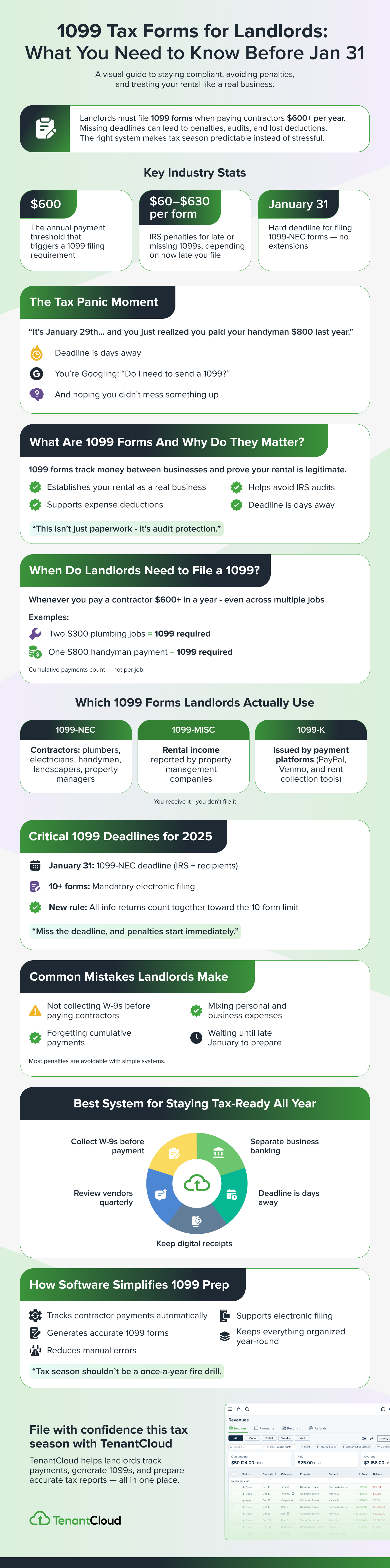

The 1099 tax form is an information return that documents payments made to non-employees. When you pay contractors $600 or more annually for property work, the IRS requires documentation. This isn't just bureaucratic paperwork—it serves three critical purposes for landlords managing business taxes:

Legitimizes your business: Proper tax filing demonstrates you're running a real business, not just passively collecting income. This distinction is crucial for accessing federal tax benefits, including the Section 199A deduction, which allows for up to 20% of rental income tax to be deducted.

Protects against audits: The IRS matches forms against your tax return expenses. When numbers don't align, it triggers automated reviews that can lead to audits. Filing accurate forms protects you by getting ahead of this matching process.

Creates clear paper trails: Documented contractor payments strengthen your expense deductions and provide audit protection. Tax experts recommend maintaining detailed receipts and financial information to support all deductions on your federal tax return.

When Must You Issue 1099s to Contractors?

Whenever you pay any unincorporated person $600+ per year for services, even if that’s across multiple payments.

The magic number for 2026 remains $600. This isn't per job—it's cumulative payments for the entire year. A plumber doing two $300 jobs totals $600, triggering the requirement to file.

Key rules and exceptions:

- Corporations are generally exempt, except that attorneys must receive forms even when incorporated

- Single-member LLCs typically need forms, while multi-member LLCs are treated as partnerships

- Always collect Form W-9 before making payments—this determines if the person qualifies for exemptions

- No forms needed for: credit card payments, employer wages (use W-2s), or reimbursed expenses under proper accountable plans

Property management companies: You send them 1099-NEC for property management fees over $600, while they send you 1099-MISC for gross rental income collected—often higher than your net receipt after their fees.

This creates dual obligations that tax experts recommend tracking carefully throughout several years. Setting up proper property management accounting systems helps track these relationships accurately.

Which Forms Do Landlords Actually Use for Tax Preparation?

Mainly 1099-NEC for contractors and 1099-MISC for rental income reporting.

Form 1099-NEC goes to independent contractors when you pay them $600+ per year. This covers plumbers, electricians, handymen, landscapers, and property managers. You'll need to prepare these forms and submit them by the January deadline.

Form 1099-MISC is mainly what you receive from property management companies reporting the rental income they collected. You may also need to file this yourself if you collect rent directly through cash, checks, or money transfers rather than payment processors.

Form 1099-K is issued by payment processors, such as PayPal or Venmo, or rent collection platforms when your transactions exceed certain thresholds. You'll receive this automatically—you don't generate it. These services provide free automated tracking and can help you access better financial information for your tax return.

Understanding which appropriate forms to use prevents errors that could cost you money or trigger IRS contact later in the process.

What Are the Critical Filing Deadlines for 2026?

January 31st is the hard deadline for 1099-NEC forms with no extensions available.

Key deadlines for tax filing:

- January 31st: Hard deadline for 1099-NEC forms to recipients and IRS

- End of February: Deadline for paper filing to IRS (if under 10 forms)

- January 31st: Electronic filing deadline if filing 10+ forms

New Electronic Filing Requirement: Filing 10 or more information returns of any type requires electronic submission. The IRS counts all forms together—six 1099-NECs plus four 1099-MISCs trigger this requirement. This threshold dropped from 250 returns, capturing many more rental property owners who must now file electronically.

Electronic filing requires advance setup through the IRS IRIS system. Apply for your Transmitter Control Code by mid-November, since processing takes up to 45 days. The benefit? Electronic filing through IRIS is entirely free and reduces processing errors that could delay your refund or trigger additional IRS correspondence.

How Do You Collect Required Information Before Paying Contractors?

Get Form W-9 from every vendor before making any payments—no exceptions.

The process looks a little something like this:

- Before any payments: Collect Form W-9 from every vendor. Make this non-negotiable when you decide to hire services

- Verify information: Use the IRS TIN Matching service ($0.45 per verification) for accuracy

- Check box 3: This indicates if the vendor is exempt from reporting

- Update annually: Re-collect W-9s periodically to guarantee current financial information

Backup withholding protection: When vendors refuse W-9s, you can implement backup withholding at 24% of payments for federal taxes. After three documented requests, this protects you from IRS penalties for failing to provide taxpayer identification. Expert help often recommends this approach to ensure compliance.

Smart landlords print W-9 forms in advance and request completion before any work begins. This simple step prevents year-end scrambling and ensures you can complete your tax preparation without delays.

What Happens If You Miss the Tax Filing Deadlines?

IRS penalties start at $60 per form and can reach $630 for willful neglect. Typically, the penalty structure looks like this:

- Within 30 days: $60 per form

- 31 days to August 1st: $120 per form

- After August 1st: $310 per form

- Willful neglect: $630 per form

Miss deadlines on ten forms, and you owe $600+ minimum—often more than professional tax preparation costs. These penalties can significantly impact your income and reduce any potential refund.

Your defense strategy: Treat January 15th as your personal deadline, giving two weeks' buffer for issues. Set October calendar reminders to prepare, not December scrambling. Tax experts recommend this proactive approach to avoid penalties.

If you miss deadlines, file immediately and prepare reasonable cause explanations for natural disasters, illness, or system failures. First-time penalty abatement may be an option if you have a clean compliance history. Contact the IRS or a tax preparer promptly to determine the best course of action for you.

How Can Software Simplify 1099 Tax Preparation?

Modern software automates tracking and generation, turning annual headaches into background processes.

Manual vs. automated approaches:

Manual compliance is effective for small portfolios but becomes unwieldy with portfolio growth. Integrated software tracks vendor payments automatically as you enter expenses throughout the year, making it easier to prepare your federal tax return accurately.

Software benefits:

- Automated tracking: Records contractor payments and generates receipts as you enter expenses

- December generation: Accurate totals from existing account data with just a few clicks

- Error reduction: Eliminates manual calculations across multiple properties that could cost you money

- Electronic filing: Many platforms handle IRS registration and submission, filed electronically for free

Cost considerations: Basic services cost $2-5 per form, while comprehensive platforms often include generation in monthly fees. Factor in time savings and reduced error risk—software investment pays for itself quickly and can guarantee better organization for tax preparation.

Expert help through integrated software often provides better access to deductions and ensures you don't owe unnecessary taxes due to missed opportunities.

What's the Best System for Year-Round Preparation?

Quarterly vendor reviews and consistent digital record-keeping prevent year-end scrambling.

The trick is to be as proactive as possible, keeping on top of things so you’re not caught out.

Quarterly reviews (March, June, September, December): Monitor cumulative payments and plan for approaching thresholds. This helps you decide on strategic payment timing opportunities around calendar year-ends and ensures you don't miss income that needs reporting.

Digital organization: Use consistent naming conventions, such as "2025_Invoices_PlumberSmith," for effortless access to financial information. Scan receipts immediately after payment to prevent missing documentation months later—a simple step that can save you money during tax preparation.

Dedicated business banking: Separate business account management creates clear paper trails for vendor payments. When personal and rental expenses mix, reconstructing business payments becomes time-intensive and error-prone, potentially costing you deductions.

Professional support: Tax experts specializing in real estate understand the nuances of compliance and often provide access to specialized software as part of their services.

For significant portfolios, expert help prevents costly mistakes while maximizing deductions—they can determine what you owe and help you file your federal tax return correctly.

Just like you might invest in online tenant screening to protect your rental income, investing in proper tax preparation protects your business finances.

This comprehensive system ensures you're ready to prepare your taxes efficiently, whether you handle them yourself or work with a professional.

How Do You Handle Different Income Types and Medical Deductions?

Report all income sources, including unemployment compensation, dividends, and royalties, while tracking deductible medical expenses.

Income reporting requirements: All income must appear on your tax return, regardless of whether you receive appropriate forms. This includes:

- Unemployment compensation from government sources

- Dividends from investment accounts

- Royalties from intellectual property

- Interest from savings accounts and investments

- Rental income from monthly payments, including any increases from rent increases you implemented during the tax year

Medical expense considerations: If you pay for medical services for tenant injuries on your property, these may be deductible business expenses. However, personal medical expenses follow different rules—tax experts can help you determine what qualifies.

The key is maintaining detailed receipts and tracking all income sources so you can file your federal tax return accurately and claim every legitimate deduction available.

What Should You Do If You Receive an Incorrect Form?

Contact the payer immediately and request a corrected form before it reaches the IRS.

Correction process:

- Review forms immediately: Check for discrepancies as soon as forms arrive

- Contact payer: Request correction before IRS submission if possible

- Document communications: Maintain records of all correction requests to guarantee accuracy

- File amended forms: If already sent to IRS, request a corrected submission

- Report on your return: If payer won't correct, explain discrepancy with detailed footnotes

Your tax return strategy: If you can't convince the payer to correct an erroneous form, include detailed explanations on your return showing why the income isn't taxable. Tax preparation software often provides templates to help you format these explanations properly.

Many tax prep options include error correction features, and some offer expert help to guide you through the process if you're unsure how to handle discrepancies.

When Should You Consider Professional Tax Preparation Services?

Complex portfolios, multiple states, or significant deductions often justify professional help.

DIY vs. professional decision factors:

You might decide to prepare your own taxes if you have a simple rental situation with few contractors and straightforward income. Free tax preparation software can handle basic scenarios and help you file your federal tax return without cost.

Consider professional services when:

- Managing multiple properties across several years requires complex tracking

- You're unsure about medical expense deductions or business expense classifications

- State requirements vary significantly across your property locations

- You want to guarantee maximum deductions and ensure you don't owe unnecessary taxes

- The cost of professional services is less than the potential penalties or missed refund opportunities

Choosing services: Look for tax experts who specialize in real estate and offer year-round access to expert advice. Many offer free consultations to help you determine if their services make financial sense for your situation.

Professional services often pay for themselves through discovered deductions and penalty avoidance, especially as your portfolio grows over several years.

Wrapping Up

The 1099 tax form isn't just paperwork—it's a business tool that demonstrates professionalism, ensures compliance, and helps claim every deduction you've earned. Proper tax filing protects your money, maximizes your refund, and gives you confidence you're running a legitimate, well-documented business.

Your Action Plan: Collect W-9s before payments, track expenses consistently, and use technology to automate compliance. Whether you file your own taxes or work with tax experts, having organized financial information throughout the year makes the process smoother and more cost-effective.

Start building these systematic approaches now. With proper preparation, you can complete your federal tax return efficiently, access all available deductions, and guarantee your next tax season feels routine instead of overwhelming.

The right process protects your income while ensuring you never owe more than necessary to the IRS.