With rent collection, repairs, vacancies, and vendor calls, landlord life moves fast. The profit and loss statement slows things down just enough to see what is working. It is the clearest way to track performance, cut wasted spend, and plan next month.

If you’re not sure what it is, you’ve come to the right place. We’re going to cover what a P&L is, what belongs on it, how to read it with your other financial statements, and practical moves to improve results without extra busywork or hiring a property manager.

What Is a Profit and a Loss?

A profit and loss statement is a type of income statement that summarizes a company’s revenues and expenses over a specific period. It is a financial snapshot of a business’s financial performance and the company's financial position for a specified period, typically a month, quarter, or fiscal year. For rentals, it consolidates every dollar of rent, fees, and spending in one place, allowing you to see what is happening.

Learn more: Profit & Loss Statement

In plain terms, it shows the profit your rentals generated after deducting all expenses incurred. If the net income is positive, it represents a profit. If negative, it is a loss. Other names include earnings statement, operating statement, statement of operations, and profit and loss statement. Your P&L reflects the company's ability to generate reliable returns, control operating expenses, and protect financial strength over time.

What is on a Profit and Loss Report?

A P&L statement shows the flow from top line to bottom line. Here’s how to read it and how to organize it:

- Gross revenue and net sales from rent and fees. If you use concessions or credits, present net revenue as the clean income figure.

- Cost of goods sold. For rentals, treat turns as “goods sold.” Include cleaning, flooring, paint, make-ready labor, and unit utilities during vacancy. This drives gross profit.

- Operating expenses. Property management, marketing, software, communication tools, admin, insurance, and licenses. These lead to operating income.

- Below the line. Interest expenses on business debt and income taxes.

- Bottom line. Net profit or net income, the number your financial report is steering toward.

Read the P&L alongside the balance sheet, which is a point-in-time statement, and the cash flow statement, which shows the actual movement of cash flow. Together, they help assess a company's financial health and results, alongside other financial statements.

How Do You Explain a P&L?

To an owner, a P&L statement is a narrative of revenues and expenses over a specified period. It starts with rent collected, subtracts cost of goods sold and operating expenses, then factors in interest expenses and income taxes to show net profit.

For non-accountants, this statement is a financial scoreboard. The P&L statement indicates whether your rentals generate revenue, manage costs effectively, and scale sustainably. Use it to spot leaks, budget more effectively, and increase gross profit and net profit margin.

How Do You Calculate Profit and Loss?

If you want to calculate your profit and loss, you need to start with the core formula: Revenue − Expenses = Profit or Loss.

- Gross profit = net revenue − cost of goods sold

- Operating income = gross profit − operating expenses

- Net income or net profit = revenue − COGS − Opex − interest expenses − income taxes

And keep in mind these key ratios:

- Gross profit margin = gross profit ÷ revenue

- Net profit margin = net profit ÷ revenue

Use repeatable category buckets to ensure that P&L statements are consistent and accurate every month. Typical buckets include rent income, fees, repairs, utilities, marketing, payroll, software, insurance, property taxes, debt service, and taxes. Consistency ensures that statements from different accounting periods are comparable and keeps your company's P&L statement decision-ready.

Single-Step vs. Multistep P&L for Rentals: What You Need to Know

What’s the difference between single-step and multi-step P&L? There are several key differences that impact how it’s organized and how it may benefit you in the future with your property finances.

- Single step. Combine all income and expenses to determine the net income. It’s a fast process, but light on diagnostics, which can be an issue later on.

- Multistep. Separate the cost of goods sold from the operating expenses. Show gross profit and operating income before the below-the-line items. Better for spotting issues and benchmarking across your financial statements.

Both formats include the same categories, but the multistep format makes the analysis easier and cleaner to read for everyone.

Cash Method vs. Accrual Method: How They Differ

- Cash method. Record when money moves. Simple for a small business owner, but timing shifts can distort results, such as late rent in one month and catch-up in the next.

- Accrual method. Record when earned and when expenses are incurred. Rent is matched to the month it is owed, and costs are matched to the month they are incurred. Accrual improves consistency across a quarter or fiscal year, demonstrating the company's ability to perform predictably.

Accrual also aligns your profit and loss statement (P&L) with the balance sheet and cash movements. It helps when reconciling the sheet and cash flow and validating the sheet and the cash position behind your results.

Read the P&L With Other Financial Statements

When you’re reading over your financial paperwork, read the P&L as one part of a three-statement picture:

- Pair with the balance sheet to see the company's assets, liabilities, equity, and working capital.

- Use the cash flow statement to understand collections timing, capital spending, and financing flows that do not appear in the loss statement.

Together, these statements explain the company's ability to generate steady results and how financial strength is built over time.

Comparing P&L Statements Over Time and Across Markets

Comparing P&L statements across different accounting periods reveals whether the company's revenues are increasing faster than its operating expenses and whether the net profit margin is stable. It also shows whether your portfolio is building durable financial health.

Benchmark to local peers. Consider rent control dynamics, property tax burdens, and trends in vacancy rates. Tie results back to growth potential in each submarket and to decisions like upgrades, rate changes, or initiatives to generate revenues and manage costs. Complement your internal financial information with reputable market data when you expand into new neighborhoods.

Landlord-Ready Categories, Checklists, and Notes

Revenue Lines

Base rent, pet rent, parking, storage, utility recapture, late fees, and tenant-paid services. Label the statement clearly to show actual net sales and net revenue.

Cost of Goods Sold

For turns, include paint, flooring, cleaning, lock changes, make-ready contract labor, and unit utilities during vacancy. Clean COGS clarifies gross profit and gross profit margin.

Operating Expenses

Repairs and maintenance, recurring contracts, lawn or snow, pest control, software, communication tools, marketing, screening, bank fees, admin, insurance. Precise Opex protects operating income.

Below the Line

Interest expenses on business debt and income taxes. Forecast these so the loss statement does not surprise you.

Notes

State whether you use the accrual method or the cash method. Readers can then interpret timing effects and compare periods fairly.

Ratio Guide and Mini-Diagnostics

Your Company’s Profitability

- Gross profit margin. Is the turn spend too high for the rent level?

- Net profit margin. Are rent prices including utilities, insurance, and repairs?

Risk

- Balance sheet support. Do the company's assets cover liabilities, and what does the sheet and cash flow position look like after debt service?

Lift Plan

- Align renewal pricing with financial report goals. Improve collections with autopay. Tighten turns and reduce repairs with proactive maintenance.

Common Questions Landlords Ask

What is the difference between a profit and loss statement and a balance sheet?

The loss statement covers a period of time. The balance sheet captures a company's assets, liabilities, and equity at a point in time.

How do I make my company’s P&L statement tell a clearer story?

Standardize categories, use accruals for timing, and reconcile with the sheet and the cash movements to validate financial information.

How do you calculate profit and loss quickly?

Start with net revenue, subtract cost of goods sold, then operating expenses, then interest expenses, and then income taxes. The result is net income or net profit.

How do you explain a P&L to partners?

Show top-line rent, point to operating expenses, and connect the dots to operating income and net profit margin.

Which statement shows cash?

The P&L is not cash. The cash flow statement reconciles accrual to cash flow and belongs beside your P&L and balance sheet.

What Landlords Should Track Monthly

Build a 12-month view so statements from different accounting periods can be stacked and trended. Track the turn-cost intensity of the cost of goods sold and the repair run rate in operating expenses. Watch cash flow metrics, such as the collections rate and delinquency days, to confirm the statement shows durable earnings, not timing noise. If growth is likely, conduct a stress test of profit and loss using conservative rent growth and actual maintenance history.

Practical Steps to Improve Profit and Loss This Year

- Boost collections. Enable online payments and autopay. Clear notices reduce the number of days late and support financial results.

- Lower turn costs. Standardize finishes, pre-buy supplies, and schedule vendors early to protect gross profit.

- Reduce Opex. Audit contracts, consolidate software, negotiate insurance, and maintain open communication with tenants using effective tools. Clear updates reduce inbound calls, repeat visits, and improve a company’s financial performance.

- Finance smarter. Refinance when justified to reduce interest expenses. Weigh prepayment penalties and total financial health.

- Plan taxes. Forecast income taxes from a realistic profit and loss statement so distributions align with cash, not just accrual figures.

Compliance and Reporting Notes

Public real estate entities file under GAAP. Private owners have more flexibility, but should keep consistent rules so the P&L statement is decision-ready. For investor talks, translate loss statement results into NOI, tie to balance sheet liquidity, and explain how the statement shows sustainable returns.

An Easy Walkthrough for Rentals

Build your monthly profit and loss statement like a pro. Start with rent and fees, then show the cost of goods sold for turns. Subtotal gross profit, list operating expenses, compute operating income, and finally, list interest expenses, income taxes, and any owner draws, similar to cash dividends declared per unit. Partners receive a clear view of the company's P&L statement for each period.

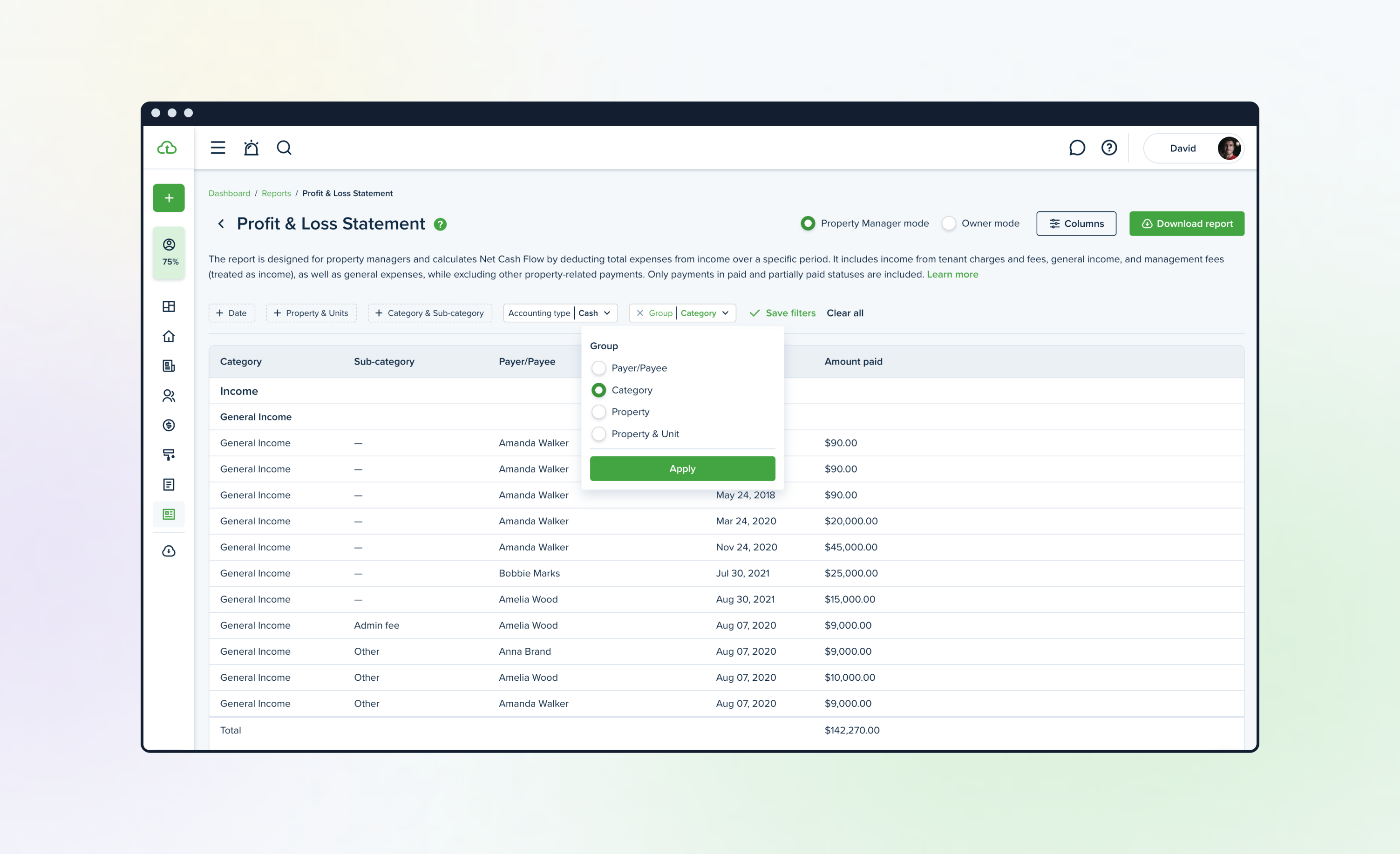

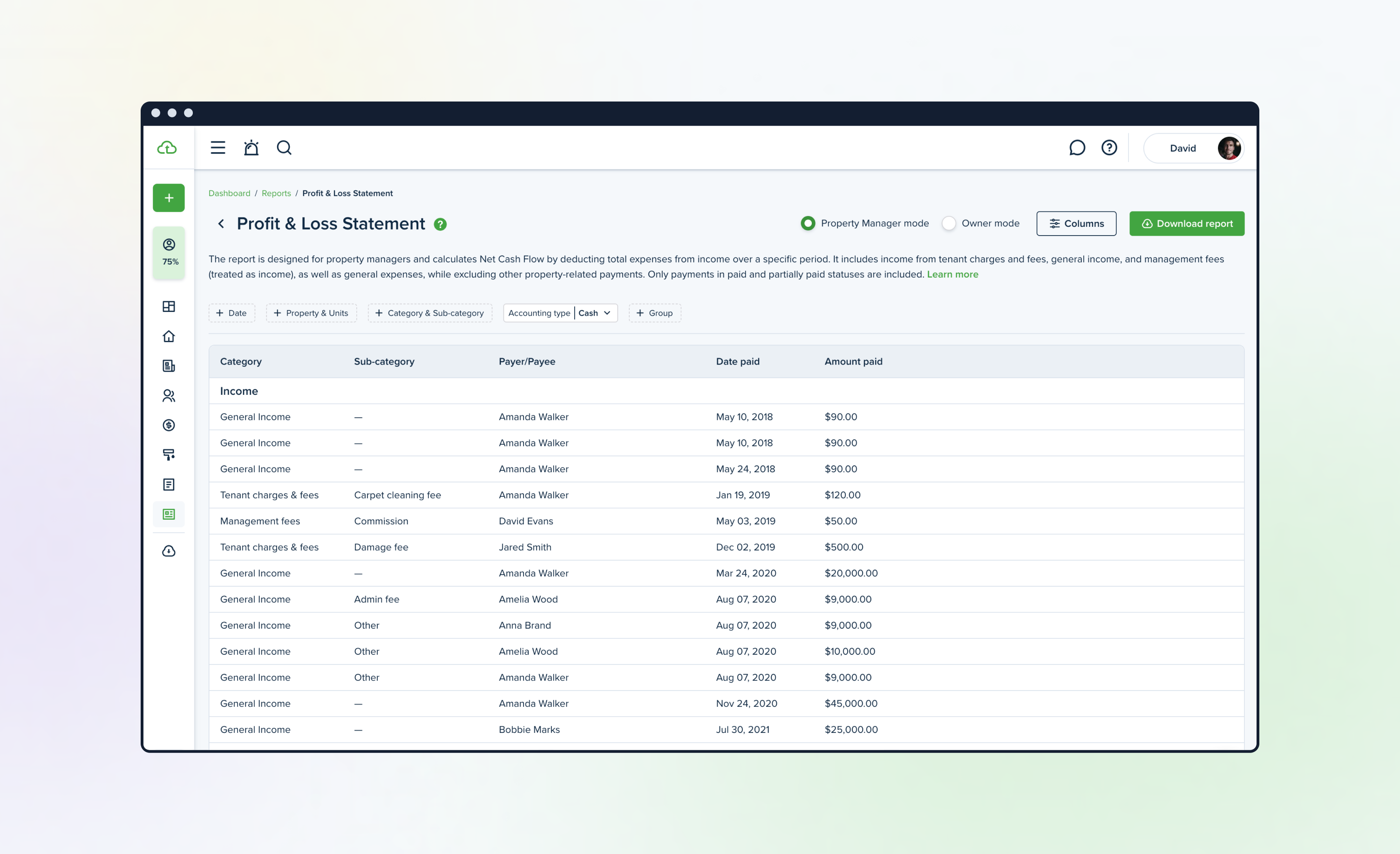

Streamline Your Property Management Business with TenantCloud

Streamline inputs, tag expenses, and generate a clean profit and loss, plus balance sheet and cash flow, in one place. Your statement consistently provides accurate financial information every month, allowing your partners to assess your financial strength at a glance.

TenantCloud helps you categorize revenues and expenses, compare quarter or fiscal year views, and monitor the company's assets, operating income, and net profit without juggling spreadsheets.

Ready to see your profit and loss come together in minutes? Create your first P&L statement inside TenantCloud and compare it to your balance sheet and cash reports. Then fine-tune operating expenses to lift net profit. Start your free 14-day trial to experience the TenantCloud difference today.