Managing rentals means keeping track of a steady stream of financial transactions—rent payments coming in, vendor bills going out, and maintenance costs popping up when you least expect them. Without a reliable method of accounting, those numbers can feel scattered and stress-inducing.

Having an accounting method brings order to the chaos. The method you choose determines how your income and expenses appear on your books, how confident you feel at tax time, and how useful your reports are when you review performance at the end of the month.

This guide walks you through the two primary approaches: cash basis accounting and accrual accounting. You’ll see the strengths and limitations of each, along with real-world examples that show how they work in practice.

We’ll also point out the signs that it might be time to switch methods. Finally, you’ll learn how accounting software can simplify the process so your system matches your workflow instead of slowing it down.

TL;DR

Choosing the right accounting method shapes how you track rental income, manage expenses, and plan for taxes.

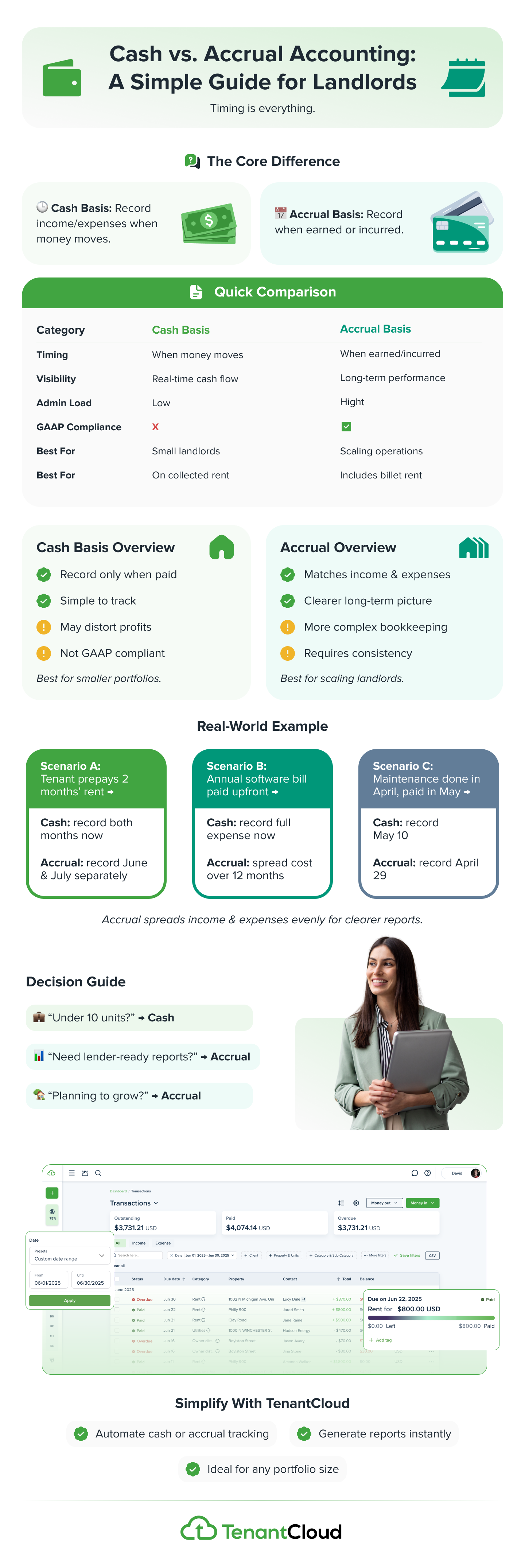

• Cash basis = record income and expenses only when money moves. It’s simple, great for small portfolios, and aligns closely with your bank balance.

• Accrual basis = record income when earned and expenses when incurred. It’s more accurate, preferred by lenders, and scales better for growth.

Small landlords often start with cash for simplicity, then switch to accrual as they expand or seek financing.

Whichever you choose, accounting software like TenantCloud can automate entries, organize reports, and keep your finances clean and compliant.

Cash vs. Accrual Accounting: The Main Difference

The main difference when you compare cash and accrual accounting comes down to timing. With the cash basis, you record income only when payment actually arrives in your bank account and expenses only when money leaves.

The accrual method, on the other hand, records income as soon as it is earned plus expenses when they are incurred. It doesn’t matter when the cash changes hands.

The single timing rule carries a lot of weight. It shapes how your financial statements look, how you plan for taxes, and how clearly you can see trends in your business. Cash basis provides a real-time snapshot of deposits and payments, which makes it easy to track cash flow at any moment.

Accrual provides a broader and more accurate picture of performance across weeks and months, which is why many growing businesses and lenders prefer it. For most small businesses, both methods are allowed, leaving the choice up to your size, needs, and reporting requirements.

Who Can Choose an Accounting Method

Eligibility is pretty straightforward. Companies with less than 25 million dollars in revenue can choose between cash and accrual accounting methods under longstanding rules. You may also see an IRS gross receipts test that adjusts for inflation, so some years the threshold lands near 30 million in gross receipts.

Public markets are different. Publicly traded companies must utilize the accrual method because the accrual method conforms to Generally Accepted Accounting Principles, or GAAP. If lenders or investors require GAAP compliance, you will use accrual basis accounting even below the threshold.

If you run small businesses with straightforward cash transactions, staying on the cash basis is often fine. If you plan to scale, seek financing, or prepare financial statements, the accrual basis becomes the lane.

Cash Basis Accounting Explained for Rentals

Cash basis accounting is often the first stop for landlords because it feels natural. With this method, you recognize rent when the cash actually hits your bank account and record an expense only when you pay the vendor.

The cash basis method does not track accounts receivable or accounts payable, which keeps your books light and simple. It maps directly to cash flow without extra adjustments, so what you see is what you have.

For tax purposes, it offers some benefits. You pay taxes only on the money you actually collect. That helps small business owners keep liabilities in check during leaner months. The system itself is straightforward, with fewer moving parts and a cleaner look at your cash position each day.

The tradeoff is that it can distort an accurate picture of profitability if, for example, three months of rent arrive in a single payment. Without accounts receivable or accounts payable, aging tenant balances and upcoming bills may be hidden.

And since cash basis is not aligned with nationally accepted accounting standards, it is not GAAP-compliant for formal financial reporting. For landlords with a handful of units, mostly immediate payment, and only simple or no credit transactions, a cash basis remains a practical choice.

Accrual Accounting Explained for Rentals

Accrual accounting takes a different approach, recognizing revenue when the unit is occupied and rent is earned, not just when the tenant pays. Likewise, expenses are recognized when the vendor provides a service, even if cash transactions happen later. This approach matches rent with the costs that supported it, giving you a clearer picture of how your rentals are really performing month to month.

Lenders usually prefer accrual because it shows long-term stability. Instead of just today’s bank balance, it highlights patterns across months, making forecasts and loan conversations easier. The resulting financial statements are more informative, which makes refinancing conversations smoother.

Accrual bookkeeping is more detailed: you’ll be tracking who owes you, what you owe, and future revenue or bills alongside your regular entries. It can also hide short-term cash crunches. Your books may show a profit while your bank account feels empty. Plus, it scales with growth but demands tighter systems and oversight.

Cash vs. Accrual Accounting: A Side-by-Side Comparison for Property Managers

For landlords and property managers, the real difference between cash vs. accrual accounting shows up in everyday bookkeeping. The way you recognize rent and expenses changes the story your financial reports tell.

Daily Recognition Rules

- Cash basis: Log rent only when payment is received.

- Accrual basis: Log rent when it is earned, even if the tenant pays later.

- Cash basis: Record vendor bills when you actually pay them.

- Accrual basis: Record vendor bills when the service is performed, tracked through accounts payable until paid.

Impact on Financial Statements

- Cash accounting: Provides immediate visibility of cash inflows and outflows, useful for planning repairs or covering mortgage payments.

- Accrual accounting: Gives an accurate financial picture of financial performance, especially across multiple months or quarters.

- Cash method limitation: Profitability may look stronger or weaker depending on when payments land.

- Accrual method advantage: Smooths out timing spikes, creating steadier reports for planning.

Taxes and Timing

- Cash basis: You pay taxes only on rent you actually collected during the year.

- Accrual basis: Profit may include billed but uncollected rent, which can cause cash flow challenges if tenants fall behind.

- Tax planning tip: Cash method allows some control by delaying invoices or prepaying expenses to adjust liability.

Administrative Load

- Cash method: Minimal entries, lower costs, shorter learning curve.

- Accrual method: Requires more detailed setup in your accounting software, monthly closes, reconciliations, and policies for deferred revenue and accrued expenses.

- Cash method fit: Owners with simple operations and mostly immediate payments.

- Accrual method fit: Growing operations with more credit transactions, larger portfolios, or lender requirements.

Quick Rule of Thumb

- Start with cash basis for simplicity.

- Move to accrual basis as you scale and need a fuller view of your financial health.

Real-World Examples, Including Prepaid and Deferred Revenue

There are many examples that help bring these concepts to life. In Scenario A, a tenant prepays two months of rent on June 25. Under the cash basis, you recognize revenue for the full payment the moment the cash arrives.

Accrual basis tells a different story. You would book deferred revenue at receipt, then recognize revenue as each month is earned, following the matching principle. This spreads income more evenly and avoids overstating revenue in June.

- Scenario B looks at your own expenses. Suppose you pay 1,200 dollars up front for a year of background check tools. Cash basis records the entire expense on payment date. Accrual basis books it as a prepaid asset, then recognizes 100 dollars of expense per month. The result is a smoother and more accurate financial picture of your operations.

- Scenario C covers maintenance. A vendor completes a repair April 29, invoices May 2, and you pay May 10. Cash basis records the expense May 10. Accrual basis records the expense in April when the work was performed and tracks it through accounts payable until paid. These practices matter because prepaids, deferred revenue, and accruals help you present your company’s financial health with clarity and consistency.

Choosing the Right Accounting Method for Your Rentals

Selecting an accounting method begins with assessing your current reality. Think about the size of your portfolio, the number of doors, how complex your credit transactions are, and whether your business requires GAAP compliance. These factors influence which method will work best both now and in the years ahead.

Decision cues help narrow the choice. If rent collections are simple and you want direct cash flow visibility, the cash method is usually the easiest. If your business is growing, you are forecasting for investors, or preparing to borrow, the accrual method tends to deliver better financial reporting.

Planning ahead matters. You can switch later, but once your books follow one method, it’s tough to change course without extra work. If you anticipate expansion, it is often wiser to choose accrual early so you do not have to rework your system later. Choose the method you can maintain accurately for the next two to three years.

Helpful Tools: From Property Management Accounting to Accounting Software

Tools can make whichever method you choose easier to manage. Start with your operations hub. Our guide to property management accounting breaks down categories, reports, and everyday entries that build a solid foundation. When outside help is involved, review property management fees so you can plan your cash flow and avoid surprises.

Payments are another critical area. Setting up ACH payments improves rent collection rates and ensures on-time payments. If you are considering mobile solutions, take a look at our rent payment app picks to find one that fits your tenants’ habits.

Accounting software ties everything together. The right accounting system automates recurring entries, sends reminders for accounts receivable, and syncs with your bank account for smoother reconciliations. Look for accounting software that supports both cash basis and accrual basis, so you are ready to switch if your business grows.

For clarity on expenses, a simple expense definition can help distinguish between operational costs and long-term investments. These tools and resources keep your accounting method consistent while saving you time and reducing errors.

Accounting Method Checklists You Can Follow Today

A checklist makes implementation easier and keeps your books consistent. Here are some lists to help you stay organized:

Cash Basis Checklist

- Confirm eligibility under gross receipts and lender requirements

- Document when you recognize rent and record vendor bills

- Review your bank account and cash transactions weekly

- Maintain a tenant balance log (no formal accounts receivable ledger)

- Create a bill calendar (no formal accounts payable ledger)

Accrual Basis Checklist

- Enable AR and AP in your accounting software

- Map recurring prepaids and deferred revenue, set reminders for recognition

- Close books monthly, reconcile bank accounts, review accrued expenses

- Share simple profitability and cash flow reports with partners

Hybrid Approach

Some landlords report taxes on a cash basis but use accrual for financial reporting. This offers flexibility, but it adds complexity. Document procedures carefully and review with your tax professional to avoid errors.

Pros and Cons for Small Businesses

Choosing between cash basis and accrual accounting often comes down to how much simplicity or detail your rental business needs. Both methods bring strengths and tradeoffs. Let’s take a look at them in-depth.

Cash Basis Advantages

- Speed and simplicity: Entries are quick, with fewer adjustments to track.

- Cash clarity: Reports mirror your bank account, so you always know how much cash is available for repairs, bills, or distributions.

- Tax alignment: You pay taxes only on rent actually collected during the year, which can ease the burden when collections slow.

Cash Basis Disadvantages

- Distorted profitability: If tenants pay multiple months at once, revenue spikes in a single period rather than being spread out.

- No receivables or payables: Without formal accounts receivable or accounts payable, unpaid rent and upcoming bills may be overlooked.

- Limited scalability: Lenders, investors, or partners may prefer more formal reporting.

Accrual Basis Advantages

- Accuracy over time: Accrual smooths out timing quirks so you can see true long-term performance.

- Professional reporting: Lenders and investors often require accrual for financing decisions.

Accrual Basis Disadvantages

- Heavier admin: More journal entries, reconciliations, and policies to manage.

- Cash gap risks: Profits may look healthy on paper while the bank account runs lean.

Frequently Asked Questions

What are the two primary accounting methods?

The answer is cash and accrual accounting, both of which offer unique benefits and disadvantages for businesses.

Which method is best for most business owners starting out?

Many small businesses begin with the cash method because it is easy to use, then shift to the accrual accounting method as they grow and reporting needs expand.

When is accrual mandatory?

Publicly traded companies must use accrual basis accounting to maintain GAAP compliance. Even private operators may be required to use accrual if their lenders or investors request it.

Can I switch later?

Absolutely! You can move from cash or accrual after consulting your tax professional. It is important to plan carefully so your accounting system transitions smoothly and your financial statements remain consistent.

How do I know what to pick right now?

Think about your credit policies, the number of units you manage, and how much reporting detail you need. Comfort with accounting software also matters. The right accounting method is the one you can maintain accurately every month.

How TenantCloud Helps You Stay Organized Under Any Method

Whether you choose cash or accrual, TenantCloud simplifies the process. Tenant onboarding, rent collection, maintenance request tracking, and property management accounting all live in one place. This setup reduces administrative time, minimizes errors, and keeps your workflow consistent.

Automatic reminders and logs help with both cash basis and accrual basis by maintaining an audit trail that supports clean financial reporting. TenantCloud also integrates with tools you already use, making accounting software setup easier and less intimidating.

If you are preparing to grow, it helps to understand property management fees before expanding your team. With the right mix of automation and clarity, TenantCloud keeps you organized regardless of which accounting method you rely on today. Sign up for our free trial today to see how TenantCloud can boost your business.