Property taxes can feel like the least glamorous part of running a rental business—but for most landlords, they’re one of the biggest recurring expenses of the year. With deadlines approaching, reassessments underway, and tax changes varying widely from state to state, understanding how property taxes work in 2026 is more important than ever.

This guide preview highlights the essential insights from our full report, giving landlords a practical, data-driven snapshot of what’s happening nationwide—without revealing the entire playbook.

What This Year’s Property Tax Landscape Looks Like

Property taxes continue to be a major revenue source for local governments, but the impact on landlords varies dramatically by location. In some regions, rising home values have triggered reassessment spikes. In others, millage rates have been adjusted to stabilize budgets. And across the country, landlords are seeing different timelines, incentives, and rules depending on their county.

In the full report, we break down these patterns and help landlords understand why their tax bills may change this year—even if nothing changed about the property itself.

Property Tax Basics: What Every Landlord Should Know

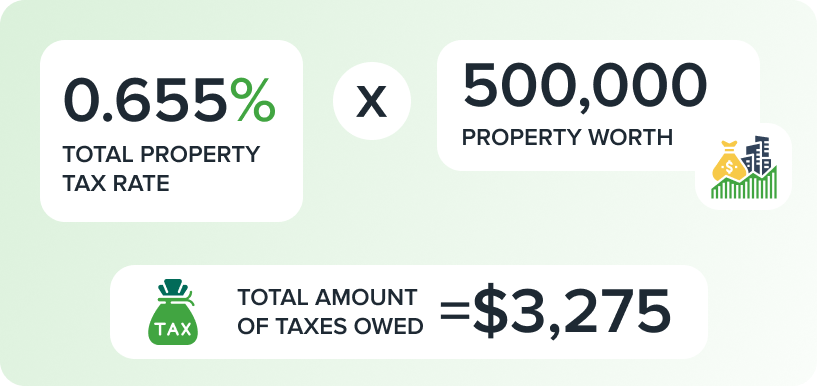

Even experienced landlords can find property taxes confusing because the rules differ in nearly every jurisdiction. This year’s guide walks through:

- How tax assessors determine property value

- What influences the millage rate

- Why some areas have taxes below $300 a year while others exceed $9,000

- The relationship between market shifts and your annual tax bill

State-by-State Trends You Should Be Watching

Not all taxes are created equal. Some states reassess properties every year, while others assess every three or five. Some offer substantial exemptions; others offer none. Certain counties experience consistent millage rate increases; others remain stable.

In the full guide, landlords will find:

- A snapshot of the highest-tax and lowest-tax regions

- States offering the most meaningful exemptions

- Counties with the steepest increases over the past year

- Where investors are finding the best ROI after adjusting for taxes

Urban Markets: Why Big Cities Don’t Always Mean Big Tax Bills

One of the most surprising findings highlighted in the full guide: several major cities with fast-growing populations also have some of the lowest effective tax rates in the country.

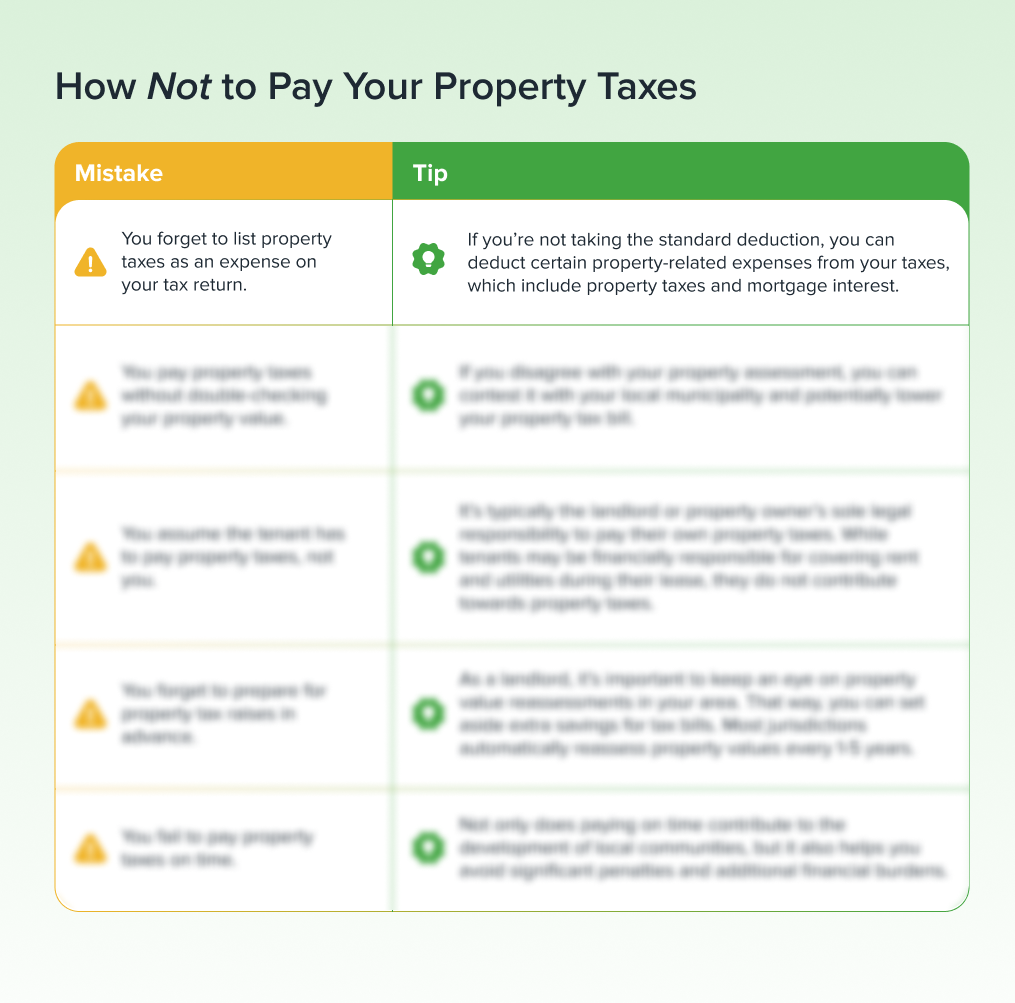

Practical Ways to Keep Your Taxes Low

Lowering your property tax bill isn’t always easy—but it’s often possible. Landlords will learn strategies ranging from reviewing assessments to filing appeals, claiming exemptions, planning upgrades strategically, and more.

Year-Round Tax Prep: Stay Ahead, Not Behind

Waiting until tax season to organize your paperwork is the biggest financial mistake landlords make. To help, the full report includes a year-round tax toolkit you can start using today—complete with organizational tips, TenantCloud report recommendations, write-off reminders, and templates.

The preview introduces the concept, but the complete version delivers the full checklist.

What’s Inside the Full Guide

Here’s a quick look at what the complete 2026 edition includes:

- Detailed explanations of how property taxes work

- A landlord-focused breakdown of annual vs. escrow payments

- State-by-state billing timelines and due dates

- The top highest- and lowest-tax states and counties

- Tax-saving strategies landlords can immediately apply

- A complete FAQ section answering common landlord questions

- A bonus year-round tax checklist for simpler financial prep

- Practical insights into how TenantCloud helps landlords track taxes, expenses, income, and deductions