When you have an apartment to rent, finding the perfect tenant can feel like searching for a needle in a haystack.

Unlike renting out a single-family unit, apartment rentals come with their own set of responsibilities—like shared parking lots, green spaces, neighbors, and being more susceptible to noise disturbances.

That being said, finding a great tenant is a crucial task.

And the most efficient way is to screen tenants with a thorough background check. Failing to perform a tenant background check can expose landlords to significant risks and potential costs—from missed rent payments to property damage and costly evictions.

In this light, background checks are the cornerstone of building a stable, reliable tenancy, providing the correct details to help you make informed decisions, protect your investment, and reduce tenant turnover.

So, let’s break down everything you need to know when it comes to getting apartment background checks working for you and safeguarding your rental business.

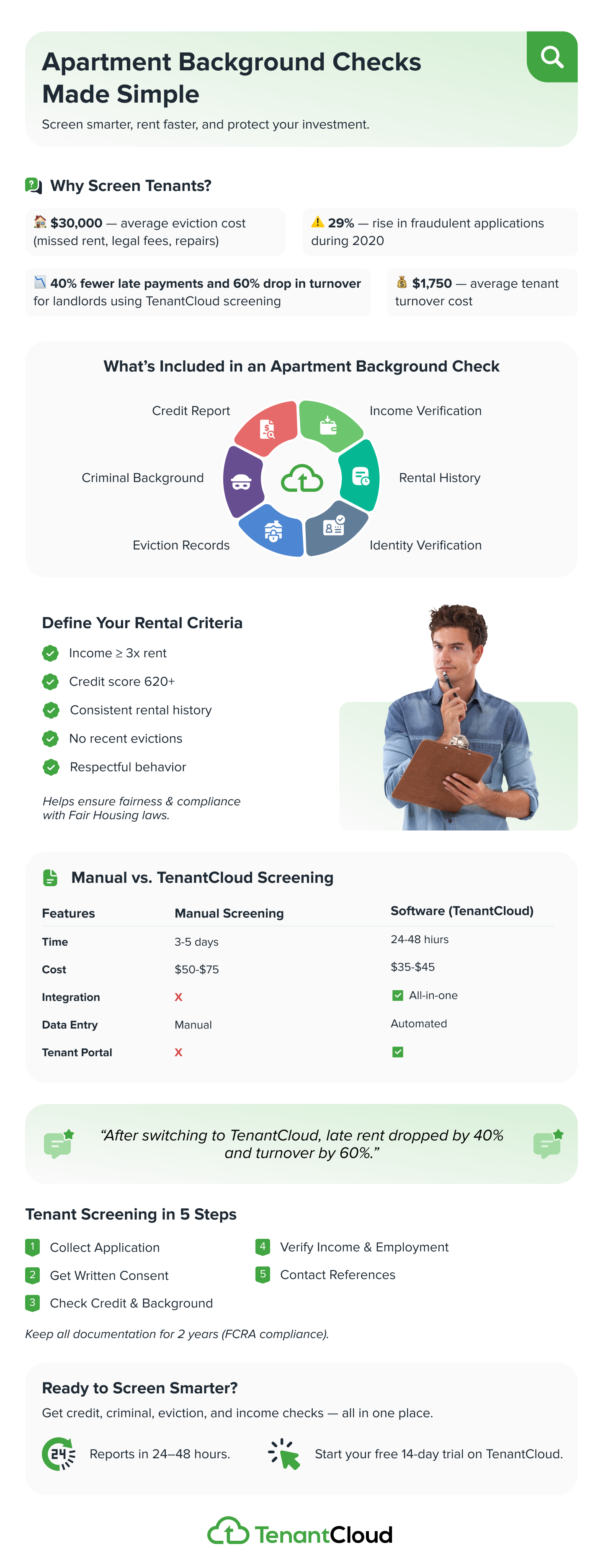

TL;DR: Apartment Background Checks Made Simple

Tenant background check isn’t just paperwork, it's your best defense against fraud, missed rent, and costly evictions. By reviewing credit, criminal, and rental histories, landlords can make smarter, fairer decisions and protect their investment. Setting clear rental criteria ensures compliance and consistency, while using an all-in-one tool like TenantCloud speeds up screening from days to hours. The result? Better tenants, fewer vacancies, and a more reliable rental community.

What It’s About | Key Takeaways |

Why It Matters | Tenant background checks prevent costly evictions, fraud, and property damage—saving landlords time and money. |

What to Check | Credit history, criminal background, eviction records, income, rental history, and identity verification. |

Set Clear Criteria | Define rental standards (income threshold, credit score, behavior) to stay consistent and compliant with Fair Housing laws. |

How to Screen | Choose between manual background checks (slower, costlier) or software screening via TenantCloud (faster, integrated, affordable). |

Legal Compliance | Follow FCRA and state laws, get written consent, and retain all screening documentation for at least 2 years. |

Results Speak | Landlords using TenantCloud screening saw 40% fewer late payments and a 60% drop in turnover rates. |

Why Background Checks for Apartments Matter

On average, an eviction costs property managers over $30,000 (£31,866) when factoring in missed rent, redecorating, legal fees, and repairs. Obviously, these are costs you absolutely want to avoid at all costs – costs that proper tenant screening can prevent.

Let’s break this down

Protect Your Investment

Rental fraud is on the rise. Between February 2020 and August 2020, fraudulent rental applications doubled from 15% to 29%, with 85% of landlords reporting they were victims of rental fraud during this period.

Without proper screening, you're gambling with your most valuable asset.

Reduce Tenant Turnover

The average cost of tenant turnover is approximately $1,750 per unit.

You can quickly work this out for yourself by dividing the total number of tenants you have that move out in 12 months by your total number of tenants and multiplying that figure by 100.

Thorough background checks help identify reliable tenants who pay rent on time and take care of your property, leading to longer tenancies and lower vacancy rates.

Make Informed Decisions

Tenant background checks offer a comprehensive review of the applicant, encompassing rental history, criminal records, and credit reports. This data-driven approach removes guesswork from your tenant selection process, allowing you to screen prospective tenants with confidence.

Legal Protection

Documented screening processes protect you against claims of discrimination. When you apply consistent rental criteria to all applicants and maintain detailed records, you demonstrate fair housing compliance.

Rental Criteria: Your Blueprint for Tenant Selection

Before you can successfully complete a background check, you need to establish your rental criteria.

These standards provide a baseline for you to refer to, ensuring that your tenant selection process is fair, consistent, and compliant with fair housing laws.

Your rental criteria checklist should encompass various aspects of a tenant's profile, including financial stability, rental history, and behavior.

Why Set Clear Rental Criteria?

The clearer your rental criteria, the greater success you'll have in determining the right renter for your apartment. Not only can it make a landlord's life easier, but it can also provide the following benefits:

- Consistency: Applying the same standards to all applicants minimizes the risk of discrimination claims.

- Transparency: Clearly communicated criteria set clear expectations for potential tenants.

- Efficiency: Streamline the tenant screening process by quickly identifying qualified applicants.

When creating your rental criteria, consider including rent requirements that align with the local market and applicable laws. These might include income thresholds, credit score minimums, and occupancy standards.

Want more tips on setting your own tenant screening criteria? Check out our article on establishing rental criteria.

What Does a Background Check for Apartment Rentals Include?

A tenant background check may include a criminal background check, credit report, eviction history, and verification of income.

Here’s each component of a comprehensive screening report, and understand what apartment background checks look for:

Credit Report & Credit Check

A credit report reveals a tenant's financial responsibility by highlighting their credit history, debt levels, and payment habits. Credit scores range from 300 to 850, with most landlords requiring a minimum score of around 620 to 650 for tenant approval.

A healthy credit score, combined with a history of timely payments, indicates financial stability and demonstrates the tenant's ability to meet rent requirements consistently.

When reviewing a tenant's credit report, look beyond just the number. Recent delinquencies, bankruptcy filings, and debt-to-credit ratio provide context about financial health.

A single financial hardship from years ago may be less concerning than multiple recent late payments.

Criminal Background Check

Criminal background checks reveal felonies, misdemeanors, and sex offender registry information. While certain convictions may be relevant to the safety and security of your property and residents, criminal records should not automatically disqualify a candidate.

Consider the nature of the offense, how much time has elapsed, and its relevance to tenancy. Federal law under the Fair Credit Reporting Act and various state-level "ban-the-box" laws provide guidelines on how to evaluate applicants with criminal histories fairly.

Rental History & Eviction Records

Past rental behavior is often a reliable predictor of future tenancy conduct. Contacting previous landlords can unveil invaluable insights into the tenant's reliability, cleanliness, and overall behavior. Did they pay rent on time? Were they respectful of the property and neighbors? These are crucial questions your rental criteria checklist should address.

Public eviction records show formal housing court proceedings, but context matters. In Washington, D.C., only 5.5% of eviction filings led to formal evictions.

Many cases are dropped, settled, or resolved in the tenant's favor. Consider obtaining a portable tenant screening report to understand the full context.

Income Verification & Employment Status

Stable employment and sufficient income are strong indicators of a tenant's ability to pay rent. A general rule of thumb is that a tenant's gross income should be at least three times the monthly rent. This threshold ensures that tenants can comfortably afford the rent alongside their other financial obligations.

Documents for income verification include recent pay stubs, W-2 forms, bank statements, or tax returns to verify financial stability.

Contact employers directly using publicly available contact information to confirm job stability and income. For more guidance on what to request, check out our article on proof of income documents you should require.

Identity Verification

To apply for an apartment, applicants typically complete a rental application and provide personal information, including their name, date of birth, Social Security number, and contact details. Identity verification prevents fraud and ensures the person applying is who they claim to be.

With 29% of rental applications containing fraudulent information, verifying identity through Social Security number confirmation and photo ID checks is non-negotiable.

How to Conduct a Landlord Background Check: Two Approaches

As a landlord, you have two main options when it comes to running a background check for apartments: traditional tenant screening services or integrated property management software screening.

Understanding the differences helps you choose the best approach for your rental business.

Manual/Traditional Background Check Services

Traditional screening services are typically standalone platforms that cater to property management companies and larger portfolios. They provide detailed, customizable tenant screening reports with access to nationwide databases.

Pros:

- Highly detailed screening reports

- Customizable search parameters

- Access to specialized databases

Cons:

- Time-consuming (3-5 days typical turnaround)

- Requires managing multiple platforms

- Higher costs ($50-75 per report)

- Manual data entry from applications

- Often designed for large companies

Property Management Software Screening

Tenant screening services integrated into property management platforms, such as TenantCloud, offer streamlined, all-in-one solutions. These systems connect directly to your rental applications, making the screening process seamless.

Pros:

- Fast turnaround (24-48 hours)

- All-in-one platform integration

- Automated from application to report

- Cost-effective ($35-45 per report)

- State and county-specific searches

- Case-by-case pricing

Cons:

- May have fewer customization options than standalone services

- Features vary by platform tier

Manual Screening vs. Software Screening - A Comparison

Feature | Manual Screening | Software Screening (TenantCloud) |

Time Required | 3-5 days | 24-48 hours |

Cost Per Report | $50-75 | $35-45 |

Number of Platforms | 3-5 separate services | All-in-one platform |

Application Integration | Manual data entry | Automated from application |

Credit Check | ✓ | ✓ |

Criminal Background | ✓ | ✓ (National & Local) |

Eviction History | ✓ | ✓ |

Income Verification | Manual contact required | Integrated verification tools |

State-Specific Searches | Limited | County & state-level options |

Tenant Portal | ✗ | ✓ |

Step-by-Step: How to Screen Tenants Online

Whether you choose a DIY background check or use a built-in screening tool, tenant screening helps landlords make informed decisions about prospective renters before granting them a lease.

You must give written consent for the landlord to conduct the background check and access your personal information—this is a legal requirement under the Fair Credit Reporting Act.

Follow these steps to screen prospective tenants effectively:

1. Application Form

Collect comprehensive information from each applicant, including employment history, previous addresses, and personal references. Applicants complete forms that require their Social Security number, date of birth, and authorization for screening.

2. Credit Report Authorization

Obtain written permission to perform a credit check, respecting applicants' privacy and complying with legal requirements. Without proper authorization, running a tenant credit or criminal background check violates federal law.

3. Landlord References

Reach out to previous landlords to inquire about the applicant's rental history, behavior, and lease compliance. Ask specific questions about on-time rent payments, property care, and any lease violations.

4. Employment Verification

Confirm the applicant's employment status and income information to ensure they meet your rent requirements. Use publicly available company contact information rather than references provided by the applicant to avoid fraud.

5. Personal Interviews

A face-to-face or virtual meeting can provide additional context and help you assess the applicant's compatibility with your rental property. This step allows you to gauge communication style and clarify any questions about the screening report.

By adhering to a thorough tenant screening checklist, you not only protect your property but also contribute to a positive, respectful rental community. For more on creating a great tenant experience, explore our comprehensive guide.

Real Results: How Proper Screening Reduces Risk

The difference between manual screening and comprehensive software-based tenant screening isn't just about convenience—it's about results.

Consider this real-world example: A landlord managing 12 rental units in Austin, Texas had been using traditional manual screening methods, juggling multiple platforms and spending days waiting for background check results.

After switching to TenantCloud's integrated tenant screening service, they implemented the complete screening bundle that includes credit reports, criminal background searches from nationwide databases, eviction history verification, and income verification tools.

The results were dramatic.

Within the first year, they reported a 40% reduction in late rent payments. More significantly, tenant turnover decreased from 45% annually to just 18%—saving thousands in vacancy costs, turnover expenses, and property damage repairs.

The automated screening process allowed them to evaluate potential tenants in half the time while making more informed decisions based on comprehensive tenant screening reports.

"Before TenantCloud, I was piecing together information from three different services," the landlord explained.

"Now everything is in one platform. I can screen applicants directly from their rental application, and the reports come back in 48 hours instead of a week. The time savings alone have been incredible, but the quality of tenants has noticeably improved."

This experience mirrors what 65% of property managers report: implementing AI-driven tenant screening tools leads to better tenant selection and reduced operational headaches.

How to Navigate the Legal Considerations of a Background Check

When selecting a renter for your apartment, be sure to adhere to the guidelines outlined in the Fair Housing Act, which protects individuals from discrimination while renting or buying a home. Discriminatory practices, whether intentional or inadvertent, can lead to significant legal repercussions.

Fair Credit Reporting Act (FCRA) Compliance

The FCRA requires landlords to follow specific procedures when using tenant background check services. Before obtaining a screening report, you must:

- Provide a written disclosure that a report will be obtained

- Obtain written authorization from the applicant

- Provide an adverse action notice if you deny or conditionally approve based on screening results

For more information, review the Fair Credit Reporting Act requirements.

State-Specific Regulations

Screening rules vary widely by state. In 2025, California limits screening fees to $62.02 and requires disclosure of all public records used. Washington bans the consideration of certain misdemeanor arrests. Research your local laws to ensure full compliance with applicable laws.

Record Retention

Maintain all tenant screening documentation for at least two years. This includes applications, screening reports, communications with references, and copies of adverse action notices. Proper documentation protects you if your decisions are ever challenged.

Ensure that your rental criteria and tenant screening practices are equitable, transparent, and consistently applied to all applicants. Understanding tenants' rights and responsibilities helps create a compliant screening process.

Frequently Asked Questions About Apartment Background Checks

Q: What's the difference between a credit check and a background check?

A credit check examines your credit report, credit score, credit history, and payment patterns. It shows how you've managed debt, whether you make timely payments, and your overall financial reliability.

A full background check for apartment rentals is more comprehensive—it includes the credit check plus criminal records, eviction history, rental history verification, employment status, and income verification. Think of a credit check as one component of the complete tenant screening report that property managers use to evaluate prospective tenants.

Some property owners may request just a credit background check for simpler applications, but most comprehensive tenant background check services include all these elements to help landlords feel confident in their decision.

Q: Do I need tenant consent to run a background check?

Yes, absolutely. Federal law under the Fair Credit Reporting Act requires written consent before landlords can access an applicant's credit report or conduct a tenant background check. Applicants must fill out authorization forms and provide their Social Security number and date of birth.

This consent protects renters' privacy and ensures the screening process follows applicable laws and respects the rights of prospective renters. Running a background check without consent can result in legal penalties for property owners, including fines and potential lawsuits.

All reputable tenant screening services and property management companies require this documentation before processing any tenant background search or criminal background verification.

Q: How long does a tenant background check take?

With modern tenant screening services like TenantCloud, most screening reports are completed within 24-48 hours. The system accesses nationwide databases for criminal records, pulls credit history from major bureaus, and compiles eviction history from housing court records.

Manual background check processes conducted through traditional tenant background check services can take 3-5 business days or longer, especially if landlords need to manually contact previous property managers, verify employment history through phone calls, or wait for responses from references.

The timeline depends on how quickly the screening service can access information provided by the applicant and whether any details require additional verification to ensure accuracy and prevent identity fraud. Properties with complete applications and accurate information provided process faster than those with missing details or inaccurate information that needs clarification.

The Ripple Effect of Thorough Background Checks

The benefits of diligent background checks extend far beyond the immediate tenant-landlord relationship. They contribute to the overall well-being of the rental community, fostering a safe, respectful, and harmonious living environment.

Satisfied tenants are more likely to respect the property, adhere to lease terms, and engage positively with other tenants and neighbors. This creates a virtuous cycle of tenancy that benefits everyone—from property owners to service professionals who maintain the building.

Proper screening also impacts the broader rental process. When potential tenants know that comprehensive background checks are standard, it deters those with dishonest intentions while attracting quality renters who value professional property management.

Consider also discussing renters' insurance as another layer of protection.

Wrapping up

Background checks aren't just paperwork—they're your frontline defense against costly mistakes. With proper tenant screening, you protect your investment, reduce turnover, and build a stable rental community that pays on time and respects your property.

The goal isn't just filling vacancies. It's finding reliable tenants who treat your apartment like home.

Ready to screen smarter?

TenantCloud's comprehensive screening includes credit checks, national criminal background searches, eviction history, and income verification—all in one platform. List properties, collect applications, and get detailed screening reports in 24-48 hours.

Start your free 14-day trial today. Join thousands of landlords who've streamlined their screening process and found better tenants faster.