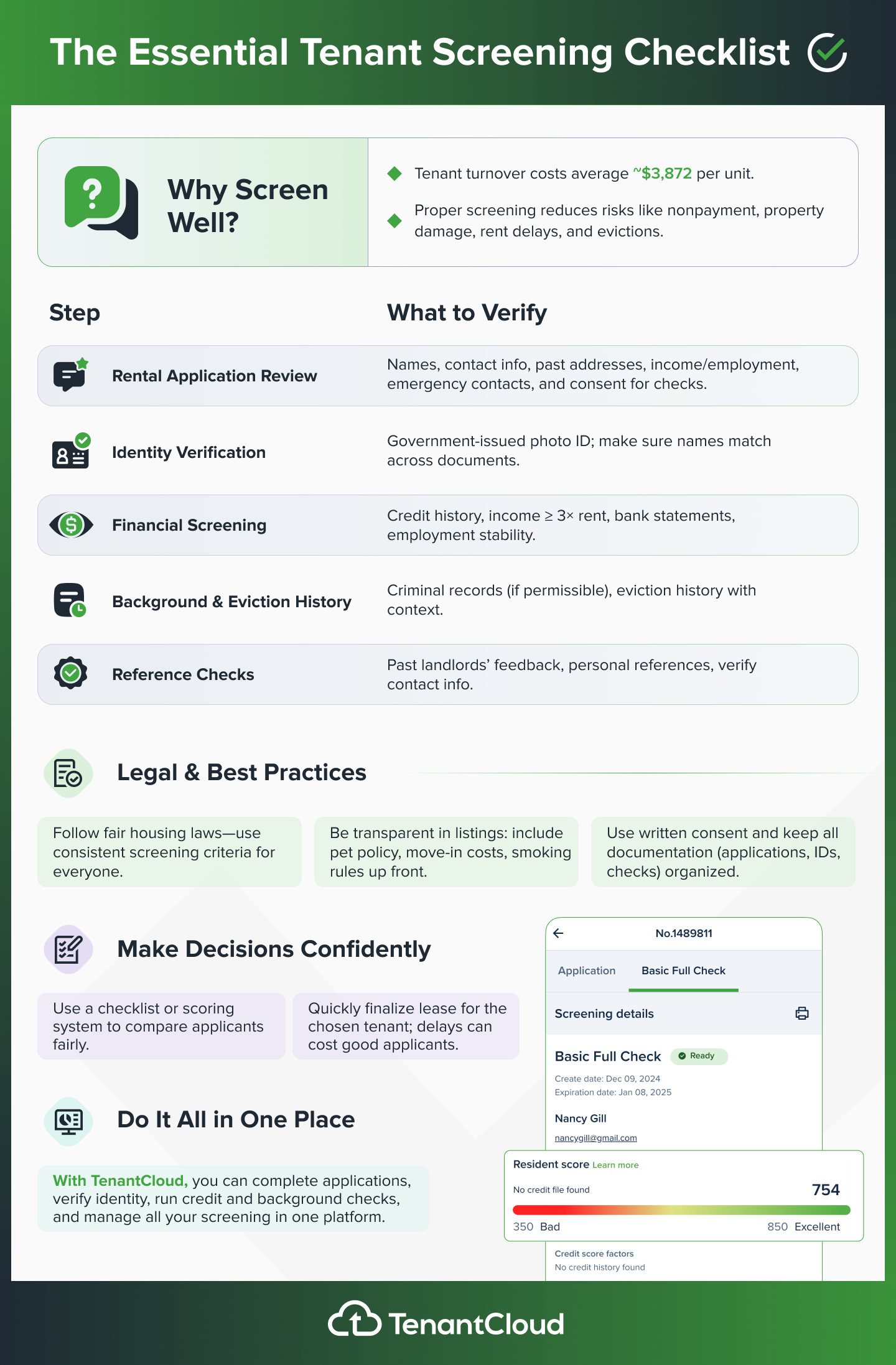

Identifying and convincing the right tenant to move into your property can make all the difference between profit and headache. And with only around 63.8% of tenants renewing their leases nationally (and tenant turnover costs averaging $3,872 per unit), finding the best tenants you can matters more than you might think.

But how do you find the right tenant who will protect your asset and stay awhile? The right tenant screening checklist can help you identify reliable tenants who will pay rent on time. But remember – the tenant screening process isn't just “filling vacancies.” It’s all about protecting your investment!

Why? Because without proper screening, property managers face increased risks of non-payment, property damage, and costly eviction proceedings.

Read on to find a complete tenant screening checklist that will help you evaluate prospective tenants while staying legal with the latest updates to fair housing laws.

You might be managing a single rental property or a full portfolio – following a strategic and standardized screening process will help you make consistent, legally defensible decisions that protect everyone involved.

What is the Tenant Screening Process?

Your tenant screening process becomes your first line of defense against a whole host of problems that keep property managers up at night.

You need a way to evaluate potential tenants using objective criteria. Rather than going with your gut feelings (which can often lead you to rushed decisions), a quality tenant screening process can help property managers make decisions informed by verifiable data.

In short, the screening process includes:

- Collecting detailed information about prospective tenants

- Verifying that information through multiple sources

- Assessing whether applicants meet your predetermined rental criteria

Why Take The Time To Build A Tenant Screening Process?

You have properties to fill – so why not just find the first person willing to fill your space and start paying?

Proper tenant screening can have a huge impact on your property's financial performance (not to mention your peace of mind!) A great screening process helps you avoid the substantial costs associated with evictions, some of which can exceed $5,000 or more.

But it’s not just avoiding worst-case scenarios. A thorough tenant screening can help significantly reduce the likelihood of unfortunate conflicts related to late payments, property damage, and lease violations. In fact, it’s one of the best ways to promote a healthy landlord tenant relationship!

Legal Frameworks and Fair Housing Compliance

Remember: operating within the bounds of fair housing laws isn't optional for property managers. You have to follow the law in order to protect your business from potential discrimination claims and hefty penalties.

For instance, the Fair Housing Act prohibits discrimination based on elements such as race, color, national origin, religion, sex, familial status, and disability. Plus, many states add additional protected classes, so it’s important that you take the time to learn both federal and local laws governing tenant screening in your area.

Beyond learning the local laws, you also need to know how to apply them. This means that your screening criteria must apply equally to all applicants – using the same criteria for everyone, regardless of their background.

Recent updates to tenant screening laws in states like California have introduced new requirements, which include the mandatory disclosure of screening criteria and new limits on application fees, currently capped at $59.67 as of 2025.

It’s All About Consistency

Don’t let the risk of legal compliance issues overwhelm you. Most of your biggest prospect management risks can be mitigated by simply establishing a set of clear, written tenant screening criteria before you ever review a rental application.

These standards need to outline your requirements for monthly income (typically three times the rent), any credit score minimums, and what you’ll accept as acceptable rental history.

You can then properly screen prospective tenants by creating a rental criteria checklist that includes specific thresholds for approval. And when it comes to application fees, be sure to stay within the legal limits set by your state or local government.

Pre-Screening: Your First Tenant Screening Checklist

Before you start looking at credit reports and background checks, you need a solid pre-screening process. This can save you hours of wasted time by filtering out the potential tenants that may not fit your criteria from the start.

How to Set Your Rental Criteria

You’ll want to start by documenting exactly what qualifies someone to rent your property.

Your rental criteria checklist should spell out non-negotiable standards that every applicant must meet. But this isn't about being picky. Think of it more as another hedge to protect your investment while treating everyone fairly.

- Minimum Credit Scores to Rent the Property: A minimum credit score requirement typically falls between 620-650. But this varies by market.

- Monthly Income Requirements: For monthly income, most property managers require a minimum of three times the rent in gross income. If your property rents for $2,000, applicants must demonstrate $6,000 in monthly income. This helps show that they can comfortably pay rent while covering their other expenses.

- Employment Status: The potential tenant’s employment status matters too. Look for at least six months at their current job, or two years if they're self-employed. Good verification shows stability, which can be a positive indicator of whether potential tenants can maintain consistent rent payments throughout the lease term.

- Rental History: Don't forget about rental history requirements. Many property managers will look for 12+ months of positive rental history – and that includes no evictions in the past five years. You’ll find that previous landlords can tell you whether applicants paid rent on time and respected the property.

Creating Effective Rental Listings

Did you know that your rental listing serves as the first screening tool in your arsenal?

When you can clearly state requirements upfront, you'll find that you often attract more prospective renters who already know they qualify.

In your rental listing, make sure you include your pet policy, smoking rules, move-in costs, and basic qualification criteria right in the listing. Anything that can help create that initial “filter” will save you time and possible headaches down the road.

This transparency might seem like it would reduce your applicant pool, but that's exactly the point. You want potential renters who read your requirements and think, "Yes, I meet all of these!"

In short, quality beats quantity every time when screening tenants.

The Complete Tenant Screening Checklist

Now for the meat and potatoes – your comprehensive tenant screening checklist. This checklist can help ensure that you're evaluating potential tenants thoroughly and consistently.

Naturally, you can edit or change this checklist to fit your specific properties, but it works as a systematic approach that protects you legally while helping identify reliable and responsible tenants.

1. Rental Application Review

Your rental application is the foundation of the entire screening process. When you have a great application review process, you can instantly weed out those tenants who won’t fit your criteria.

The complete application should capture:

- The full legal names and contact details for all adult occupants

- Current and previous addresses (aim for a minimum of the past two years)

- Employment details, including employer contacts and monthly income

- Space to include personal references and emergency contacts

- Written consent for background and credit checks

There are simple red flags you can watch for to make sure you don’t let unqualified potential tenants through. Look for incomplete sections, reluctance to provide employer information, or gaps in rental history.

When prospective tenants leave sections blank or provide vague answers, that's your cue to dig deeper or move on to the next applicant.

2. Identity Verification

Many property owners and landlords are surprised by how often rental fraud occurs.

To protect yourself from the unthinkable, always require and verify government-issued photo ID for every adult who'll occupy the property. This single step protects you from many of the scams out there and helps you know that the applicant's rental history and credit reports actually belong to them.

Always match the ID against the rental application. The names should be identical, and the photo should clearly be the person standing in front of you (or on your video call).

For out-of-state applicants, you may want to consider using tenant screening services that include identity verification features.

3. Financial Screening

Now it's time to dive into the numbers. First, start with credit checks.

Credit Checks

Credit checks reveal more than just a credit score for potential tenants. They can display payment history, debt-to-income ratios, and financial red flags, such as recent bankruptcies or excessive credit inquiries.

You’ll find that a minimum credit score of 650 is most common, but remember to look at the complete picture.

Bank Statements

You should also review bank statements to verify the income claimed on their application. Potential tenant pay stubs should show consistent earnings that meet your income requirements.

You may have self-employed applicants, so request tax returns from the past two years. This income verification helps you see that the tenant's income can truly support the rent they're committing to pay.

But don't just verify income exists – make sure it's stable. Review the history of consistent deposits and look for an absence of overdrafts. Small details can help paint a picture of financial stability that goes beyond simple income verification.

4. Background Verification

Criminal Background Checks

You may not want to think about the worst occurring, but it can – and does. That’s why criminal background checks are key for protecting your property and other tenants.

These checks search national databases for criminal records, but remember that you can't automatically disqualify someone just because they have a record. Laws protecting individuals from discrimination due to past mistakes.

Instead, think on the nature, severity, and timing of any convictions. A decade-old misdemeanor is quite different from a recent violent felony.

Many local laws now restrict the use of criminal history in tenant screening. California, for instance, prohibits considering arrests that didn't lead to convictions or summary offenses older than two years.

Always get the prospective tenant's written consent before running these checks – it's legally required under the Fair Credit Reporting Act.

Eviction History

Don’t just look at criminal background information. You’ll also want to check for eviction history through specialized databases or court records.

Previous evictions are strong predictors of future problems, but remember again that context matters. An eviction from five years ago during the financial crisis tells a different story from multiple recent evictions for lease violations.

When evaluating eviction history, consider the reasons behind each eviction.

- Was it purely financial, or were there other lease violations?

- How long ago did it occur?

- Has the applicant's rental history improved since then?

The context matters more than the presence of an eviction itself.

5. Reference Checks

Contacting Previous Landlords

Now we get to the part where you separate good applicants from great ones. Always contact previous landlords (not just the current one.)

Why? Current landlords might give glowing references just to get rid of problem tenants!

As part of this check, ask specific questions:

- Did they pay rent on time?

- How did they maintain the property?

- Were there noise complaints?

- Would you rent to them again?

As you talk with past landlords, listen for hesitation or vague answers. You may find that what landlords don't say tells you more than what they do.

Here’s an important detail: Verify you're actually talking to a landlord! You may find that applicants provide contact information for friends posing as previous landlords.

Cross-reference the phone number with property records or online listings to confirm legitimacy.

Employment Verification

You’ll also want to call the employer directly using a number you find independently.

Confirm employment status, position, length of employment, and income. Some employers will only verify basic information, but that's usually enough to confirm the applicant isn't lying about their job.

For self-employed applicants, this gets trickier. Request bank statements showing regular deposits, contracts with clients, or a letter from their accountant. The goal is to confirm a consistent, reliable income that supports their ability to pay rent on time.

Personal References

While personal references usually paint a rosy picture, the right ones can still provide immense value come decision time.

With personal references, ask about the applicant's reliability, how they handle conflicts, and their general lifestyle. These conversations can reveal red flags that you may not find in background checks or landlord chats.

What Documents Should You Include in Your Tenant Screening Checklist?

The tenant screening process isn’t just about the checks. It’s also about collecting the right documents upfront. Getting key documents from your potential tenants can prevent delays and ensure that you have everything needed for thorough screening.

Required Documentation

The rental application should come with:

- Government-issued photo ID for identity verification

- Pay stubs from the last 2-3 months showing consistent income

- Bank statements demonstrating financial stability

- Employment verification letter or contact information

- Previous landlords' contact details for at least two years

- Personal references (minimum of two non-family members)

If you have self-employed applicants, make sure to add:

- Tax returns from the past two years

- Profit and loss statements

- Client contracts or invoices showing regular income

Consent Forms and Legal Documents

To stay legal and compliant, you’ll want to make sure you have signed authorization forms. Your prospective tenant's written consent should explicitly allow you to:

- Run credit reports and credit checks

- Conduct criminal background checks

- Verify employment and income

- Contact previous landlords and references

- Check eviction records

Keep these documents organized and secure. They're your legal protection if an applicant later claims you violated their privacy or conducted unauthorized checks.

The Tenant Screening Report

Once you've gathered all the information, it’s time to pull all the data together into a comprehensive tenant screening report.

This report can give you a holistic view of a potential tenant and help you make better decisions based on all the available information. This report should include:

- Credit score and credit history analysis

- Criminal record findings (if any)

- Eviction history results

- Employment verification status

- Reference check summaries

- Income-to-rent ratio calculation

Modern tenant management services can automate much of this compilation, providing standardized reports that make comparing multiple applicants easier while ensuring consistent evaluation criteria.

Tips for Making the Final Decision

Evaluate All Your Potential Applications Objectively

With all the information collected, it's time to make your decision!

At this point, return to your original screening criteria and evaluate each applicant against the same standards.

You might create a simple scoring system if helpful. Assign points for credit score ranges, income levels, and rental history quality.

Always remember that you must apply the same criteria to everyone. If you require a 650 credit score, that applies to all applicants. If you make exceptions, document why to protect yourself down the road.

Handle Application Denials Carefully

While you want to find the perfect tenant, you’ll still end up with a number of other tenants who are denied. It’s just part of the process!

However, when denying an application, make sure to follow the proper procedures. If your decision was based on information from credit reports or background checks, you must send an adverse action notice. This is a key notice, and should include details such as:

- The specific reason for denial

- The name and contact information of the screening service used

- A statement about the applicant's right to dispute the information

- Notice that the screening service didn't make the decision

Send this notice quickly once the decision has been made, and keep copies of all correspondence for your records.

Finalize the Details with Approved Tenants

When you’ve approved applicants, move quickly to get them in the system and moved in!

Good tenants often apply to multiple properties, and delays could mean losing them to another landlord. Send the lease agreement fast, and clearly outline move-in procedures. Don’t forget to collect deposits according to your local laws.

Final tip: Document everything. This includes signed lease agreements, receipt of deposits, move-in inspection forms, and any other relevant agreements. This documentation becomes crucial if disputes arise later.

Screen & Find The Best Tenants With The Right System

A strong tenant screening checklist goes beyond just a simple paper document. It can become a standard roadmap to finding reliable tenants who will pay rent consistently and care for your property.

Remember, proper tenant screening starts before you even list your property. And always consider the time you put into a tenant screening process as time invested. That investment can pay dividends through reduced turnover, fewer problems, and much better tenant-landlord relationships.

Are you looking for a better way to optimize all aspects of your property management? TenantCloud's integrated screening tools automate the heavy lifting – from online applications to comprehensive background checks – all while helping you stay compliant with fair housing laws.

Our platform helps property managers know the right questions to ask potential renters and makes checking eviction records simple and thorough. Upgrade your tenant screening from a time-consuming chore into an efficient, professional process that protects your properties and your peace of mind.