TL;DR

Tenant screening is essential for landlords—it protects your properties, finances, and peace of mind. With so many options available, it can be hard to know which service delivers the best balance of speed, accuracy, and price.

We’ve compared seven of the top-rated tenant screening services for 2026, outlining their features, pros, cons, and pricing to help you choose confidently.

A single bad tenant can cost you thousands.

For starters, the average eviction runs over $30,000 once legal fees, missed rent, and damages are factored in, and nearly 1 in 3 rental applications include fraudulent details.

To protect your business, you’ve got to use the tools available to help you weed out ill-intended tenants and find reliable tenants who will treat your rental with respect.

Screening tools are one of the best ways to do this. Your screening process is your safeguard against unreliable tenants, helping you confirm financial responsibility, rental history, and overall credibility before handing over the keys to prospective tenants.

So how do you know which tenant screening services are best? That’s what this guide is all about. Let's go over the most popular tenant screening services today to find out which ones are best for landlords and property managers.

What Makes a Great Tenant Screening Service?

There are several main features and factors that go into top tenant screening services, and it’s not all about whatever new or trendy AI feature has been added lately. You want tenant screening services with these features:

- Comprehensive screening reports: First and foremost, you need a range of tenant screening reports that cover all bases—like credit reports, criminal background checks (national and local databases), eviction history, employment history verification, and identity verification. Having a wide range of detailed reports help you evaluate a prospective tenant's financial responsibility.

- Accurate and compliant data: This should be a non-negotiable for property managers. Only use reputable screening services and those who partner with recognized credit bureaus, such as TransUnion, Experian, or Equifax. Since you’re working with personal data, your preferred tool must comply with local, state, and federal fair housing laws as well as the Fair Credit Reporting Act.

- Speed and efficiency: When you're trying to fill vacancies quickly, you likely want screening tools that can be delivered within 24-48 hours, with some services offering same-day turnaround.

- Transparent pricing: If filling vacancies often, you want to make sure you're using a tenant screening service that provides predictable costs per screening and allows you to manage your budget effectively.

- Built-in workflow: A great tenant screening should exist in your property management workflow to save time and reduce the likelihood of errors.

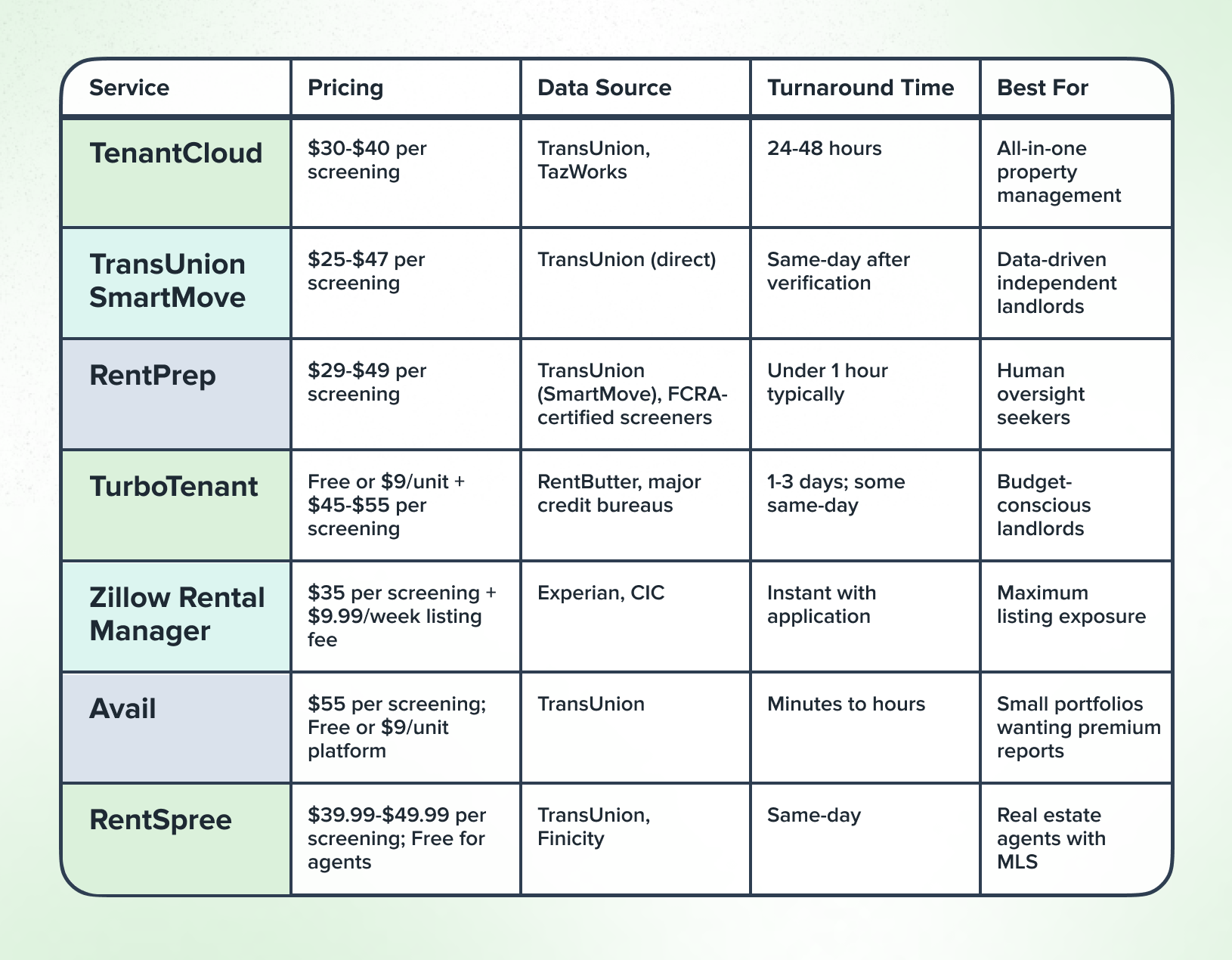

Now let's compare the most popular tenant screening services, side by side.

7 Best Tenant Screening Services in 2026

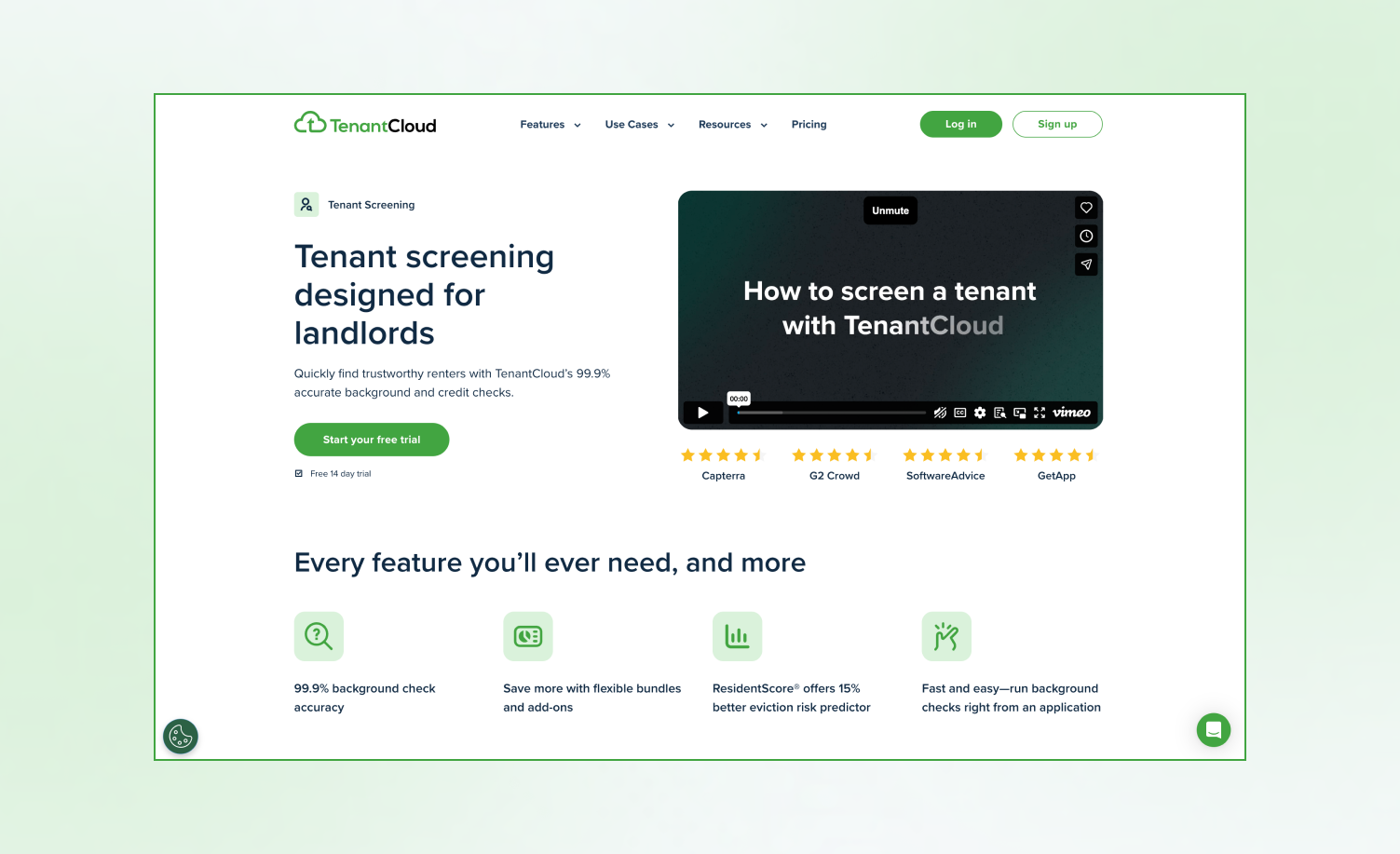

1. TenantCloud: All-in-One Property Management Solution

Best For: Landlords wanting integrated screening, rent collection, and property management in one platform.

TenantCloud delivers a complete property management ecosystem that combines tenant screening with rent collection, maintenance tracking, and accounting—all in one centralized platform.

With over 99.9% background check accuracy at the state level and screening packages powered by TransUnion, landlords get reliable, FCRA-compliant reports that help them make confident decisions fast.

The platform's ResidentScore® offers a 15% better eviction risk predictor compared to traditional credit scores, giving you sharper insights into applicant reliability.

You can run background checks directly from applications, eliminating extra steps and keeping your entire workflow streamlined from listing to lease signing.

TenantCloud stands out by offering unlimited units on all pricing tiers, making it scalable whether you're managing five doors or 500.

The platform also includes optional add-ons like Snappt Income & Employment Verification (99.8% accuracy with fraud protection), County Criminal Search expansions, and Income Insights to verify reported earnings against actual credit data.

What's Included in Screening Reports

- Basic Background ($30): Criminal background check, eviction history, identity verification

- Credit Check ($30): Full TransUnion credit report with ResidentScore®, SSN verification, address history, bankruptcy searches

- Full Check ($40): Everything in Basic Background and Credit Check combined—criminal records, identity verification, education and employment history, evictions, and comprehensive credit analysis

Reports typically arrive within 24-48 hours with automated record matching. You can enhance any package with add-ons like county-level criminal searches and income verification tools.

Pros of TenantCloud

- Truly all-in-one platform eliminates the need for multiple software subscriptions

- Competitive pricing at $30-39 per screening with flexible package options

- Fast turnaround times of 24-48 hours for comprehensive reports

- TransUnion partnership ensures accurate, reliable data

- State-specific searches provide county and local-level criminal checks

- Seamless integration with applications, leasing, and property management

- Unlimited units available on all pricing tiers, making it scalable

- Tenant and landlord portals improve communication and documentation

- Free 14-day trial allows you to test all features risk-free

Cons of TenantCloud

- Learning curve for new users due to the extensive feature set

- May feel like too much for landlords who prefer basic screening without property management tools

Key Information

Pricing | $30-39 per screening (Credit $30, Basic Background $30, Full Check $40) |

Platform Fee | Starter plan: $18/month, Growth: $35/month, Business: $60/month |

Report Turnaround | 24-48 hours |

Credit Bureau | TransUnion & TazWorks |

Best For | Landlords wanting all-in-one property management with integrated screening |

Who Pays | Landlord or tenant (flexible) |

Rating | 4.3/5 stars (Capterra, based on 400+ reviews) |

Free Trial | 14 days |

Mobile App | Yes (separate landlord and tenant apps) |

Bottom Line

For landlords managing multiple units, TenantCloud offers unmatched value—integrating screening, rent collection, maintenance, and accounting into one efficient system. The 99.9% accuracy rate, flexible pricing packages, and unlimited unit availability make it ideal for growing portfolios.

If you want to consolidate multiple tools into a single platform, TenantCloud delivers comprehensive functionality at competitive prices.

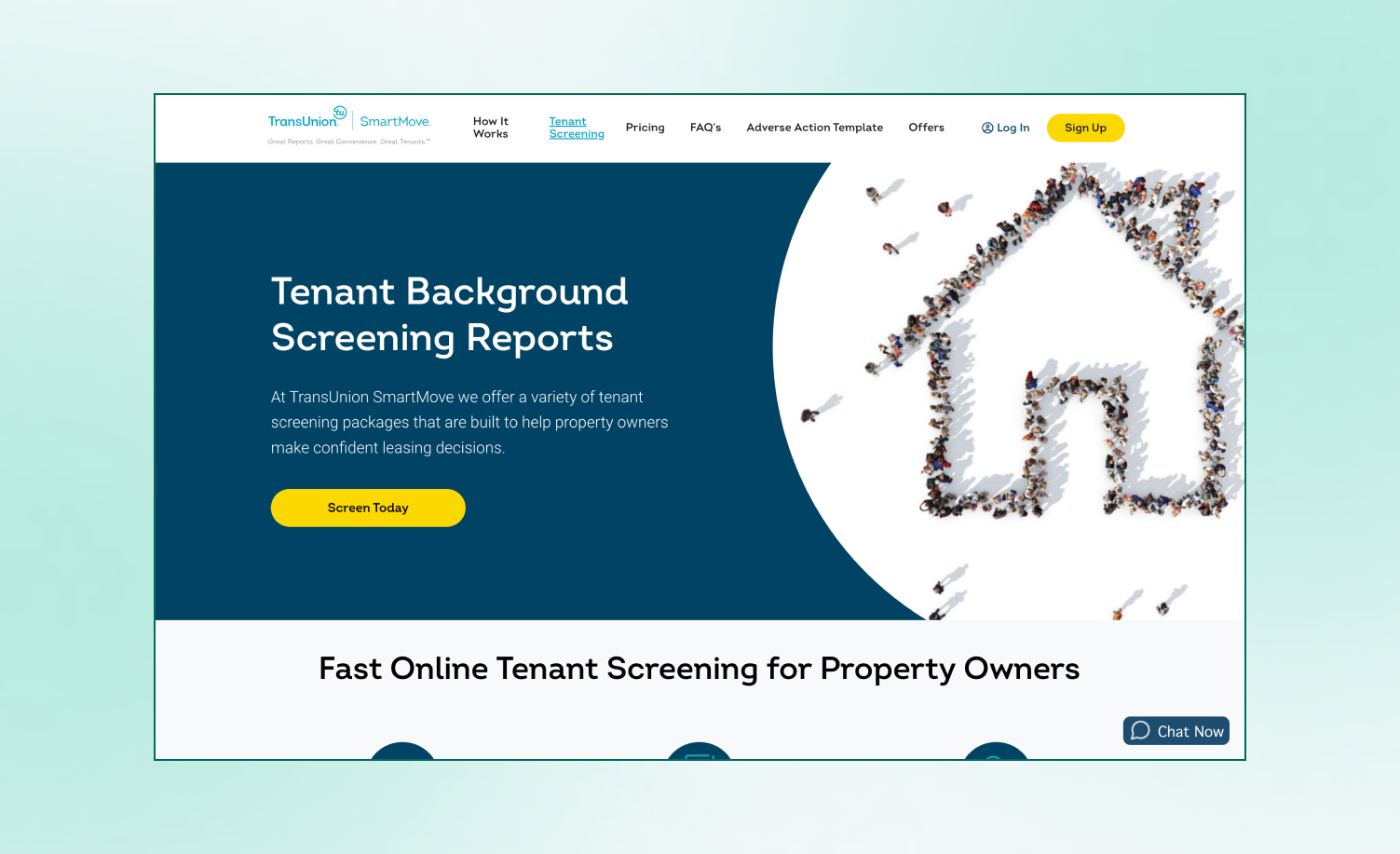

2. TransUnion SmartMove: Direct Access to Trusted Credit Data

Best For: Independent landlords who want reliable, data-driven reports.

SmartMove is TransUnion’s official screening solution, offering direct access to its vast credit and eviction databases. All designed to help you fill properties quickly and with the best tenants available.

Most notably, SmartMove’s ResidentScore® predicts potential evictions 15% better than traditional credit scores, giving you a sharper risk assessment using trusted information

Packages

- SmartCheck Basic ($25): ResidentScore + criminal checks

- SmartCheck Plus ($40): Basic plus Credit Report and Eviction-related reports

- SmartCheck Premium ($47): Contains all checks, including ResidentScore, Criminal Background Check, Credit Report, Eviction Related Report, Income Insights Report, and Identity Check Report

Pros of SmartMove

- Direct TransUnion data from a major credit bureau ensures reliability

- ResidentScore® predictive analytics outperform standard credit scores for rental risk assessment

- Quick reports with same-day delivery after identity verification

- Tenant-initiated screening protects consumer privacy and reduces landlord liability

- Pay-as-you-go model with no subscriptions or hidden fees

- Free account creation with no setup costs

- Income Insights feature helps validate employment and earnings

Cons of SmartMove

- Higher pricing compared to competitors, especially for multiple screenings

- Limited property management integration requires manual processes

Interface could be more intuitive according to user reviews

- No bundled property management tools, unlike all-in-one platforms

Key Information

Pricing | $25-44 per screening (Basic $25, Plus $40, Pro $44) |

Report Turnaround | Same day (most reports) |

Credit Bureau | TransUnion |

Best For | Landlords wanting direct TransUnion data with ResidentScore analytics |

Who Pays | Landlord or tenant (flexible) |

Rating | 4+/5 stars across platforms |

Integration | Limited; standalone service |

Special Feature | ResidentScore® predicts evictions 15% better than traditional credit scores |

Bottom Line

SmartMove is the right choice for independent landlords who prioritize data accuracy and predictive analytics, and looking specifically for screening.

Direct access to TransUnion's databases and the ResidentScore® predictive model provides great risk assessment compared to traditional credit scores.

While pricing runs higher than competitors, you're paying for reliability and the peace of mind that comes with industry-leading credit bureau data. Best suited for landlords who screen occasionally and value quality over cost.

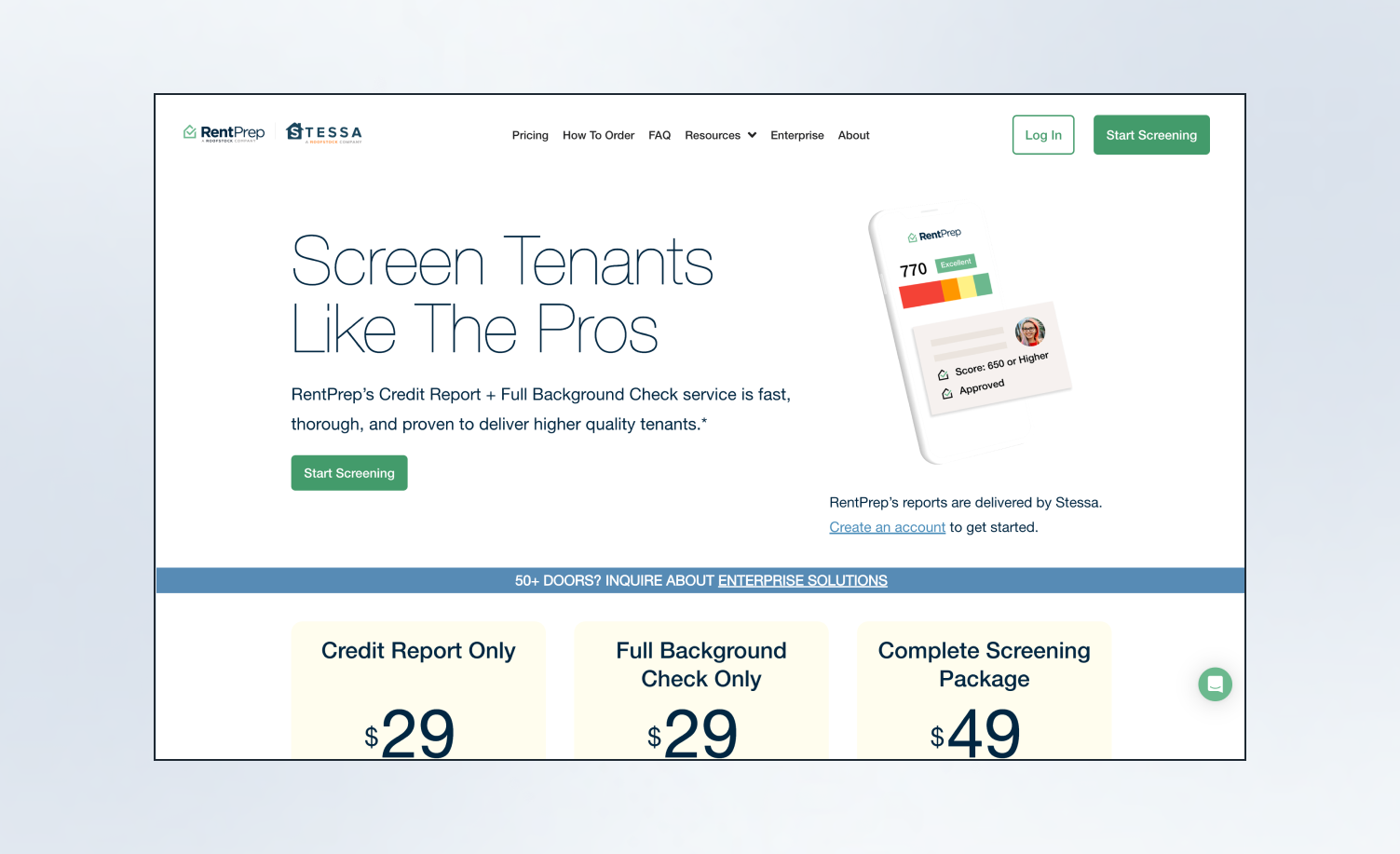

3. RentPrep: Manual Screening with Human Oversight

Best for: Landlords who want human oversight, flexible payment options, and customizable add-ons.

RentPrep—now powered by Stessa—is one of the few tenant screening services that combines automation with FCRA-certified screener reviews. Reports are comprehensive, easy to read, and customizable, making it a trusted choice for landlords managing a few units or large portfolios.

Unlike purely automated systems, RentPrep’s background checks undergo manual review for accuracy, ensuring no important detail slips through. With both landlord- and tenant-pay options, it’s adaptable to different management setups.

Packages

- Credit Report Only ($29): A SmartMove-powered package includes a full TransUnion credit report, ResidentScore®, and bankruptcy search. Optional add-ons are available for deeper income or employment verification. Both landlord- and tenant-pay options are supported.

- Full Background Check Only ($29): This option includes a full background review by an FCRA-certified screener, SSN verification, nationwide criminal and sex offender searches, nationwide evictions, judgments, liens, and bankruptcies. Optional add-ons can be added. Available for landlord pay only.

- Complete Screening Package ($49): The most comprehensive option, this includes everything in both the Credit Report and Background Check tiers—covering SSN verification, nationwide criminal and eviction searches, judgments, liens, bankruptcies, and a certified screener review. Optional add-ons are also available. Both landlord and tenant pay options apply.

- Enterprise Screening (Custom): Designed for landlords managing 50+ doors, this plan includes a dedicated account representative, custom workflows, API integration, advanced search options, tiered screening, and applicant pay flexibility. Ideal for property management companies seeking scalability.

Pros of RentPrep

- Human-verified reports improve accuracy

- Competitive pricing

- Quick turnaround (often under an hour)

- Excellent customer support

Cons of RentPrep

- Slightly slower than instant services

- No full property management tools

Key Information

Pricing | $21-40 per screening (Background $21, Full Credit $40) |

Report Turnaround | Under 1 hour (often 10-60 minutes) |

Credit Bureau | TransUnion (for credit reports) |

Best For | Landlords want human-verified accuracy and detailed screening |

Who Pays | Landlord or tenant (flexible) |

Rating | 4.7/5 stars (Google Reviews, 185+ reviews) |

Special Feature | FCRA-certified screeners hand-compile every report |

Volume Discounts | Available for enterprise customers |

Bottom Line

RentPrep stands out with its human-verified screening approach, combining automation with FCRA-certified screener reviews for added accuracy. The flexible add-on structure lets you customize searches based on each applicant's needs, and the quick turnaround (often under an hour) helps fill vacancies faster.

Ideal for landlords who want the assurance of manual oversight without sacrificing speed, especially when managing portfolios where every detail matters.

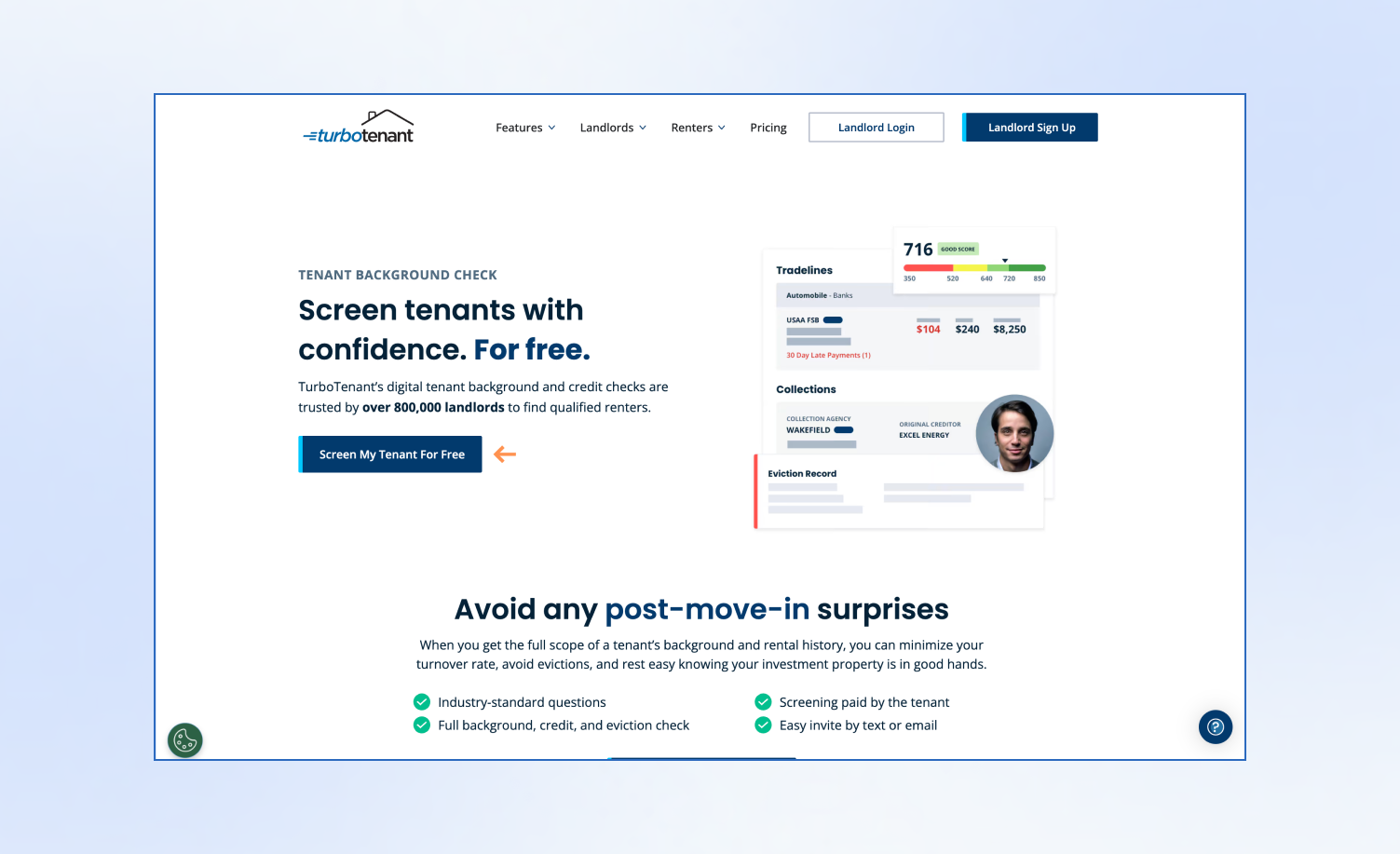

4. TurboTenant: Free Property Management, Pay-Per-Use Screening

Best For: Landlords on a budget who want a free management platform with flexible screening options.

TurboTenant has built its business model around providing core property management features completely free, with over 850,000 landlords using the platform. You only pay when you need to screen a tenant—whether you've got 1 door or 1,000.

Screening reports are powered by RentButter and include data from major credit bureaus, covering credit history, criminal records, and eviction history. Your listings automatically syndicate across major rental sites like Zillow, Trulia, and Apartments.com for maximum exposure.

What's Included in Screening Reports

- Credit score and full credit report from major bureaus

- Lines of credit and credit inquiries

- Debt in collections and payment history

- Criminal record checks (300+ million records)

- Eviction history (27 million records across all 50 states)

- Income Analysis tool (Premium only)

The process is straightforward: enter the applicant's email, TurboTenant verifies their identity, and you receive the report. Most screenings are completed within 1-3 days, with some same-day results.

Packages & Pricing

- Free Plan ($0/ 0/month): $55 per applicant screening. Includes unlimited listings, applications, screening reports, rental marketing, rent collection, and maintenance tracking.

- Premium Plan ($9/unit/month): $45 per applicant screening. Everything in Free Plan, plus Income Analysis tool, enhanced lease agreement features, and priority customer support.

Pros of TurboTenant

- 100% free core management tools with no hidden fees

- Trusted by 850,000+ landlords

- Automated listing syndication to major rental sites

- Never collect sensitive applicant information—they enter it directly

- Mobile app for iOS and Android

- Comprehensive free features: rent collection, maintenance tracking, expense tracking

Cons of TurboTenant

- Screening costs add up with multiple applicants ($55 each)

- Some users report occasional rent payment processing delays

- No integration with other property management platforms

Key Information

Pricing | Free plan: $55/screening; Premium: $9/unit + $45/screening |

Data Source | RentButter partnership, major credit bureaus |

Turnaround Time | 1-3 days; some same-day |

Payment Options | Applicant or landlord pay |

Customer Support | Email, help center, priority support on Premium |

Mobile App | iOS and Android |

Integration | Standalone platform with rental site syndication |

Compliance | FCRA-compliant |

Bottom Line

TurboTenant is ideal for cost-conscious landlords who want comprehensive property management tools without monthly subscriptions. The pay-as-you-go screening model works well for smaller portfolios with infrequent turnover, though screening costs can accumulate during busy application periods.

When you factor in the free listings, applications, leases, and rent collection, TurboTenant delivers strong value for independent landlords managing under 20 units.

5. Zillow Rental Manager: Maximum Listing Exposure

Best For: Landlords focused on visibility and lead generation who want streamlined tenant screening.

Zillow Rental Manager leverages one of the largest rental audiences in the country, giving your properties maximum exposure across Zillow, Trulia, and HotPads. When renters apply to your listing, they can use the same application across all participating properties for 30 days—making it convenient for applicants and efficient for you.

Zillow partners with industry leaders Experian (for credit reports) and CIC (for background checks) to deliver comprehensive tenant screening reports. The platform combines listing management, applications, screening, lease signing, and rent collection in one centralized interface.

What's Included in Screening Reports

- Credit score, open credit lines, and credit history from Experian

- Employment history and residence history

- Past bankruptcies and collections

- Criminal background check

- Eviction history

- Income documentation provided by the applicant

The screening reports are included automatically with each application—no additional wait time required. Renters pay the application fee, and their screening reports are valid for 30 days across unlimited participating rentals.

Packages

- Single Screening Package ($35): Includes a complete credit report from Experian, background check from CIC, eviction history, and income documentation. Fee paid by applicant. Reports are reusable for 30 days across participating properties.

Pros of Zillow

- Massive audience reach across Zillow, Trulia, and HotPads

- Free for landlords—renters pay the $35 application fee

- Reusable screening reports save time for applicants and landlords

- Instant screening results with submitted applications

- Built-in lease creation and digital signing tools

- Automated rent collection with autopay features

- Industry-leading compliance filtering meets local screening laws

- Easy application management with email notifications

Cons of Zillow

- Ongoing listing fee of $9.99/week per property

- Single screening package offers less customization than competitors

- Limited add-on options for deeper searches

Key Information

Feature | Details |

Pricing | $35/screening (paid by applicant); $9.99/week listing fee |

Data Source | Experian (credit), CIC (background checks) |

Turnaround Time | Instant with application submission |

Payment Options | Applicant pay only |

Customer Support | Email and help center |

Mobile App | iOS and Android |

Integration | Zillow, Trulia, HotPads syndication |

Compliance | FCRA-compliant with local law filtering |

Bottom Line

Zillow Rental Manager is ideal for landlords prioritizing maximum listing exposure across Zillow, Trulia, and HotPads. The reusable 30-day screening reports and instant turnaround help fill vacancies faster.

While the $9.99/week listing fee adds up, the massive audience reach and integrated leasing tools make it worthwhile for landlords who value lead generation and tenant-friendly applications backed by trusted names like Experian.

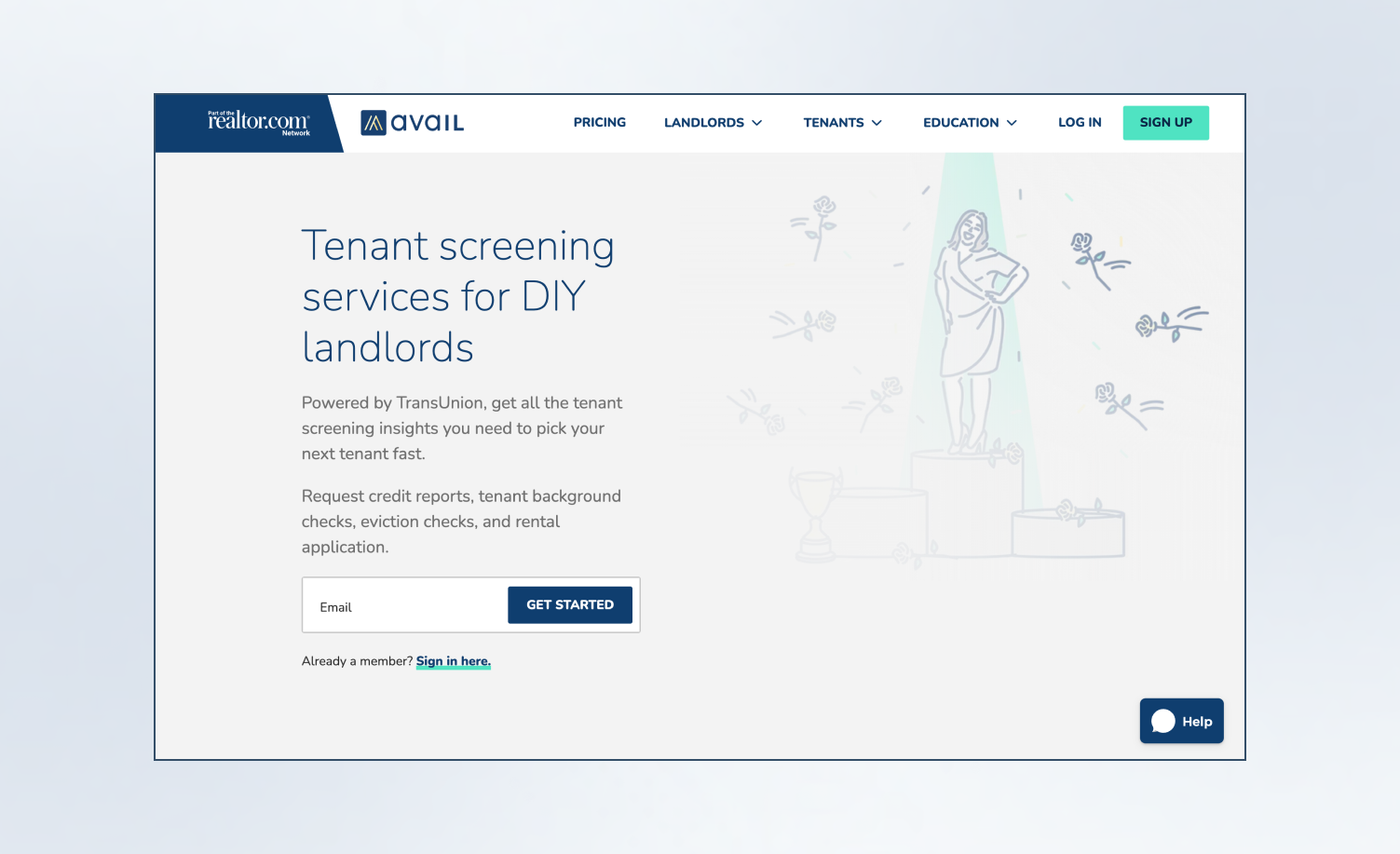

6. Avail (by Realtor.com): Premium Reports for Small Portfolios

Best For: Small landlords wanting polished, detailed reports with simplified screening communication

Avail combines professional-grade reporting with a clean, intuitive interface designed specifically for DIY landlords. Powered by TransUnion, their screening reports include comprehensive credit, criminal, and eviction data with identity verification—all presented in easy-to-read formats that help you make confident decisions quickly.

The platform goes beyond basic screening by keeping all application details, screening results, and follow-ups organized in one place.

Applicants can create Renter Profiles and share their already-paid-for screening reports with multiple landlords, streamlining the process for everyone involved.

What's Included in Screening Reports

- Full credit report including credit score, trade lines, inquiries, available credit, and debts

- Nationwide criminal history (felony and misdemeanor records from all 50 states and local municipalities)

- State-by-state eviction checks matching name and SSN from all 50 states plus Washington D.C.

- Identity verification

- Integrated income verification options

The entire screening process is streamlined: list your vacancy, automate your scheduling directly from listings, set applications to be automatically requested from all lead inquiries, and review everything in one organized dashboard.

Packages

- Standard Screening Report ($55): Includes full TransUnion credit report, nationwide criminal background check, state-by-state eviction search, and identity verification. Landlord or applicant can pay. Reports stored indefinitely in your Avail account for future reference.

- Unlimited (Free): Full screening capabilities, listings on 22+ sites, applications, leases, rent collection

- Unlimited Plus ($9/unit/month): Everything in Unlimited, plus promoted listings for premium placement, priority support, and enhanced features

Pros of Avail

- Beautiful, easy-to-read report layouts with professional presentation

- TransUnion-powered data ensures reliability and accuracy

- Applicants can preview and share their reports with multiple landlords

- All application materials are organized in one centralized dashboard

- Automated tour scheduling doubles the chances of receiving applications

- Compliant, prewritten messages for approving or denying applicants

- Listings syndicate to 22+ top rental sites

- Reports stored indefinitely for future reference

- Free plan includes full screening functionality

Cons of Avail

- Higher per-report pricing at $55 compared to competitors

- Some users note transaction fees on rent collection

- Promoted listings require Unlimited Plus subscription

Key Information

Pricing | $55/screening; Platform: Free or $9/unit/month |

Data Source | TransUnion |

Turnaround Time | Minutes to hours after applicant completion |

Payment Options | Applicant or landlord pay |

Customer Support | Email, help center, priority support on Unlimited Plus |

Mobile App | iOS and Android |

Integration | Listings syndicate to 22+ rental sites |

Compliance | FCRA-compliant |

Bottom Line

Avail offers polished, easy-to-read reports perfect for landlords managing smaller portfolios who value presentation and organization.

The $55 screening cost is offset by report quality, shareable applicant profiles, and a comprehensive free platform with listings, leases, and rent collection. If you want professional-grade reports with beautiful layouts and no monthly fees, Avail delivers excellent value.

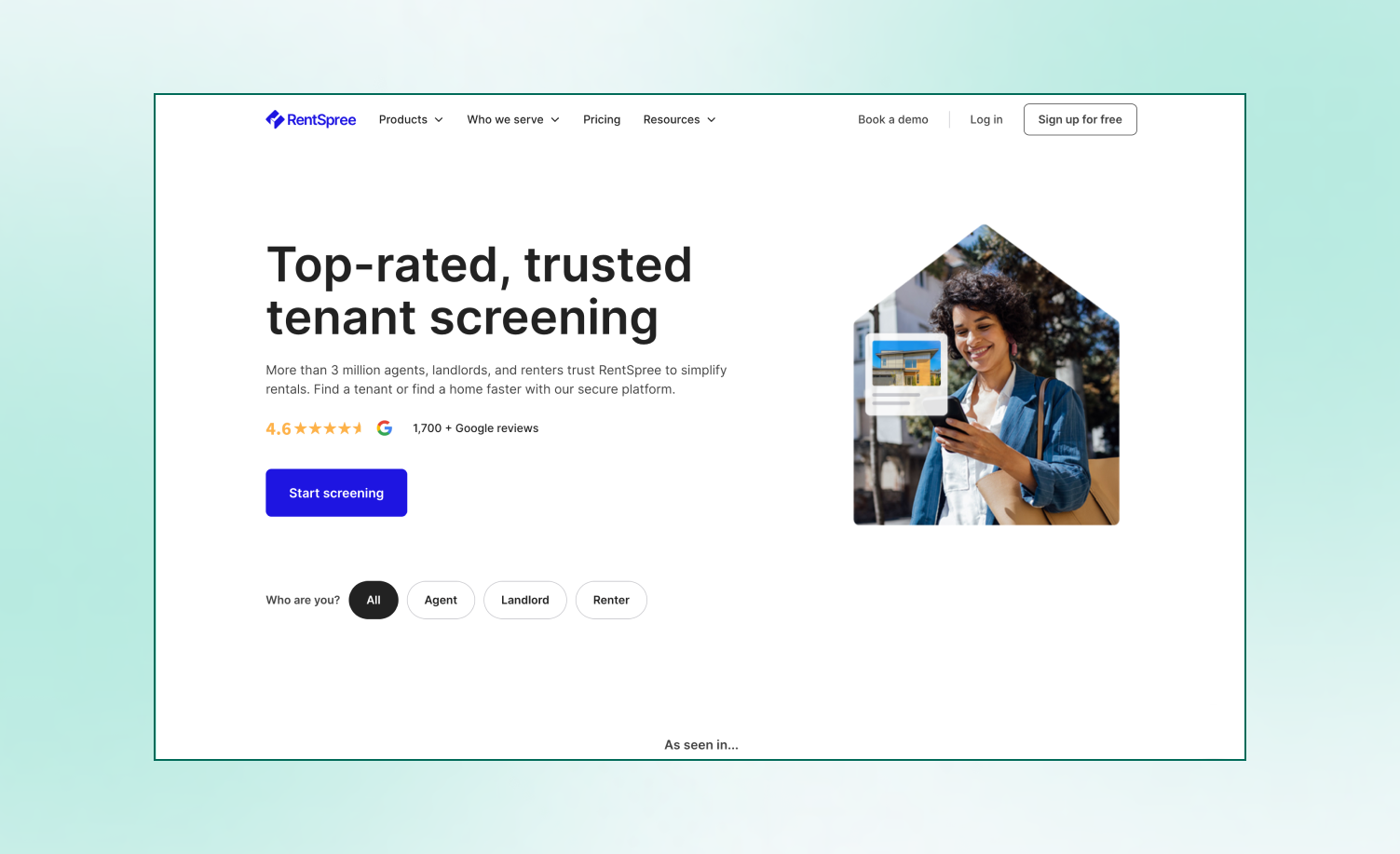

7. RentSpree: Designed for Real Estate Agents

Best For: Real estate agents and property managers using MLS integrations who need fast, reliable screening reports.

RentSpree's platform is built specifically for busy real estate professionals, with over 300 MLS and real estate partners and more than 3 million users.

Powered by TransUnion and Finicity (a Mastercard company), the platform delivers comprehensive screening reports through a mobile-friendly dashboard that works from your desk or on-the-go.

The standout feature is RentSpree's MLS integration, making it seamless for agents to screen tenants directly within their existing workflow.

With same-day turnaround and a centralized dashboard for managing multiple applicants, RentSpree eliminates the paperwork hassle while keeping sensitive information secure with SOC2 Type II certification.

What's Included in Screening Reports

- ResidentScore® and full credit history (payments, trade lines, inquiries, collections)

- Criminal background check from millions of records

- Eviction history from 25+ million records across the United States

- Income verification with bank-verified proof of income and employment (powered by Finicity)

- Identity verification and document uploads

- Reference check outreach

The screening process takes just minutes: sign up, set up your property, share your custom application link, and watch completed submissions come straight to your dashboard.

Packages

- Rental Application Only (Free): Basic rental application with no screening reports. Free for agents and landlords.

- Standard Screening ($39.99): Includes credit report with ResidentScore®, criminal background check, and eviction history. Fee paid by applicant. Reports expire after 30 days per TransUnion regulations.

- Extended Background Check (Add $10): Adds state and local court records that most providers skip.

- Complete Package (Up to $49.99): Everything in Standard, plus extended background check, income verification, reference checks, and ID upload capability.

Pros of RentSpree

- Free for agents and landlords—applicants pay the screening fee

- 300+ MLS and real estate partner integrations

- Same-day report delivery after applicant completes the submission

- Mobile-friendly reports and a dashboard for screening anywhere

- SOC2 Type II certified security for sensitive information

- Bank-verified income confirmation through Finicity partnership

- ResidentScore® specifically designed for rental performance prediction

- Reports can be saved or printed as PDFs within 30 days

- No subscription fees—pay-as-you-go model

- Handles reference check outreach automatically

Cons of RentSpree

- No income verification on standard package (requires upgrade)

- Some local records are missing in select states

- Reports expire after 30 days (TransUnion requirement)

- Limited property management tools compared to all-in-one platforms

Key Information

Pricing | Free for agents/landlords; $39.99-$49.99 per applicant |

Data Source | TransUnion, Finicity (Mastercard company) |

Turnaround Time | Same-day after applicant submission |

Payment Options | Applicant or landlord pay |

Customer Support | Help center, email support |

Mobile App | Mobile-friendly web platform |

Integration | 300+ MLS partnerships, API available for enterprise |

Compliance | FCRA-compliant, SOC2 Type II certified |

Bottom Line

RentSpree is the go-to choice for real estate agents needing fast, MLS-integrated screening reports. The platform's 300+ MLS partnerships, SOC2 security certification, and same-day turnaround make it ideal for busy professionals managing multiple applicants.

While it lacks full property management features, RentSpree excels at efficient screening with pay-as-you-go pricing that's accessible for agents of all portfolio sizes.

Frequently Asked Questions

What’s included in a tenant screening report?

Credit reports, criminal background checks, eviction history, identity verification, and sometimes income verification or sex offender registry searches.

Which tenant screening service offers the best value for background, credit, and eviction checks?

To find the best value, look for tenant screening services that offer more than just a low price—but also provide detailed and helpful information. TenantCloud offers a built-in tenant screening service that combines credit history, nationwide criminal checks, and eviction records into one easy-to-read report. Designed for property managers and landlords, these tenant screening reports walk you through the specifics so you can make more informed decisions faster.

Which tenant screening service delivers the fastest results for filling vacancies quickly?

When vacancies cost money, you want results as fast as possible. However, instant results may lead to false information and verification. Many tenant screening services deliver quick credit and background results in as little as one business day. With TenantCloud, a property management platform, a full report (including a background, credit, and eviction-related report) typically returns the same day. Other data, such as income and identity verification, typically takes longer, as it is dependent on the applicant completing their part of the report. To find the fastest services, look for those that offer digital screenings with no offline processing.

Which tenant screening platforms save the most time compared to manual reports?

Tenant screening platforms save time by eliminating additional steps. Look for services that allow applicants to submit their own information, provide digital consent, and trigger reports automatically. With TenantCloud, tenant screening reports are generated inside your property management dashboard, so you spend less time chasing paperwork and more time making choices with confidence.

Who pays for tenant screening?

Usually the applicant, though some services let landlords pay. Always check your state’s fee regulations.

How long do reports take?

Anywhere from a few minutes to 48 hours. Automated systems like TurboTenant and Avail are nearly instant, while manual services like RentPrep take up to an hour.

Are these services legally compliant?

Yes—all listed providers comply with the Fair Credit Reporting Act (FCRA) and follow strict data-handling standards.

The Smart Investment

Tenant screening is a simple way to protect your assets. With eviction costs averaging tens of thousands, paying $30–$55 for a verified report is a small price for long-term peace of mind.

Each service offers unique strengths, but for most landlords, TenantCloud provides the best overall balance of value, speed, and integrated management.

Ready to simplify your tenant screening and property management?

Start your free 14-day TenantCloud trial and manage everything—from applications to rent collection—in one place.