Are you a property manager or landlord spending too much time chasing down late rent or spending extra time depositing checks?

Payment issues are still a major cause of concern for property managers, especially those who still rely on traditional payment methods like checks or cash. Not only are you losing time that could be spent upgrading your properties or expanding your portfolio, but you’re likely losing money along the way.

Property managers who move to online rent collection platforms report saving nearly 20 hours weekly on administrative tasks. For a 20-unit property, that's $480 to $2,160 wasted annually just on check-processing fees.

Yet despite the many advantages, 40% of rent payments in 2025 are still flowing through checks and money orders.

Why the gap? It’s largely because property managers – particularly independent landlords – haven’t found the right platform for their needs. You want an online rent payment system that offers fast processing as well as tenant-friendly features, without overpaying for features you’ll never use.

To help you out, we’ve pulled together our list of the top online rent collection services on the market today – from those that handle just the basics in payment processing to full-suite solutions that large-scale property managers will love.

TL;DR

- Online rent collection services can automate rent payments and reduce late payments – all while cutting administrative costs by up to 70%.

- The top online rent collection services include features such as automated rent payment reminders, multiple payment methods, credit reporting, and more.

- When analyzing potential options, look for fee structures and processing times, as well as partial payment handling, to help residents stay ahead of rent payments.

- While 40% of renters still use checks, properties that offer dedicated payment apps often see much higher adoption rates.

What Are Online Rent Collection Services and How Do They Compare?

Online rent collection services are, at their most basic, digital platforms that allow tenants to pay their rent electronically, often through secure web portals or mobile apps.

This means that instead of writing a check or handling cash, renters just hop online and pay their rent using a credit or debit card, or an ACH bank transfer. Many rent collection systems now accept digital wallets like Apple Pay and Google Pay.

When a tenant initiates a payment, the system processes the transaction through encrypted channels and verifies that the funds are available. They then transfer the money directly to the property manager's designated account. Both parties receive instant confirmation, creating a clear digital record – and fewer headaches when rent is due!

What Features Should You Look for in Online Rent Collection Services?

There are several online rent collection platforms, so you’ll want to make sure that you find one that works best for your unique needs. As you browse, you’ll want to prioritize capabilities that reduce your workload as a property manager, while making it easy to pay and track rental payments.

Automated Recurring Payments

Any top online rent collection will be built around a strong automated recurring payment system.

Tenants should be able to set up automatic rent payments that process on the same date each month without having to log in and manage them manually.

The ability to automate and create rent payment habits reduces late payments by 30-50% and eliminates the monthly reminder cycle. The top platforms will allow tenants to choose their preferred payment method for automatic payments and send confirmation emails after each transaction.

Multiple Payment Methods

One of the best ways to make sure your tenants pay their rent on time? Offer multiple payment options to suit their needs.

The best online rent collection platforms accept ACH bank transfers (lowest cost), debit card payments, credit card payments, and digital wallets like Apple Pay and Google Pay.

You’ll find that tenants appreciate your flexibility in payment management, particularly when you make it easy for them to pay through a variety of options.

Payment Reminders and Notifications

If having multiple payment options is a top way to make sure tenants pay, then automated reminders are a close second!

Automated rent reminders can reduce late rent by notifying tenants well before due dates approach. The top systems allow you to customize and send reminders via email and text at intervals of your choice – typically 5 days before, 1 day before, and on the due date.

Plus, once rent is paid, tenants receive instant payment confirmation and digital receipts they can reference later. Landlords also receive notifications for all incoming rental payments, as well as any failed attempts or upcoming payment due dates.

Late Fee Automation

Do you find that you are constantly tracking down late payments and having to deal with charging late fees and fines? Let your system handle it for you!

Online rent collection services can automate late fees according to your lease terms, applying charges automatically after grace periods expire.

You’ll want to look for tools that let you configure late fee rules by property and set grace periods. Many also offer the ability to block partial payments until late fees are paid.

Tenant Portal Access

Today’s renters expect to have 24/7 digital access to their payment options. That means you’ll want to pick a rent collection service with a well-designed tenant portal. A portal provides self-service capabilities, including current balance displays, payment history with downloadable receipts, and the ability to update payment methods.

Don’t forget: the portal should be mobile-responsive or offer a dedicated mobile app, as many tenants prefer to manage everything from their smartphones!

Integration with Property Management Accounting

Standalone rent collection tools are available, but they can quickly create data silos that complicate property management accounting. The top solutions will integrate easily with tools such as QuickBooks or offer built-in accounting features. This integration eliminates double-entry bookkeeping and automatically keeps financial records up to date.

Professional Platforms vs. Payment Apps

The biggest mistake property managers make? Trying to save money by relying on consumer payment apps like Venmo, Zelle, or PayPal for rent collection – especially in rent control situations.

While these apps work fine for splitting dinner bills, they lack many of the features we’ve listed above, and can come with much higher costs and lower security.

For instance, PayPal charges 2.9% + $0.30 per transaction but provides no rent-specific tools. Venmo and Zelle offer free personal transfers but explicitly discourage business use and provide zero protection for landlord-tenant transactions.

Professional payment platforms give you the tools you need to run your business, while ensuring you stay compliant with all landlord-tenant law requirements.

Best Online Rent Collection Services

So, what are the best online rent collection services?

Different platforms will offer different use cases depending on portfolio size, management style, and each property manager's needs. What works perfectly for an independent landlord with three units becomes limiting or expensive for property managers overseeing 50+ properties.

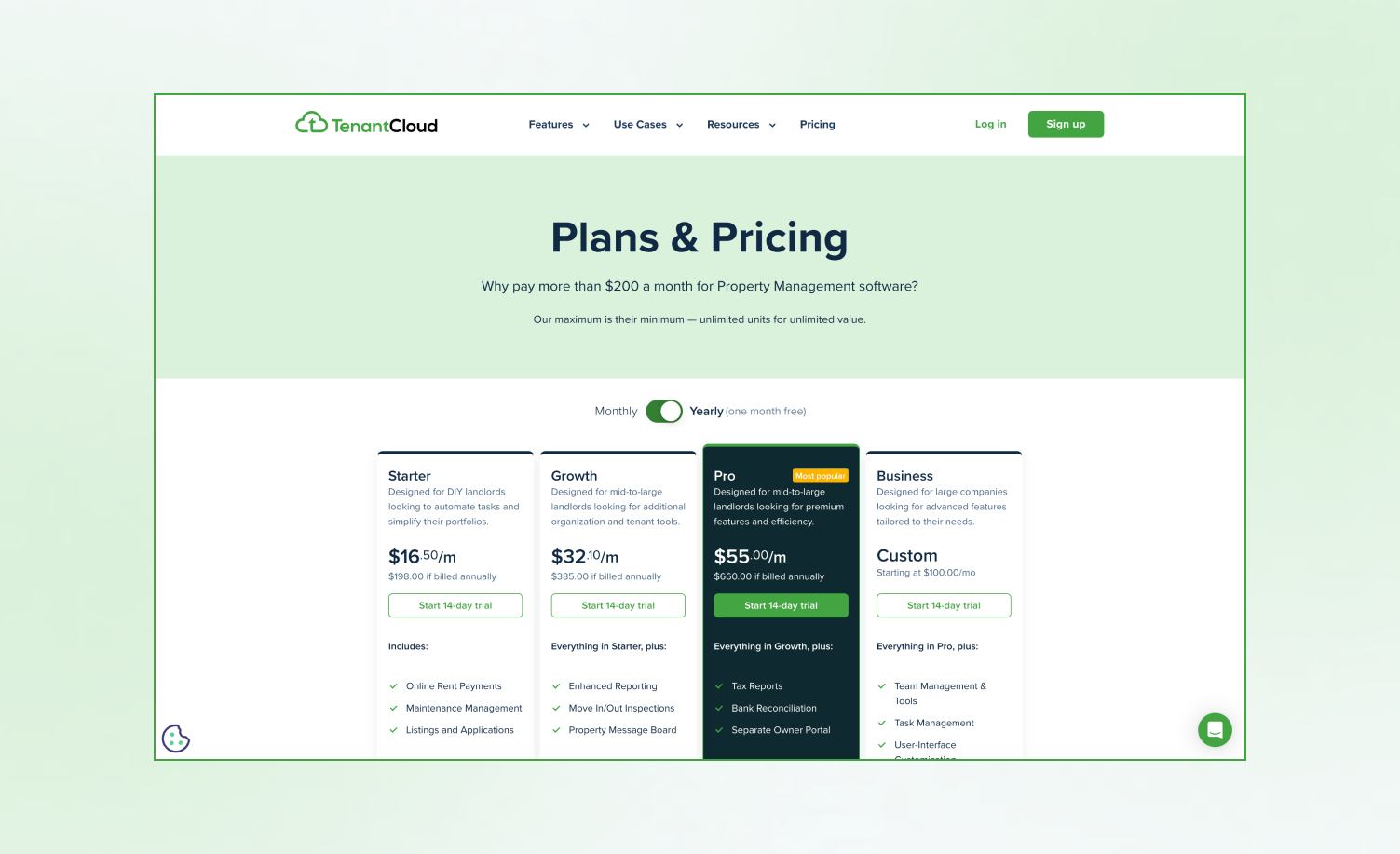

TenantCloud

TenantCloud is one of the top online rent collection services on the market today. The free plan includes features that every property manager needs, such as automatic online rent collection, a free custom listing website, maintenance request tracking, and basic accounting features – all without hidden limitations.

As your business grows, Pro and Business tiers add features such as advanced automation, QuickBooks integration, API access, and state-specific lease forms. The scalability built into TenantCloud means you won't outgrow the platform as your portfolio grows.

The advanced tiers also provide unlimited documents, customizable financial reports including Vacant Rentals tracking, Renters Insurance monitoring, and detailed Occupancy reports.

Baselane

Baselane is a great choice for cost-conscious landlords, offering features such as unlimited ACH payments, integrated banking designed specifically for rental property, automated expense tracking, and more at minimal fees.

The all-in-one banking feature eliminates the need for separate business accounts, and it also offers credit reporting features through Experian, which can help your tenants build credit while you ensure that you receive on-time payments.

Avail by Realtor.com

Avail offers a similar format and function to Baselane, with a clean, intuitive interface and unlimited units supported on the free plan.

ACH payments cost $2 per transaction on the free tier, but upgrading to the paid subscription eliminates these fees entirely.

Related: Avail vs. TenantCloud: A Comparison For 2025

The Avail platform also includes features such as tenant screening, lease templates, and direct deposit capabilities – so you get all the essentials without overwhelming complexity.

Apartments.com Rental Manager

Apartments.com Rental Manager – part of the Apartments.com system – is set up to help landlords and property managers collect rent, utility payments, and security deposits online completely free with no transaction fees for ACH transfers.

The features are limited, but part-time landlords who primarily need payment processing without extensive features will find that it works well.

Rentec Direct

Rentec Direct appeals more to the large-scale property manager or firm, offering full-suite capabilities that are built for larger portfolios.

The platform comes packed with custom tenant portals, more sophisticated accounting modules, and support for multiple payment methods. It also features extensive reporting modules that provide the analytics professional property managers need for portfolio-level decisions.

Stessa

Stessa is another top rent collection service and offers landlords free unlimited unit support with advanced accounting and banking integration. Stessa stands out for its sophisticated financial analytics, helping growing property managers understand portfolio performance and track expenses across properties.

Related: TenantCloud vs. Stessa: Which Property Management Software is Best?

While the free plan omits tenant screening and maintenance management features, the rent collection and accounting capabilities alone deliver significant value for larger portfolios.

Which is the Best Choice for Your Property Management Business?

Choosing the right online rent collection service can completely change how you handle your rentals and property business. And knowing what features come with each – and how you’ll best use them – can help you determine the extent to which you’ll need a particular tool.

Regardless of portfolio size, you’ll want to avoid consumer payment apps for professional rent collection. The lack of automation, proper documentation, and tax-ready reporting creates far more problems than any perceived convenience provides.

The key is to start by identifying your must-have features. Do you want free ACH payments? QuickBooks integration and credit reporting for tenants? Unlimited unit support?

When you know the features that will work for you, then you’ll find that one typically rises above the others – without overwhelming you with features or costs.

The right platform pays for itself many times over as you see improved cash flow and an enhanced landlord-tenant relationship.

Upgrade Your Rent Collection Today with TenantCloud

Are you ready to stop chasing rent payments and start saving 20 hours a week? TenantCloud offers everything you need to collect rent payments online fast and efficiently.

Set up takes minutes, and your tenants will appreciate the flexible payment options, including ACH bank transfers, credit cards, and digital wallets. Plus, as your portfolio grows, TenantCloud grows with you – so you know you always have the right tools and features at your disposal.

Start collecting rent online with TenantCloud today and experience the difference professional property management software makes.

FAQ

What low-cost rent collection tools work for small portfolios?

Small landlords mostly benefit from simple, all-in-one rent collection tools. Platforms like TenantCloud are built for portfolios of any size, supporting online payments, rent reminders, and financial reporting for even small, DIY landlords.

How do tenants pay rent online?

To pay online, tenants will typically log into a secure portal or mobile app provided by the online rent collection service. Once they log in, they will submit payments using their preferred method: credit card, debit card, ACH bank transfer, or digital wallets like Google Pay or Apple Pay.

What is the cheapest way for landlords to collect rent online?

ACH bank transfers are usually the most affordable way for landlords to collect rent online. They carry lower processing fees than cards and remove the need for paper checks. TenantCloud offers secure ACH payments to help landlords reduce costs while keeping rent collection consistent.

How long does it take to process online rent payments?

Timing will depend on the features and payment method. Most online rent portals process payments within 1 to 3 business days for ACH bank transfers and 2 to 3 business days for credit and debit card payments, depending on the provider's processing system. TenantCloud processes credit cards instantly, while ACH takes 2-5 business days.

Can tenants set up automatic payments?

The best online rent collection services will allow tenants to schedule recurring rent payments through most online rent portals. This feature automatically withdraws rent on the same date each month, eliminating the need to submit manual payments.

Who pays the transaction fees – landlords or tenants?

Landlords can choose to absorb transaction fees or pass them to tenants on most platforms. Properties covering ACH fees see digital adoption rates approaching 96%, as tenants overwhelmingly choose free payment options. Many landlords strategically absorb low-cost ACH fees (typically $0-$2) while passing through higher credit card fees (2.5-3.5%).

Are online rent payments secure?

Online rent payment services are significantly more secure than traditional methods. Digital payment platforms typically use bank-grade 256-bit encryption to secure transactions and two-factor authentication to protect account access. Newer platforms now use AI-powered fraud monitoring to detect and block suspicious activity.

Do online rent collection services report to credit bureaus?

Some services report on-time payments to major credit bureaus, which can help tenants build credit history – a big plus for landlords who want a positive tenant experience while helping those in need. This feature incentivizes on-time payments while helping tenants build credit for future mortgages and loans—creating a win-win situation for both landlords and renters.