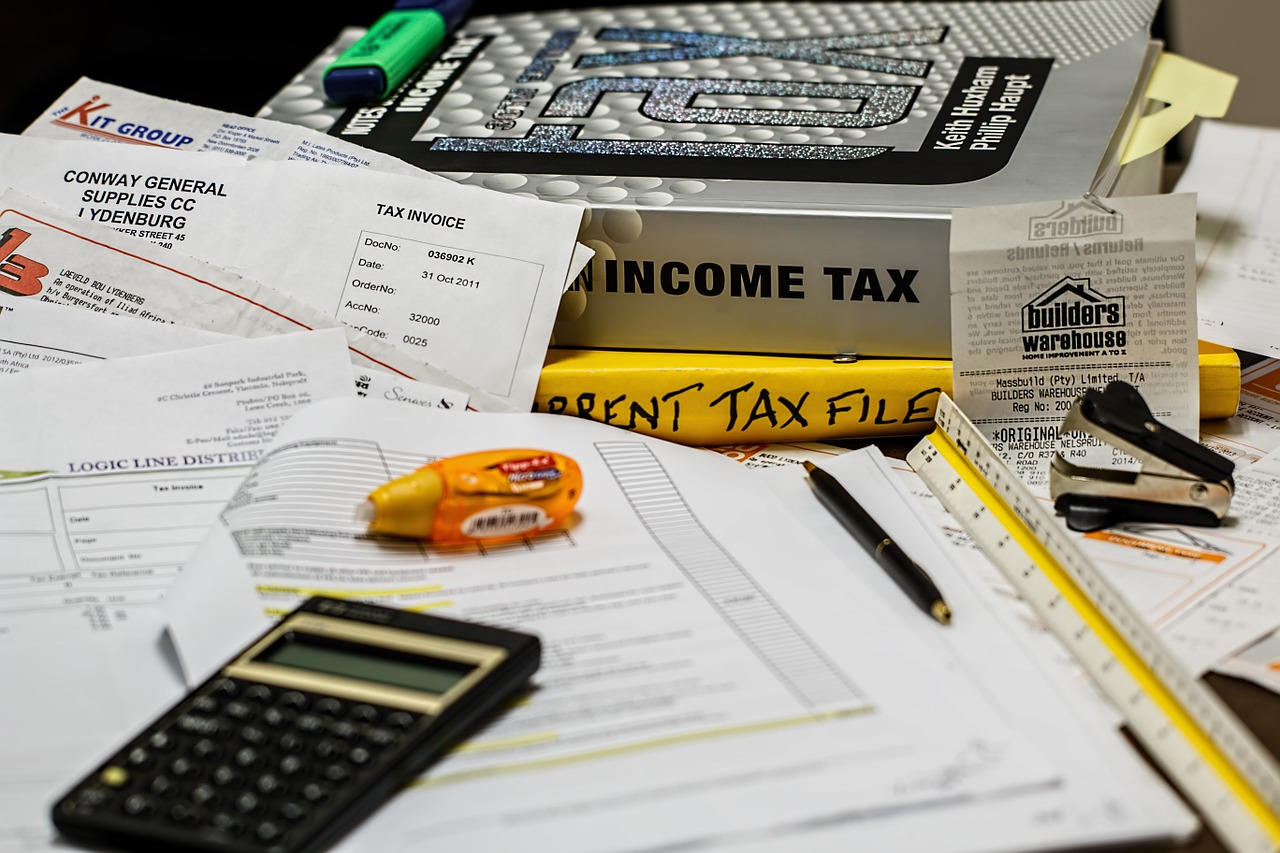

In just a few days Tax Season will come to an end. We bet you are all done or at least ready with your returns, but in case you need to double check everything, here’s our helpful guide of possible tips that have been available on the TenantCloud blogs:

When you begin, you need tips that will guide you in the right direction. In many cases a reason for owning a rental property is the tax advantages, but many don’t end up utilizing the advantages because they get lost in the details. As a real estate investor learning the tax benefits is important, so finding easy ways to learn that are an even higher priority. So, to make your tax season the best, read these 5 tips.

Here are 3 more tips for on automating the process to make filing your return easier. Adding technology to your life can remove the stress that tax season brings. Take your time, consider if your paper routine is worth your precious time and money. So, read about cloud based rental accounting.

To add to that, as we become more paperless each year, as a result more and more tech savvy Landlords prefer to file their taxes online. That means we need to become more aware on how to protect ourselves online. Especially when it comes to sensitive information and how protecting yourself. So, to make sure you are staying safe this Tax Season, here are tips to protect your identity.

As a conclusion, we suggest you to look through our blog Tax Season Is Finally Over! Tips on Making it Easier Next Time, to help limit tax season pre and post stress. True, if you like sleepless nights during tax season - our tips are not for you. But if sleep is your friend who has an open door policy then these tips are for you!

Anyway, using TenantCloud makes keeping track of your rentals finances much easier:

Passive Activity Loss Rules: Rental Property Limitations for Landlords

Form 1040, Schedule E, Supplemental Income and Loss: Tax Season 2020

Tax Deductions For Landlords: Every Landlord's Tax Deduction Guide