As a tenant, renters insurance might not be the first thing you think about when moving into a new place, but it’s one of the smartest ways to protect yourself. In the event of an emergency, the home you rent will usually be covered by your landlord's insurance, but would not cover your own precious belongings like your laptop, bike, or couch.

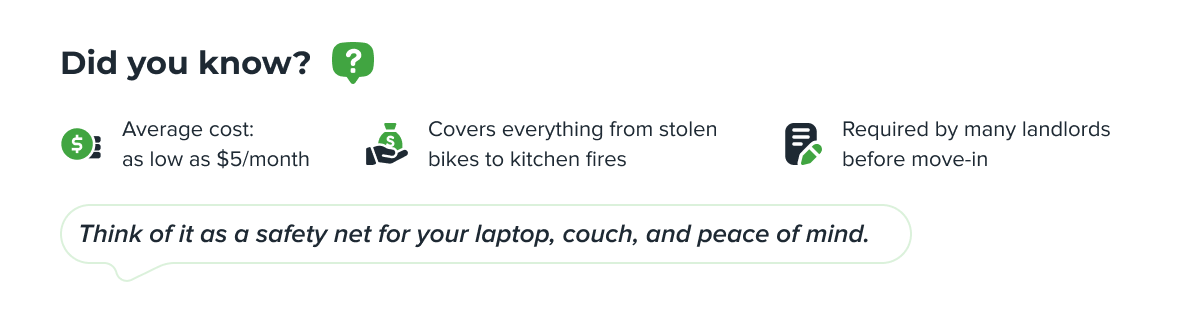

That’s where renters insurance comes in. Sometimes it's required by landlords before tenants can sign a lease, but even when it's not, it's something every tenant should budget for to protect your personal property.

Simply put, renters insurance covers your personal items stored in your rental home, and it's easier and more affordable than you think. Let's go over the details of what renters insurance is, how to get a renters insurance quote, and what renters insurance covers so you know what to expect.

The TL;DR

Renters insurance protects your stuff, your liability, and even your living expenses if you need a temporary place to stay. It's separate from a landlord's insurance policy which typically covers the building itself, but not the tenant's belongings. Renters insurance policies are typically affordable, starting as low as $5 per month, and can cover theft, water damage, kitchen fires, and even medical expenses for guests.

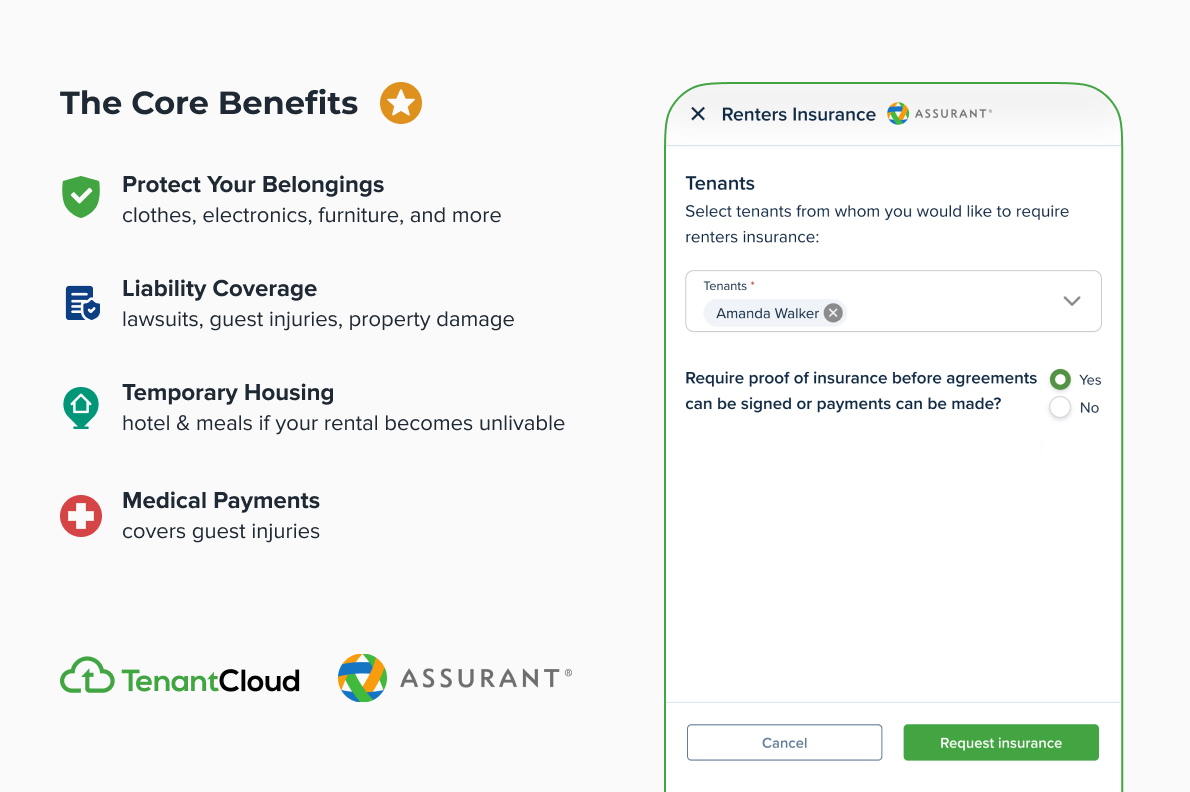

With TenantCloud Renters Insurance, you can quickly find insurance coverage that meets landlord requirements. You can even add your landlord or property manager as an interested party so they are included in the process. A good renters insurance should make it easy to keep an updated record of your belongings, review your policy regularly, and understand exclusions so you’re ready if life throws you a curveball.

What is Renters Insurance?

Renters insurance is all about protecting you and your stuff—inside the rental you're staying in. If your belongings are stolen or damaged by an accident like a kitchen fire or water leak, renters insurance can help you stay covered. It also includes liability protection in case someone gets injured in your home or you accidentally damage someone else’s property who has renters insurance. Some renter insurance policies even include medical coverage for injured guests or help with medical bills if a visitor is injured in your home.

What Does Renters Insurance Cover?

The exact coverage depends on your actual policy and the chosen coverage options, but most insurance companies include coverage along these lines:

- Personal belongings – Protects items like clothing, furniture, and electronics against theft, fire, or water damage. Some policies also include coverage for pet injuries or damage caused by pets.

- Liability coverage – Provides liability protection if you accidentally cause damage to the rental property or if someone gets injured in your home. Renters insurance helps protect you from lawsuits and can even help pay medical expenses for your guests.

- Additional living expenses (ALE) – If a covered loss, like a kitchen fire or flood damage, forces you out of your apartment, ALE helps pay for a temporary place to live, meals, and other extra protection needs.

The type of renters insurance coverage you'll need will vary from your neighbors, so it's important to pay close attention to your renters insurance quote and determine if it's covering the belongings you want protected the most.

Does Renters Insurance Cover Pets?

Renters insurance can cover injury your pet causes to a visitor in your rental, although it does not cover any personal property damage your pet causes. If your dog bites your spouse, child, or roommate, that injury liability is also not covered.

Pets are not protected under renters insurance in the case of an emergency or illness. Some tenants (and homeowners) protect their pets separately with pet insurance, which is designed to help with unexpected veterinary bills in the event of an illness or injury.

Types of Renters Insurance Coverage

Before you receive renters insurance, you'll need to get a quote from a renters insurance company. When you are reviewing your renters insurance quote, you’ll typically need to choose between two types of coverage for your personal property:

- Actual Cash Value (ACV) – Reimburses you for the current value of your belongings, factoring in depreciation. For example, if your three-year-old laptop is stolen, you’ll get the depreciated amount, not the price of a new one.

- Replacement Cost Value (RCV) – Covers the cost of replacing your belongings with brand-new items of similar kind and quality, without deducting depreciation. While premiums may be higher, this type of renters policy offers more complete protection.

Choosing between an ACV and RCV renters insurance policy depends on your insurance needs, your rental budget, and how much coverage you want for your belongings.

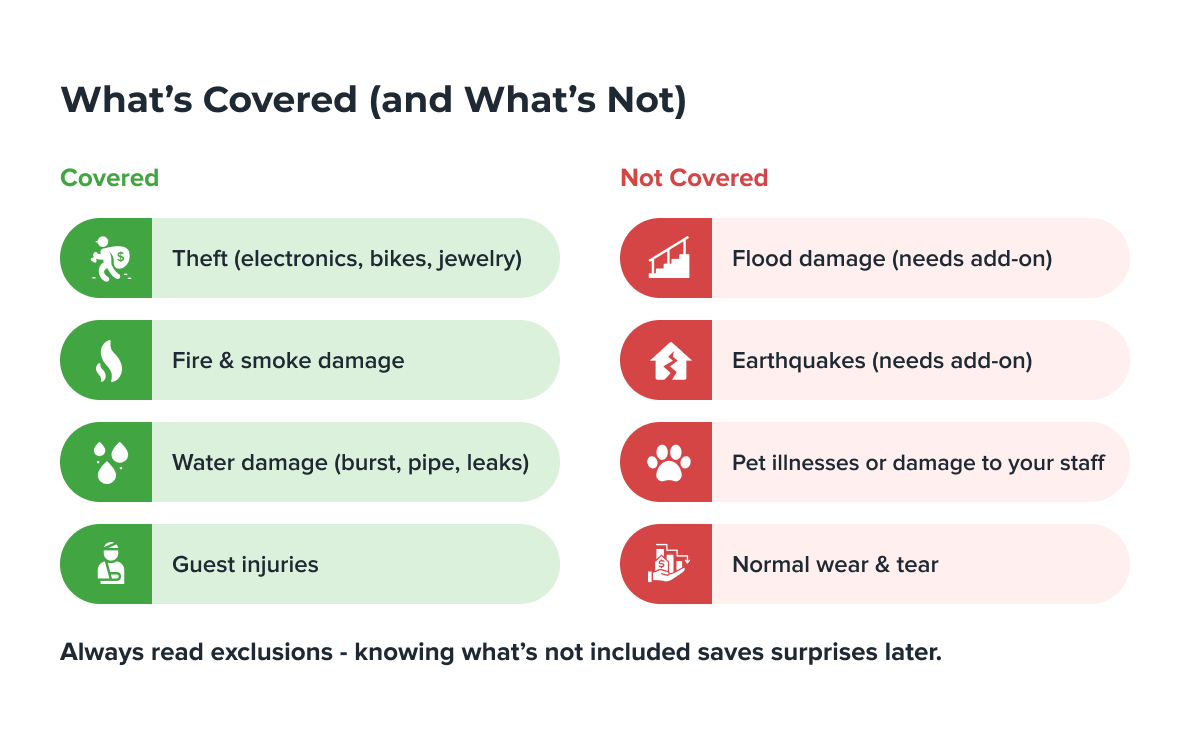

What Does Renters Insurance Not Include?

Renters insurance is a strong safety net, but like any policy, it has its limits. Most providers have exclusions, so it’s important to review the fine print carefully. For example, standard coverage often won’t include flood damage, earthquakes, or certain types of pet-related incidents; however, you may be able to add these as optional coverages if needed.

The key is making sure the policy matches your lifestyle and risk factors. Revisit your coverage regularly, ask questions if you’re unsure, and don’t assume everything is automatically included. Understanding what’s not covered can be just as important as knowing what is - so you’re never caught off guard.

How Much Does Renters Insurance Cost?

One of the biggest misconceptions about renters insurance is that it’s expensive. In reality, it’s one of the most affordable types of insurance coverage you can get, as low as $5 per month.

Your renters insurance cost will depend on factors like the coverage limits you select, whether you choose replacement cost or actual cash value, and the deductible amount you’re willing to pay out of pocket before insurance kicks in. Insurance companies may also adjust premiums based on your location, the size of your rental property, and other factors like past claims history.

Renters Insurance Discounts

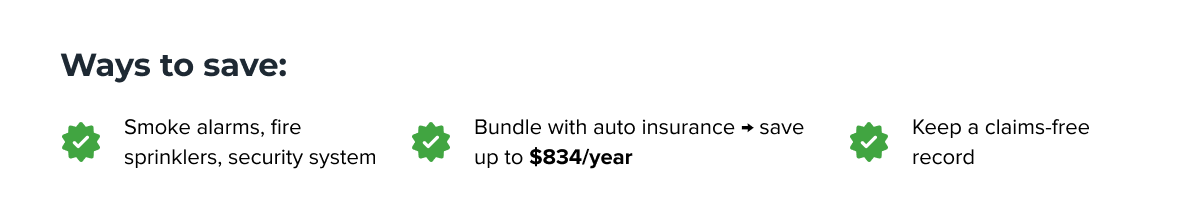

Can you get a discount on renters insurance? Absolutely. Here are two ways you can provide liability coverage at a low cost.

Rate Discounts

Many renters insurance providers offer rate discounts if your home has protective devices installed, such as smoke alarms, burglar alarms, or fire extinguishers. Talk to your provider for more details on how to claim your discount.

Bundling Renters Insurance

If you’re already paying for auto insurance, bundling renters insurance with your other insurance packages, such as auto insurance, could unlock competitive rates and additional savings—up to $834 a year, according to State Farm Insurance.

Minimum Policy Requirements

There's no minimum requirement for renters insurance as it's not mandated by state laws. However, landlords often require liability coverage for their tenants. Occasionally, they may ask for a policy with specific liability coverage limits to protect both you and the property. Even if it isn’t required, it’s worth reviewing your policy carefully to make sure your belongings and liability are covered at the right level. The goal is to strike a balance between affordable coverage and enough protection to give you peace of mind.

Interested Parties Vs. Added Parties

Renters insurance policies often give you the option to add additional parties to your insurance plan. It's important to understand the difference of each type so you can determine what to include in yours.

There are two types of parties, :additional insured" and “interested party.”

- Additional Insured - This is someone in your household you would like covered under your policy, such as a spouse, adult child, or roommate. These additions can make file claims on their own. Take note that some insurers may not allow roommates or non-relatives to be added to a single renters insurance policy.

- Interested Party - This is a third party that receives notifications about your policy but does not have any coverage under it. Landlords and property managers often require you to list them as an interested party for proof of coverage and to be notified if your policy lapses.

Keep in mind, an interested party simply means they can be kept in the loop about any updates or claims you make under your renters insurance, adding a layer of accountability.

Renters Insurance Tips

A little preparation goes a long way when it comes to finding and maintaining renters insurance. Start by keeping a record of your belongings:

- Start a Visual Record - When you move in, take a video of your personal belongings in your home and snap photos of specific items you want covered.

- Compile Receipts - Keep receipts of big ticket items stored safely in a digital file so they can be reached from anywhere. This can help provide proof of purchase.

- Set Up Your Policy - Work with your insurance provider to ensure that your coverage went through. The last thing you want to happen in the event of an emergency is to find out that your paperwork was not completed or your policy did not go through.

It’s also a good idea to revisit your policy from time to time. Life changes quickly; new furniture, tech upgrade, or even a move can mean your old coverage no longer fits your current needs. And when choosing a provider, make sure they have a solid track record for customer service and handling claims.

The Smartest Move for Renters

Think of renters insurance as a small investment for big peace of mind. From covering your laptop to helping with liability if a guest is injured, renters insurance has your back. It's an easy, affordable way to ensure that your belongings can be replaced in case an emergency happens.

Protect Your Belongings No Matter Where You Rent

Need insurance coverage? You've got options.

TenantCloud Renters Insurance

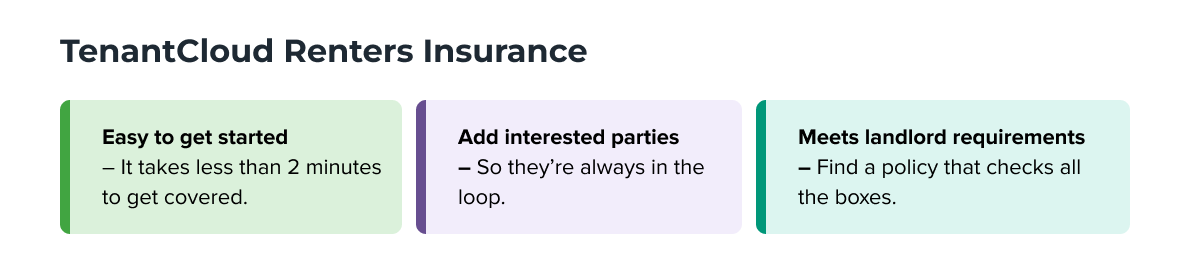

You deserve to feel protected in your rental. With TenantCloud Renters Insurance, you can protect your personal belongings, cover liability, and add a safety net that fits your budget.

Why You'll Love It

- Easy to get started – No need to spend time researching providers. Compare options and secure a coverage plan right inside your TenantCloud account.

- Meets landlord requirements – Find a policy that checks all the boxes.

- Add interested parties – Add your landlord or property manager so they’re always in the loop.

Affordable Renters Insurance Coverage That Fits You

Every renter’s situation is unique, so TenantCloud's platform is designed to help you find coverage that matches your needs. Whether you’re looking for basic protection or something more comprehensive, you’ll have options that balance affordability with reliable protection.

Ready to Get Started?

Ask your landlord about renters insurance or check out this Help Center article for a quick walkthrough on purchasing TenantCloud Renters Insurance directly.