Allow to pay rent jointly or split the amount

Add credits, discounts, and do refunds

Do rent increase and decrease

Return or apply deposit towards unpaid invoices

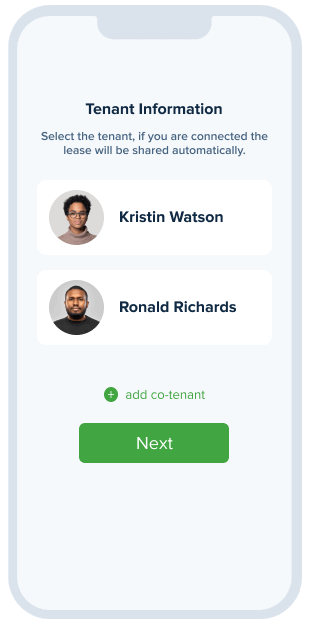

Rent to multiple tenants?

With TenantCloud, roommates can pay their individual portion of the rent individually or pay one invoice jointly.

Every roommate sets their own TenantCloud account and can access the lease and transactions.

Log inRent to roommates in just a few steps

Moving in tenants to the same rental unit and organizing their rental payments has never been easier or more convenient.

Run a screening report for each tenant

Set up automatic late fees

Upload or send to sign the rental agreement

Schedule rent increase/decrease

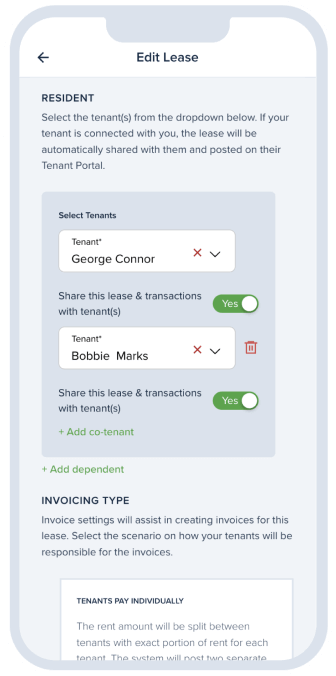

Choose the invoicing type

The separate invoicing type allows roommates to pay the fixed portion of the rent and other invoices.

The combined lease type allows roommates to be collectively responsible for the whole rent amount and other invoices.

Log in

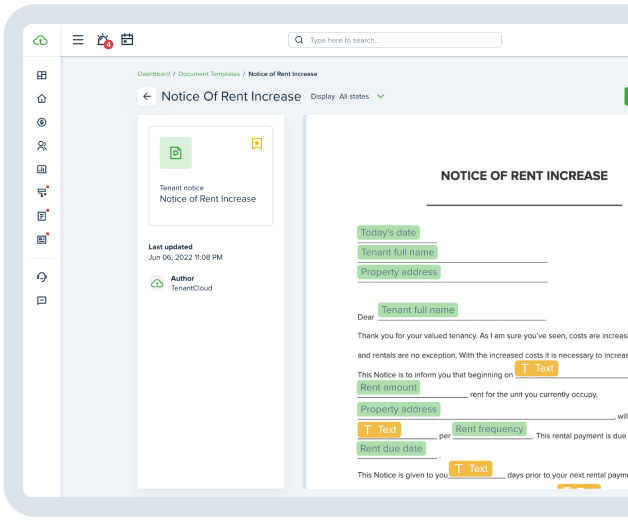

Send a Notice

Sending a notice to a tenant or roommates is easy. You can schedule the Rent Increase or decrease, add utility, and other recurring invoicing, remind about outstanding balance or end a lease. Just select the related notice and send it out.

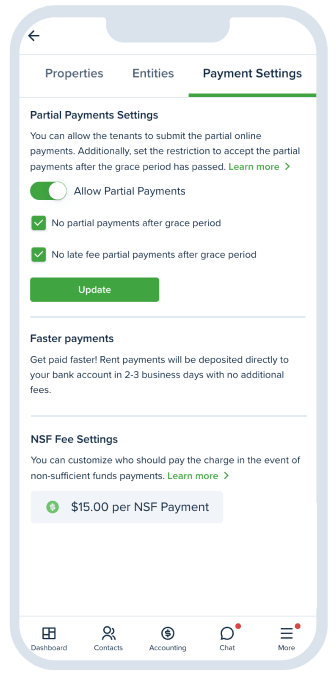

Set Partial Payments

Allow your tenants to pay partial rent prior to the due date, or a whole amount. It’s up to you. You can set up all the appropriate settings during the Move-in process. You can turn off partial payments at any time.

Learn more

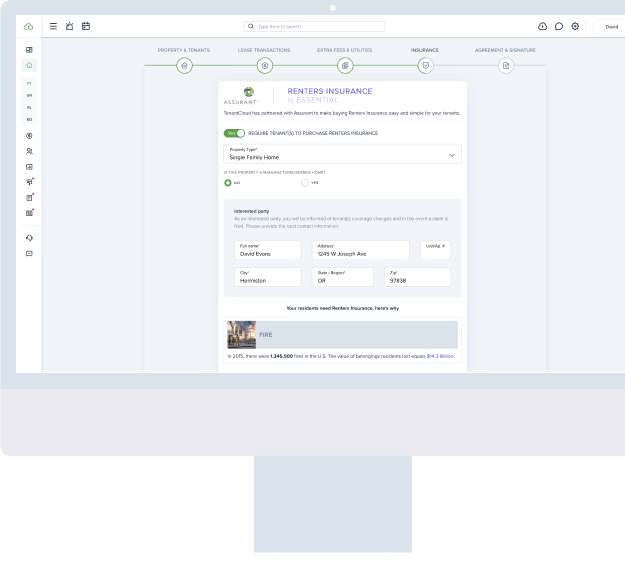

Renters Insurance

Protect your rental, your tenant’s home, and all the precious belongings in it by requiring the Renters Insurance upon Move-in.

A tenant can provide their insurance or get instant quotes right in their TenantCloud account. Renters Insurance is powered by Assurant.

Managing Roommates Made Easy

All you need to do is set up a lease in a few easy steps and start collecting rent online.

Pricing & Plans

- Enhanced Reporting

- Move In/Out Inspections

- Property Message Board

- Team Management & Tools

- Task Management

- User-Interface Customization

Help your business grow!

Get started today and instantly prosper from managing your properties online.